Though Sprint now owns what might under other circumstances be a controlling interest in Clearwire, both Sprint and Clearwire say that is not the case.

Clearwire CEO Erik Prusch addressed that issue on Clearwire's latest earnings report. "I want to be crystal clear, Sprint has not gained any additional governance rights or board seats through their agreement to purchase Eagle River shares," said Prusch.

"The strategic investor group board seats and governance rights do not transfer when shares are sold," said Prusch. That means Sprint does not gain additional board seats whenever it buys investment stakes held by other Clearwire investors, says Prusch.

It appears that some of the confusion grows from earlier decisions by Sprint and Clearwire whereby Sprint agreed not to have management control of Clearwire. Also, Sprint has in the past declined to take steps to control Clearwire or buy the company outright.

Still, many believe, despite the logic of the latest Clearwire statement and its factuality, in a de jure sense, that the de facto reality could be different.

Friday, October 26, 2012

CEO Says Sprint Did Not Gain Control of Clearwire

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Samsung, HTC, Apple Warn Abouit 4Q Earnings

Severe competition between smart phone and tablet makers will intensify in the period leading up to the Christmas and holiday season, likely signaling a tougher earnings climate.

Apple, Samsung and HTC gave cautious cautious guidance on their fourth quarter prospects. Major new device launches and the impact of a slowing global economy are seen as issues.

Total worldwide handset shipments reached 410 million units in the third quarter of 2012, Strategy Analytics says. Overall global shipments of mobile handsets were virtually flat in the second quarter, rising only one percent to 362 million units, according to Strategy Analytics.

But some might note that smart phone sales in some markets, such as the United States, have been slowing for years.

Apple, Samsung and HTC gave cautious cautious guidance on their fourth quarter prospects. Major new device launches and the impact of a slowing global economy are seen as issues.

Total worldwide handset shipments reached 410 million units in the third quarter of 2012, Strategy Analytics says. Overall global shipments of mobile handsets were virtually flat in the second quarter, rising only one percent to 362 million units, according to Strategy Analytics.

But some might note that smart phone sales in some markets, such as the United States, have been slowing for years.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Thursday, October 25, 2012

Clearwire Scales Back LTE Deployment, as Planned

Clearwire plans to have 2,000 Long Term Evolution sites on air by the end of June 2013 and expects to start receiving Sprint prepayment installments in June 2013. That plan is a reduction in sites from the earlier plan to light about 5,000 LTE sites.

Clearwire has decided not to attempt to create a full national LTE network, but instead will focus on a smaller number of markets where Clearwire could hope to provide wholesale service to other carriers.

Clearwire has decided not to attempt to create a full national LTE network, but instead will focus on a smaller number of markets where Clearwire could hope to provide wholesale service to other carriers.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Order of Magnitude Better Wireless Bandwidth by Tweaking TCP?

Testing the system on Wi-Fi networks at MIT, where two percent of packets are typically lost, Medard's group found that a normal bandwidth of one megabit per second was boosted to 16 megabits per second.

In a circumstance where losses were five percent—common on a fast-moving train—the method boosted bandwidth from 0.5 megabits per second to 13.5 megabits per second.

The technology is said to work by transforming the way packets of data are sent. Instead of sending packets, the system sends algebraic equations that describe series of packets.

So if a packet goes missing, instead of asking the network to resend it, the receiving device can solve for the missing one itself. Since the equations involved are simple and linear, the processing load on a phone, router, or base station is negligible,

The licensing is being done through an MIT/Caltech startup called Code-On Technologies.

As with all new technologies, it isn't clear whether similar results will be seen in the "real world," in commercial, mass deployments. But significant improvements should be expected.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Apple: The Company That Used to Make Computers

Apple's latest earnings report shows where Apple makes its money: phones and tablets. It still sells computers, but that is not what drives revenue.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

What Will Softbank Do with Sprint, Clearwire?

Whether you think Sprint's latest third quarter earnings report was modestly good or modestly bad almost does not matter at this point. What matters is what Softbank is willing to do with the Sprint and Clearwire assets.

Some believe, based on past evidence, that Softbank will try to disrupt the U.S. mobile market, probably using pricing in some way.

That was what Softbank did earlier in the Japanese market. That might lead some observers to speculate about whether the Softbank-owned Sprint will try to become the “Free Mobile” of the U.S. market.

In France, the Illiad-owned “Free Mobile” has disrupted the French mobile market. Already, FreedomPop is trying to disrupt mobile broadband pricing, as the Illiad Free Mobile effort already has done in the French mobile market.

In 2006, when Softbank decided to buy Vodafone KK assets, it likewise was criticized in some quarters for undertaking a risky gambit.

Some will argue Softbank is taking another huge risk by entering a country where iit has no previous operating experience, and by assuming a huge new debt load, after only recently shedding a similar debt load.

Softbank argues it is a reasonable risk, and that its prior experience taking on NTT Docomo and KDDI show it can compete in a market dominated by larger service providers.

