Monday, June 11, 2012

Answer, Send to Voicemail, Reply with Message, Remind me to Call Back Later

Apple's latest operating system roughly doubles the typical inbound call handling options most people will use, especially for those of you who, for any reason, think call waiting is not something to be used.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Apple has 400 Million Payment Accounts

But all of those 400 million active accounts have active credit cards that can be used on iTunes and the App Store.

PayPal has 110 million active accounts and Amazon.com has 152 million customer accounts.

At least for the moment, Apple seems content to use its payment system in a closed-loop way, as does Starbucks.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Apple's iOS 6 Will Launch Apps on iPads

Apple's iOS 6 mobile operating system will be made available on iPads, and will include the ability to its launch apps, Apple says. Siri now also answers real-world questions about sports, movies and restaurants.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

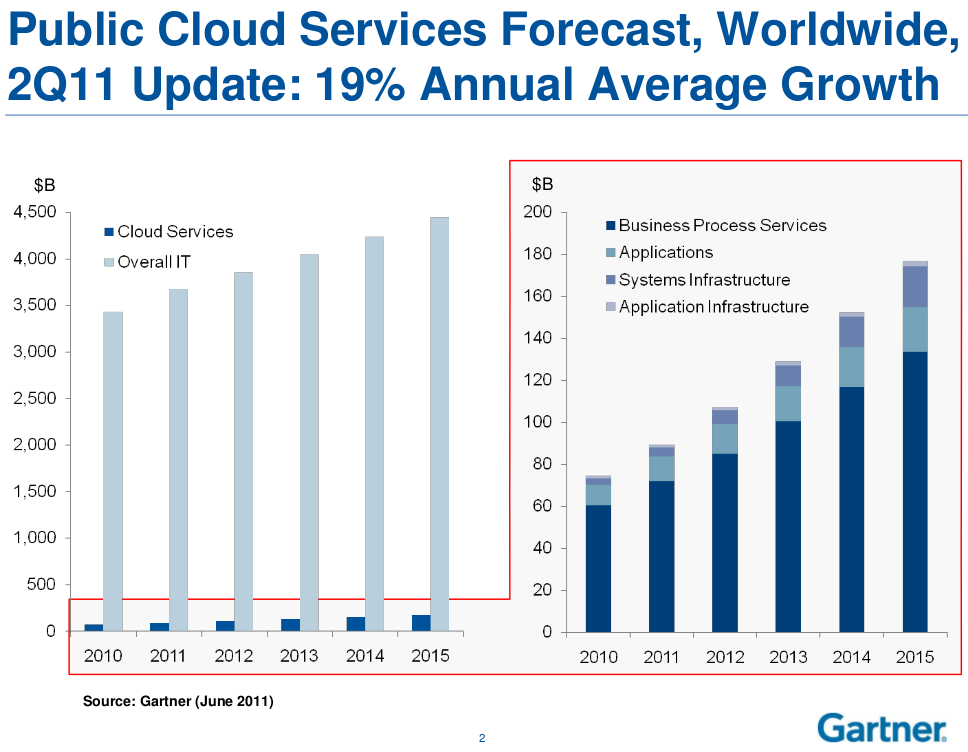

What Does it Mean that "Cloud Computing" is Growing 28% a Year?

Cloud computing was the fastest-growing category of U.S. service provider infrastructure spending in 2011, with a 28.4 percent increase, according to the Telecommunications Industry Association.

The TIA also expects cloud computing will continue to be the fastest-growing category of network and facilities investment during the next four years, averaging 20.3 percent compounded annually.

But it is end user spending that arguably drives most of the revenue, so one might argue that much of the opportunity will be reaped by firms that sell enterprise applications, not firms that sell infrastructure services more centrally related to hosting, for example.

TIA argues that end user spending on cloud apps will more than double to $12.1 billion in 2015 from $5.8 billion in 2011, according to the TIA. Separating out what that could mean for providers of cloud “data center facilities” is harder to assess.

In fact, most of the revenue upside appears likely to accrue to hardware and software suppliers, at least initially, according to a Morgan Stanley analysis.

In the infrastructure end of the business, telecom service providers might make a business out of rental of computing cycles, storage and ancillary services. But what has to be done to market and support that business, and should effort be put elsewhere?

In the telecom space, the analysts expect key winners to include Rackspace, Equinix and competitive local exchange carriers and metro bandwidth suppliers. In other words, hosting and access will be where the telecom revenue lies, possibly not in the infrastructure, platform or software as a service businesses.

The point is that assessing cloud computing revenue contributions for various ecosystem participants is complicated.

That forecast suggests why cloud computing initiatives by telcos will have to be targeted. There actually isn’t as much revenue in cloud computing as some tend to think. Nor is the space uncontested.

Companies such as Google, Amazon Web Services, Hewlett-Packard Development Co., Microsoft Corp. and Salesforce.com are themselves already leaders in the cloud infrastructure space, and already are displacing traditional infrastructure outsourcing alternatives, one might argue.

North America, specifically the U.S., currently represents the largest opportunity for SaaS, and it is the most mature of the regional markets. SaaS software revenue is forecast to total $9.1 billion in 2012, up from $7.8 billion in 2011.

