“Connected devices” (tablets, principally) drove net mobile additions at AT&T during the third quarter of 2013, as did U-verse broadband services in the fixed network segment.

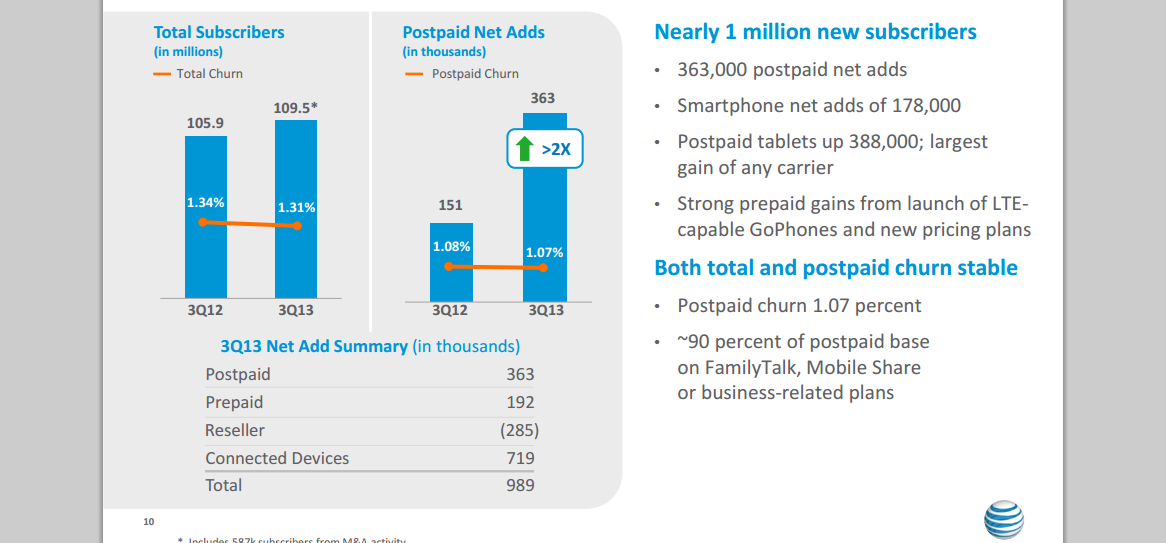

AT&T added nearly one million net mobile subscribers, including 63,000 mobile postpaid accounts and 192,000 prepaid accounts.

But connected device net adds were 719,000, or 73 percent of net additions.

In the fixed network segment, overall consumer revenue grew 2.4 percent, year over year, principally because of U-verse services.

About 70 percent of AT&T U-verse TV subscribers take three or four services from AT&T, driving average revenue per user for U-verse triple-play customers to more than $170 a month.

Also, In the third quarter, more than 90 percent of new U-verse TV customers also signed up for U-verse high speed Internet services, showing the growing importance of the broadband double play (high speed Internet access plus video entertainment).

U-verse TV penetration of customer locations continues to grow and was at 20.8 percent at the end of the third quarter, AT&T said.

U-verse revenues grew 28.1 percent, on the strength of 655,000 high speed Internet subscribers and 265,000 U-verse TV subscribers. AT&T also added 97,000 U-verse business customers.

For the quarter ended September 30, 2013, AT&T's consolidated revenues totaled $32.2 billion, up 2.2 percent year over year. Total third-quarter fixed network revenues were $14.7 billion, down one percent, year over year.

AT&T’s fixed network operating income totaled $1.5 billion, down 13.7 percent versus the third quarter of 2012.

Third-quarter fixed network operating income margin was 10.6 percent, compared to 12.1 percent in the year-earlier quarter, down primarily due to customer growth-related costs and costs incurred as part of Project VIP, AT&T’s network upgrade program.

Mobile segment revenues grew 5.1 percent, with service revenues up 3.7 percent, year over year.

Mobile data revenues grew 17.6 percent compared to the year-earlier period, and mobile operating income margin was 26.4 percent, while mobile EBITDA service margin was 42.0 percent.

One might draw several conclusions from those figures. First, the sharply-reduced rate of net additions confirms that the mobile phone market is saturated. In past years the U.S. mobile industry added 300,000 to 800,000 net new customers every quarter, most added by just two carriers, Verizon Wireless and AT&T Wireless.

So for AT&T to add just 63,000 postpaid customers is a huge reduction of about an order of magnitude.

Also, prepaid now accounts for an order of magnitude more net new adds than postpaid, showing where growth now is occurring, at least for AT&T.

The new development is the commanding role of tablet connections, even if the average revenue per device is going to be far lower than for phones.

The third quarter results also showed continued movement towards usage-based plans. About 72 percent, or 36.4 million, of all AT&T postpaid smart phone subscribers are on usage-based data plans, up from 64 percent, or 28.5 million, a year ago.

The newer trend is a shift of connections from the new “Mobile Share” plans, which also likely accounts for the surge of tablet connections. More than 16 million connections, or more than 22 percent of postpaid subscribers, have moved to Mobile Share plans.

The number of Mobile Share accounts reached 5.3 million in the third quarter with an average of about three devices per account.

Take rates on the higher-data plans continue to be strong with 30 percent of Mobile Share accounts choosing 10 gigabyte or higher plans. About 15 percent of Mobile Share subscribers came from unlimited plans.

In the third quarter, postpaid churn was down slightly to 1.07 percent compared to 1.08 percent in the year-ago quarter. Total churn was 1.31 percent versus 1.34 percent in the year-ago quarter and 1.36 percent in the second quarter of 2013.

About 90 percent of postpaid subscribers are on FamilyTalk, Mobile Share or business plans. Churn levels for these subscribers are significantly lower than for other postpaid subscribers, which is one reason service providers such as AT&T like them.