Softbank, many believe, will use the same strategy it used in Japan, which some would describe as providing a large number of complementary features or services to create a “sticky” relationship with the end user.

Others will point to the pricing strategy. In Japan, Softbank’s 2006 acquisition of the Vodafone unit was not universally considered wise. But in just one year, Softbank managed to boost its subscriber base from 700,000 in fiscal 2006 to 2.7 million.

By the beginning of 2008, Softbank had grabbed 44 percent of Japan’s new mobile subscribers, well ahead of KDDI’s 35 percent and NTT-DoCoMo’s 11 percent.

Some think Softbank will be willing to launch a price war. In Japan, Softbank was willing to sacrifice voice average revenue per unit to make market share gains.

Back in the 2006 to 2008 period, Softbank was willing to accept a $13 a month ARPU decline to build market share.

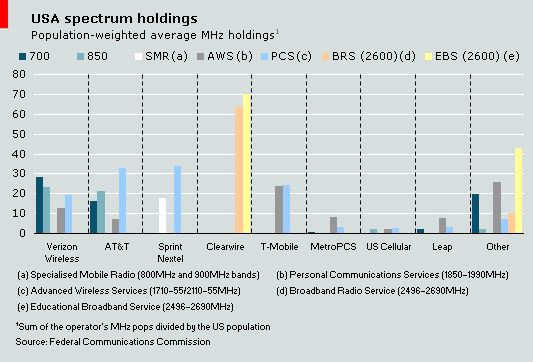

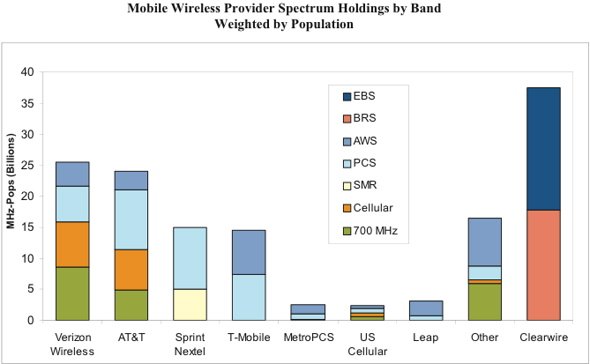

Spectrum will among the assets Softbank will be able to leverage.

Some believe, based on past evidence, that Softbank will try to disrupt the U.S. mobile market, probably using pricing in some way.

That was what Softbank did earlier in the Japanese market. That might lead some observers to speculate about whether the Softbank-owned Sprint will try to become the “Free Mobile” of the U.S. market.

In France, the Illiad-owned “Free Mobile” has disrupted the French mobile market. Already, FreedomPop is trying to disrupt mobile broadband pricing, as the Illiad Free Mobile effort already has done in the French mobile market.

In 2006, when Softbank decided to buy Vodafone KK assets, it likewise was criticized in some quarters for undertaking a risky gambit.

Some will argue Softbank is taking another huge risk by entering a country where iit has no previous operating experience, and by assuming a huge new debt load, after only recently shedding a similar debt load.

Softbank argues it is a reasonable risk, and that its prior experience taking on NTT Docomo and KDDI show it can compete in a market dominated by larger service providers.

Softbank, many believe, will use the same strategy it used in Japan, which some would describe as providing a large number of complementary features or services to create a “sticky” relationship with the end user.

Others will point to the pricing strategy. In Japan, Softbank’s 2006 acquisition of the Vodafone unit was not universally considered wise. But in just one year, Softbank managed to boost its subscriber base from 700,000 in fiscal 2006 to 2.7 million.

By the beginning of 2008, Softbank had grabbed 44 percent of Japan’s new mobile subscribers, well ahead of KDDI’s 35 percent and NTT-DoCoMo’s 11 percent.

Some think Softbank will be willing to launch a price war. In Japan, Softbank was willing to sacrifice voice average revenue per unit to make market share gains.

Back in the 2006 to 2008 period, Softbank was willing to accept a $13 a month ARPU decline to build market share.

Spectrum will among the assets Softbank will be able to leverage.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Some Things Don't Change: Sprint Subscriber Losses From Nextel

To the extent that Sprint is losing customers, those losses are attributable to Nextel, not "Sprint." As has been the case for some years, Sprint has been gaining subscribers, but those gains are offset by departing "Nextel" customers.

In other words, net gains on the "Sprint" side are offset by declines on the Nextel side of the company.

In other words, net gains on the "Sprint" side are offset by declines on the Nextel side of the company.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Subscribe to:

Posts (Atom)

DIY and Licensed GenAI Patterns Will Continue

As always with software, firms are going to opt for a mix of "do it yourself" owned technology and licensed third party offerings....

-

We have all repeatedly seen comparisons of equity value of hyperscale app providers compared to the value of connectivity providers, which s...

-

It really is surprising how often a Pareto distribution--the “80/20 rule--appears in business life, or in life, generally. Basically, the...

-

One recurring issue with forecasts of multi-access edge computing is that it is easier to make predictions about cost than revenue and infra...