But keep in mind that most of that revenue is earned providing expense management, financials, email and office suites. Though Web conferencing also is a SaaS application, few telcos are players to any major extent.

In Western Europe, SaaS revenue is forecast to surpass $3.2 billion in 2012, up from $2.7 billion in 2011, while SaaS revenue is Eastern Europe is projected to reach $169.4 million, up from $135.5 million last year.

SaaS revenue in Asia/Pacific is on pace to reach $934.1 million in 2012, up from $730.9 million in 2011.

SaaS revenue in Latin America is forecast to total $419.7 million in 2012, up from $331.1 million last year. None of those revenue streams are terribly large, by tier one service provider standards, nor are telcos the most logical providers.

In addition to the possibility that cloud-delivered enterprise apps compete most centrally with distributors of "shrink wrapped" apps, it can be argued that cloud infrastructure also competes with traditional "outsourcing" services.

Cloud infrastructure services are an alternative to traditional IT outsourcing services, often reducing the IT costs of their clients by at least 40 percent, according to livemint.com.

Likewise, you might argue that enterprise or other "app stores" might also compete with other software delivery channels.

What you will note about the enterprise app store concept is that it disintermediates nearly all of the premises networking infrastructure. There is no need for the enterprise local area network, except perhaps to switch to Wi-Fi access at times.

You can imagine this will have serious implications for firms that traditionally make a living selling gear and services for enterprise LANs. Just as easily, you can see the upside for traditional communications providers who now could have an expanded role in the information technology business.

What products would be “natural” parts of a communications and information technology bundle? How much easier would it be for traditional telco sales organizations to sell key business software?

In fact, non-technical sales forces of all types might find there are new opportunities to sell products that might have been “too technical” in the past. Firms outside “IT” might find they can create bundles almost on the fly, customized for vertical markets or businesses of various sizes and types.

A shift to some new computing architecture based on cloud resources and mobility could have huge implications for any number of businesses in the information technology and communications businesses.

Although growing interest has been observed in vertical-specific software, the most widespread use is still characterized by horizontal applications with common processes, among distributed virtual workforces and within Web 2.0 activities.

Cloud computing will have implications for most firms in the business applications, information technology support and data center businesses. Whether that impact is large or relatively small is hard to say, at the moment.

The TIA also expects cloud computing will continue to be the fastest-growing category of network and facilities investment during the next four years, averaging 20.3 percent compounded annually.

But it is end user spending that arguably drives most of the revenue, so one might argue that much of the opportunity will be reaped by firms that sell enterprise applications, not firms that sell infrastructure services more centrally related to hosting, for example.

TIA argues that end user spending on cloud apps will more than double to $12.1 billion in 2015 from $5.8 billion in 2011, according to the TIA. Separating out what that could mean for providers of cloud “data center facilities” is harder to assess.

In fact, most of the revenue upside appears likely to accrue to hardware and software suppliers, at least initially, according to a Morgan Stanley analysis.

In the infrastructure end of the business, telecom service providers might make a business out of rental of computing cycles, storage and ancillary services. But what has to be done to market and support that business, and should effort be put elsewhere?

In the telecom space, the analysts expect key winners to include Rackspace, Equinix and competitive local exchange carriers and metro bandwidth suppliers. In other words, hosting and access will be where the telecom revenue lies, possibly not in the infrastructure, platform or software as a service businesses.

The point is that assessing cloud computing revenue contributions for various ecosystem participants is complicated.

That forecast suggests why cloud computing initiatives by telcos will have to be targeted. There actually isn’t as much revenue in cloud computing as some tend to think. Nor is the space uncontested.

Companies such as Google, Amazon Web Services, Hewlett-Packard Development Co., Microsoft Corp. and Salesforce.com are themselves already leaders in the cloud infrastructure space, and already are displacing traditional infrastructure outsourcing alternatives, one might argue.

North America, specifically the U.S., currently represents the largest opportunity for SaaS, and it is the most mature of the regional markets. SaaS software revenue is forecast to total $9.1 billion in 2012, up from $7.8 billion in 2011.

But keep in mind that most of that revenue is earned providing expense management, financials, email and office suites. Though Web conferencing also is a SaaS application, few telcos are players to any major extent.

In Western Europe, SaaS revenue is forecast to surpass $3.2 billion in 2012, up from $2.7 billion in 2011, while SaaS revenue is Eastern Europe is projected to reach $169.4 million, up from $135.5 million last year.

SaaS revenue in Asia/Pacific is on pace to reach $934.1 million in 2012, up from $730.9 million in 2011.

SaaS revenue in Latin America is forecast to total $419.7 million in 2012, up from $331.1 million last year. None of those revenue streams are terribly large, by tier one service provider standards, nor are telcos the most logical providers.

In addition to the possibility that cloud-delivered enterprise apps compete most centrally with distributors of "shrink wrapped" apps, it can be argued that cloud infrastructure also competes with traditional "outsourcing" services.

Cloud infrastructure services are an alternative to traditional IT outsourcing services, often reducing the IT costs of their clients by at least 40 percent, according to livemint.com.

