Fiber to the home is a better long-term solution than fixed wireless, most would agree. Of course, it all depends on whether we are looking at pure technology or practical business models.

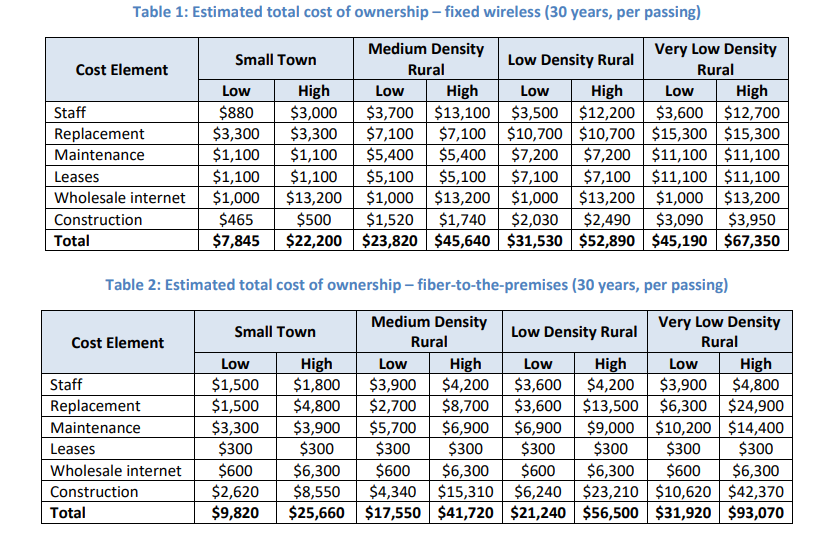

It frequently happens that FTTH is not a practical platform for many service providers, for all sorts of reasons. In a study by the Benton Foundation, commissioned by the Communications Workers of America, the 30-year total cost of FTTH ownership often is lower than the 30-year total cost of ownership for fixed wireless.

source: Benton Foundation

We can always quibble about the cost assumptions, but the comparisons seem reasonable enough, on a 30-year payback basis. In competitive markets, 30 years is not a meaningful time frame. Companies go out of business and executives are fired if their platform choices take too long to produce actual financial results.

So the issue is not whether fiber is better on a 30-year time frame, but whether it is workable right now, and for the next decade, for most internet service providers that must make a deployment decision.

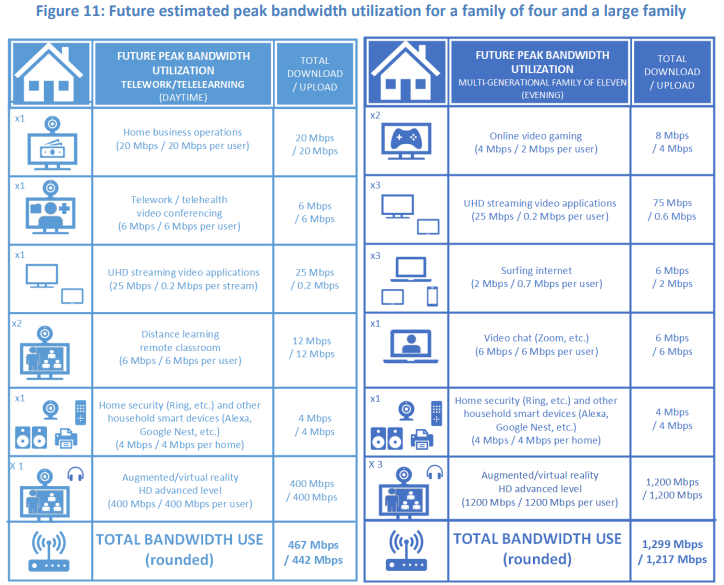

To be sure, multi-user households remain the customers with greatest need for lots of bandwidth, as the report suggests.

source: Benton Foundation

But a substantial percentage of U.S. households are not that sort of multi-user case. Some 28 percent are single-person households, for example. About 30 percent are two-person households.

In other words, even as bandwidth consumption continues to increase, the direction of change for many decades has been towards households that are not “married couples with children,” the prime example of multi-user accounts.

source: PRB.

Since 1960, for example, the average number of persons per household has declined.

source: Statista

The point is that even with increasing typical bandwidth consumption, FTTH is not the only platform capable of serving a significant percentage of households, with cable modems being the alternative that is most similar to FTTH in terms of capacity.

source: Benton Foundation

As always, the business decision about bandwidth is a balancing of end user demand in specific neighborhoods with the cost to upgrade platforms. Also, mobile operators can use their 5G platforms to reach a significant portion of the market that does not have the highest multi-user household requirement, especially when they cannot justify an out-of-territory FTTH build.

In other cases, incumbent fixed network providers might have to carefully consider the payback when facing cable operators with lower near-term bandwidth upgrade capabilities and strong market share positions.

As one wag said in the late 1980s: “fiber is the technology of the future, and always will be.” That is a bit of an exaggeration, but still germane.