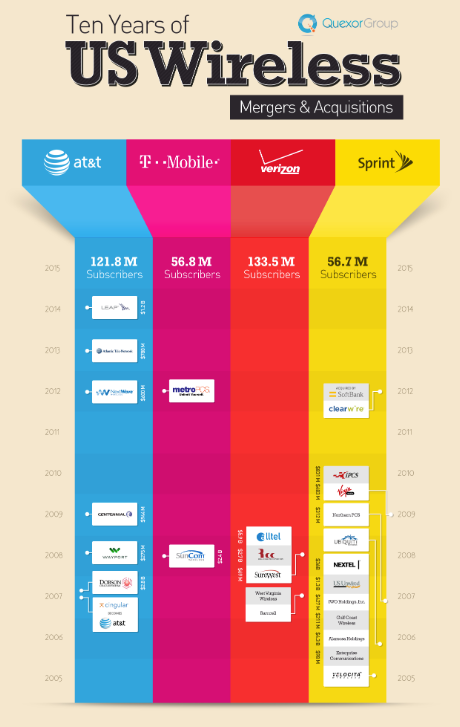

There is one element beyond “consolidation” or “asset shuffling” that is not yet a significant development on this chart of major U.S. telco acquisitions since 1985: deconstruction, deconsolidation or disaggregation of functions.

The chart, for obvious reasons of showing only formal asset ownership of brands, does not show internal or structural changes across the industry to separate application creation from asset ownership; with revenue flows following.

source: Wall Street Journal, Seeking Alpha

The chart does not show shifts in business strategy beyond “gaining scale” and does not show the acquisition of any mobile service provider assets, either.

source: Quexor Group

Beyond shifts of asset ownership, connectivity providers have moved on a variety of fronts to disaggregate functions, sometimes retaining asset ownership; sometimes divesting assets and retaining functions in some other way. The adoption of TCP/IP as the “next generation” architecture, for example, necessarily entails separating connectivity functions into layers.

Fundamentally, that means applications can be created and consumed by customers or users without app owners having formal business relationships with access network providers.

In other cases, mobile service providers have opted to sell off their cell tower networks, in favor of leasing arrangements. More recently, telcos have shifted their computing networks from internal and owned platforms to use of cloud computing suppliers.

And while virtualization of network functions, or separated control and data planes, do not intrinsically require ownership disaggregation, it always enables function disaggregation.

Category | Moves | Examples |

Sale of cell towers | Major telecom companies have sold off their cell towers to independent tower companies. This allows the telecom companies to focus on their core network functions, while the tower companies can focus on managing and maintaining the towers. | In 2019, AT&T sold its 8,200 cell towers to Crown Castle for $8.1 billion. In 2020, Verizon sold its 10,000 cell towers to American Tower for $5.1 billion. In 2021, T-Mobile sold its 4,000 cell towers to SBA Communications for $3.4 billion. |

Virtualization of network functions | Telecom companies are moving away from traditional, hardware-based network functions and towards virtualized network functions (VNFs). VNFs are software-based network functions that can be run on generic hardware. This allows telecom companies to be more agile and to scale their networks more easily. | In 2017, AT&T announced that it would be moving its network functions to a virtualized architecture. In 2018, Verizon announced that it would be moving its 5G network to a virtualized architecture. In 2019, T-Mobile announced that it would be moving its network functions to a virtualized architecture. |

Use of wholesale | Telecom companies are increasingly using wholesale networks to provide services to their customers. Wholesale networks are owned and operated by independent companies, and they sell capacity to telecom companies on a wholesale basis. This allows telecom companies to offer their customers a wider range of services without having to invest in their own network infrastructure. | In 2017, AT&T announced that it would be using the FirstNet wholesale network to provide 5G services to first responders. In 2018, Verizon announced that it would be using the CBRS spectrum to provide wholesale services to its customers. In 2019, T-Mobile announced that it would be using the DISH 5G network to provide wholesale services to its customers. |

Adoption of TCP/IP | Telecom companies are increasingly adopting TCP/IP as the underlying protocol for their networks. TCP/IP is a standard protocol that is used for data communication over the internet. This allows telecom companies to interoperate with other networks and to offer their customers a wider range of services. | In 2017, AT&T announced that it would be migrating its network to a TCP/IP-based architecture. In 2018, Verizon announced that it would be migrating its 5G network to a TCP/IP-based architecture. In 2019, T-Mobile announced that it would be migrating its network to a TCP/IP-based architecture. |

Architectures using data plane and control plane | Telecom companies are increasingly adopting architectures that use separate data planes and control planes. This allows the data plane to be optimized for performance, while the control plane can be optimized for flexibility. | In 2017, AT&T announced that it would be using a data plane and control plane architecture for its 5G network. In 2018, Verizon announced that it would be using a data plane and control plane architecture for its 5G network. In 2019, T-Mobile announced that it would be using a data plane and control plane architecture for its 5G network. |

Likewise, any shift to use of wholesale mechanisms is a form of disaggregation from formerly-vertically-integrated asset ownership.