Likewise, you might argue that enterprise or other "app stores" might also compete with other software delivery channels.

What you will note about the enterprise app store concept is that it disintermediates nearly all of the premises networking infrastructure. There is no need for the enterprise local area network, except perhaps to switch to Wi-Fi access at times.

You can imagine this will have serious implications for firms that traditionally make a living selling gear and services for enterprise LANs. Just as easily, you can see the upside for traditional communications providers who now could have an expanded role in the information technology business.

What products would be “natural” parts of a communications and information technology bundle? How much easier would it be for traditional telco sales organizations to sell key business software?

In fact, non-technical sales forces of all types might find there are new opportunities to sell products that might have been “too technical” in the past. Firms outside “IT” might find they can create bundles almost on the fly, customized for vertical markets or businesses of various sizes and types.

A shift to some new computing architecture based on cloud resources and mobility could have huge implications for any number of businesses in the information technology and communications businesses.

Although growing interest has been observed in vertical-specific software, the most widespread use is still characterized by horizontal applications with common processes, among distributed virtual workforces and within Web 2.0 activities.

Cloud computing will have implications for most firms in the business applications, information technology support and data center businesses. Whether that impact is large or relatively small is hard to say, at the moment.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Africa Mobile Market Fastest Growing in World

If you can remember 1970s and 1980s policy discussions in the global telecom community about how to provide basic telephone service to the billion or more people who had never made a phone call, you will be astonished at how powerful mobile services have been. A problem thought too expensive to solve now is well on the way to vanishing.

Africa, for example, is the fastest-growing mobile market in the world and the largest after Asia, according to the GSM Association.

The number of subscribers on the continent has grown almost 20% each year for the past five years, according to the GSM Association GSMA report on the African mobile market. The GSMA expects there will be more than 735 million subscribers by the end of 2012.

Among the changes mobility is bringing is a new access to banking services. Africa already has 51 mobile money systems in place, serving more than 40 million African users.

Africa, for example, is the fastest-growing mobile market in the world and the largest after Asia, according to the GSM Association.

The number of subscribers on the continent has grown almost 20% each year for the past five years, according to the GSM Association GSMA report on the African mobile market. The GSMA expects there will be more than 735 million subscribers by the end of 2012.

Among the changes mobility is bringing is a new access to banking services. Africa already has 51 mobile money systems in place, serving more than 40 million African users.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

iPad Owners will Double in 2012

In fact, eMarketer predicts the number of iPad users in the US will rise by over 90 percent in 2012 to 53.2 million, as users replace older models and new consumers purchase the device. This year, the iPad will continue to be in the hands of more than 75 percent of all tablet users in the country, eMarketer predicts.

Of course, no product or service can sustain triple-digit growth forever, so the 2011 growth of iPad sales of 143.9 percent will slow over time. On the other hand, Apple does not appear likely to lose its commanding market share lead.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Sunday, June 10, 2012

Mobile, Web Commerce Use Drastically-Different Payment Methods

A study by ShopVisible suggests mobile payments use different methods than online payments.

Some 67 percent of customers used PayPal or an alternative payment method when buying something from their mobile, while 33 percent paid by credit card, a ShopVisible study of 23,000 transactions has found.

For Web transactions over the same period, the results were reversed, the study found. Some 62 percent of buyers paid by credit card, 12.9 percent by Amazon Payments, 8.1 used Google Checkout, and just 16.8 percent used PayPal.

It might be too early to extrapolate too much from the results. It probably remains the case that mobile shopping is for different products than online shopping.

It might be that a typical transaction amount is significant enough to influence the choice of payment method.

There could be other reasons why credit cards make sense for PC-based shopping. Perhaps entering a long string of credit card numbers is viewed as a feasible and convenient operation on a PC and not so much on a mobile, leading to a preference for payment methods that do not require such operations.

Some 67 percent of customers used PayPal or an alternative payment method when buying something from their mobile, while 33 percent paid by credit card, a ShopVisible study of 23,000 transactions has found.

For Web transactions over the same period, the results were reversed, the study found. Some 62 percent of buyers paid by credit card, 12.9 percent by Amazon Payments, 8.1 used Google Checkout, and just 16.8 percent used PayPal.

It might be too early to extrapolate too much from the results. It probably remains the case that mobile shopping is for different products than online shopping.

It might be that a typical transaction amount is significant enough to influence the choice of payment method.

There could be other reasons why credit cards make sense for PC-based shopping. Perhaps entering a long string of credit card numbers is viewed as a feasible and convenient operation on a PC and not so much on a mobile, leading to a preference for payment methods that do not require such operations.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Subscribe to:

Comments (Atom)

On the Use and Misuse of Principles, Theorems and Concepts

When financial commentators compile lists of "potential black swans," they misunderstand the concept. As explained by Taleb Nasim ...

-

We have all repeatedly seen comparisons of equity value of hyperscale app providers compared to the value of connectivity providers, which s...

-

It really is surprising how often a Pareto distribution--the “80/20 rule--appears in business life, or in life, generally. Basically, the...

-

One recurring issue with forecasts of multi-access edge computing is that it is easier to make predictions about cost than revenue and infra...