To be sure, there are practical reasons for undertaking these moves. At one level, no grand shift of strategy is required, and each single move can be seen as an incremental change to improve operating economics.

Move | Reason |

Sale of cell towers | Allows telecom companies to focus on their core network functions, such as switching and routing, and to outsource the management and maintenance of their cell towers to third-party companies. This can help telecom companies reduce costs and improve their flexibility. |

Shifting to wholesale | Allows telecom companies to offer their customers a wider range of services without having to invest in their own network infrastructure. This can help telecom companies reach new customers and compete with larger rivals. |

Separating network and business functions | Allows telecom companies to become more agile and to respond more quickly to changes in the market. This can help telecom companies stay ahead of the competition and offer their customers the best possible services. |

Taking other steps to separate asset ownership | Allows telecom companies to interoperate with other networks and to offer their customers a wider range of services. This can help telecom companies stay ahead of the competition and meet the growing demand for connectivity. |

But all the steps, taken together, in a context where revenue growth remains sluggish, capital investment requirements arguably are rising and competition is growing, might signal continued pressures to disaggregate.

Indeed, the new involvement of private equity investors in digital infrastructure asset ownership might be part of the shift. To be sure, most such investments involve acquiring both operating and physical assets. To that extent the asset shifts are simply part of the background of asset disposals or acquisitions on an incremental level, and not a “grand strategy.”

But many business plans envision both retail and wholesale operations. And the same is true for the growing number of municipal networks, independent facilities-based internet service provider operations as well. Over time, more fiber-to-home networks are being added that allow wholesale access to other ISPs.

So far, only cable operator mobile service operations have been based extensively on wholesale mechanisms. And cable operators are moving to shift substantial reliance to their own assets, including both spectrum assets and small cell networks, for example.

The larger point is that business model drivers might, over time, increase the value or necessity of further disaggregation in the direction of a more-layered organization of the business, especially for non-dominant service providers.

One clear example, however, is the growing use of joint ventures to build fiber-to-home infrastructure. For some observers, a growing role for app providers such as Google might seem quite noteworthy.

Year | Location | Partners | Details |

2020 | United States | Google and Frontier Communications | Google will invest $1 billion in Frontier to help the company build a fiber-optic network to 1 million homes in 25 states. |

2020 | United Kingdom | Virgin Media O2 and Vodafone | The two companies announced a joint venture to build a fiber-optic network to 1 million homes in the U.K. |

2021 | United States | Google and AT&T | Google will invest $2 billion in AT&T to help the company build a fiber-optic network to 3 million homes in 10 states. |

2022 | United Kingdom | CityFibre and Macquarie Infrastructure and Real Assets | The two companies announced a joint venture to build a fiber-optic network to 5 million homes in the U.K. |

2023 | United Kingdom | Google and Openreach | Google will invest £1 billion in Openreach to help the company build a fiber-optic network to 2 million homes in the U.K. |

So far, Google alone has made FTTH investments in firms including Zayo Group, SiFi Networks, Ting, Webpass, Frontier Communications, AT&T and Openreach, in addition to operating its fully-owned Google Fiber business.

ear | Location | Joint Venture Partners |

2020 | United States | Zayo Group and Frontier Communications |

2021 | United Kingdom | CityFibre and Vodafone |

2021 | Australia | Telstra and TPG Telecom |

2021 | Canada | Bell Canada and Rogers Communications |

2022 | Brazil | TIM Brasil and Telefonica |

2022 | India | Reliance Jio and Google |

2022 | Japan | NTT Docomo and KDDI |

2022 | South Korea | SK Telecom and KT |

2022 | Taiwan | Chunghwa Telecom and Far EasTone |

Perhaps one would speculate that facilities disaggregation for FTTH networks will often manifest itself in the form of joint ventures. That is an incremental step that only “shares” asset ownership rather than dispensing with it.

-----------------