Most of us believe that technology creates net jobs. But history might suggest the net impact is more mixed. Agricultural automation allowed farmers to do vastly more work with vastly less people, for example.

And it is possible that, on a net basis, software and hardware businesses, while creating new jobs, might displace more jobs, overall, than they create.

Some might argue the same also is true of broadband access, which virtually all of us might suggest is essential for learning and working in the 21st century. But some studies suggest the answer is quite nuanced.

One study suggests there are clearest benefits to "high technology" firms, fewer benefits for other firms, and limited benefits for consumers. Other studies also suggest there is a nuanced or subtle mix of benefits.

Consider the example of "rural" broadband, a seemingly clear case of how high speed Internet access can boost economic activity. The argument is that businesses will not locate in areas where high speed access is not available.

That arguably makes sense. But think about it: places where high speed access is best tend to be places where there are lots of people, lots of economic activity, the best transportation facilities, the closest distance to big markets, the biggest pools of skilled workers and the largest populations of consumers.

For that reason, one might argue that the best high speed Internet access follows people, rather than people following high speed access. It is an observation that cannot be scientifically tested, but correlation is not necessarily causation, in other words.

Some also might argue that the ability to work from home also has a negative impact on potential job creation in a particular rural area, since the connectivity might allow a job to be created remotely, even if the employee lives in a remote area and telecommutes.

Any many would argue that the impact is hard to discern, either way. That is not to say promoting broadband is wrong. We all agree it is important infrastructure. What is not so clear is whether spending too much on areas where broadband delivery is not so good will actually change very much in those areas.

Social equity is a praisworthy goal. But there is a difference between arguing that residents in rural areas should have substantially the same service are residents of urban areas, and arguing that providing such access equity will actually do much to boost economic activity in rural areas.

Talk to anybody in the business of rural communications and you quickly will find there are few customers of any type, business or consumer, to serve. And without a critical mass of people, many businesses simply cannot afford to locate in a rural area, no matter what the potential benefits might be.

There still is an income effect, but less than if a company were physically located in a rural area. One example is offshore call centers, or offshore software development. Because of high speed communications, jobs that might otherwise be sited in one country are actually sited in another country.

The bigger issue is now whether high speed access supports existing companies and jobs, or creates some number of new jobs that did not exist before. The larger question is whether those new jobs actually destroy other jobs in the broader economy, as agricultural mechanization has done.

Saturday, October 27, 2012

Does New Technology Create Net Jobs, or Destroy Them?

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Mobile Wallet Runs into the "Adoption Curve"

Mobile wallets or mobile payments are not the first new technology-based innovations presented to U.S. consumers as the "next big thing." So far, actual adoption has been fairly limited, outside of Starbucks stores, where Starbucks operates what most would consider to be the most-successful closed-loop mobile payments or mobile wallet service.

"Mobile payments and purchasing at the physical point of sale have experienced little adoption in the U.S. marketplace despite abounding innovation in mobile and payments technologies," according to Javelin Strategy & Research.

But that will change, for other reasons. A major shift of credit card security technology is coming, and that will be favorable for mobile payments.

Globally, an estimated 76 percent of point of sale terminals and 45 percent of cards are EMV‐enabled. “EMV” stands for “Europay, MasterCard and Visa,” a global standard for integrated circuit cards (IC cards or "chip cards") and IC card capable point of sale (POS) terminals and automated teller machines (ATMs). EMV often is referred to as a “chip and PIN” approach to security, as contrasted with the more-familiar U.S. “magnetic stripe” found on the backs of credit, debit and prepaid cards.

Right now, about 10 perent of U.S. terminals deployed in the United States support EMV. About one percent of cards use EMV.

The potential of mobile payments based on near field communications, which Javelin believes will ultimately emerge as the most successful mobile payments technology for the long-term, provides a powerful justification for merchants to invest in dual‐interface EMV terminals that support contactless NFC transactions and NFC-based mobile wallets.

“Javelin believes that NFC will ultimately be the leading technology underlying mobile wallet solutions, and implementing the EMV standards will facilitate that,” said Beth Robertson, Javelin director.

In other words, if most retail merchants upgrade to EMV, and they will, then the companion NFC support will create a ubiquitous point of sale infrastructure to support NFC-based payments. And retailers will adopt EMV because the payment networks have clearly said any merchant not using EMV will in the future bear the losses from fraud, not the payment networks, as now is the case.

That’s a big enough carrot to drive 100 percent of merchants to adopt EMV.

But new technologies historically take some time to reach 10 percent, then 50 percent, then virtually ubiquitous adoption. To be sure, there has been a tendency for new technologies based on digital and electronic technology to be adopted faster. But a decade period to reach perhaps 10 to 20 percent adoption is hardly unusual.

That is not much of an issue for point solutions like computers that can be used without lots of additional change in infrastructure. That is not true for highly-complex ecosystems such as payments, though.

ATM card adoption provides one example, where "decades" is a reasonable way of describing adoption of some new technologies, even those that arguably are quite useful.

Debit cards provide another example. It can take two decades for adoption to reach half of U.S. households, for example.

"Mobile payments and purchasing at the physical point of sale have experienced little adoption in the U.S. marketplace despite abounding innovation in mobile and payments technologies," according to Javelin Strategy & Research.

But that will change, for other reasons. A major shift of credit card security technology is coming, and that will be favorable for mobile payments.

Globally, an estimated 76 percent of point of sale terminals and 45 percent of cards are EMV‐enabled. “EMV” stands for “Europay, MasterCard and Visa,” a global standard for integrated circuit cards (IC cards or "chip cards") and IC card capable point of sale (POS) terminals and automated teller machines (ATMs). EMV often is referred to as a “chip and PIN” approach to security, as contrasted with the more-familiar U.S. “magnetic stripe” found on the backs of credit, debit and prepaid cards.

Right now, about 10 perent of U.S. terminals deployed in the United States support EMV. About one percent of cards use EMV.

The potential of mobile payments based on near field communications, which Javelin believes will ultimately emerge as the most successful mobile payments technology for the long-term, provides a powerful justification for merchants to invest in dual‐interface EMV terminals that support contactless NFC transactions and NFC-based mobile wallets.

“Javelin believes that NFC will ultimately be the leading technology underlying mobile wallet solutions, and implementing the EMV standards will facilitate that,” said Beth Robertson, Javelin director.

In other words, if most retail merchants upgrade to EMV, and they will, then the companion NFC support will create a ubiquitous point of sale infrastructure to support NFC-based payments. And retailers will adopt EMV because the payment networks have clearly said any merchant not using EMV will in the future bear the losses from fraud, not the payment networks, as now is the case.

That’s a big enough carrot to drive 100 percent of merchants to adopt EMV.

But new technologies historically take some time to reach 10 percent, then 50 percent, then virtually ubiquitous adoption. To be sure, there has been a tendency for new technologies based on digital and electronic technology to be adopted faster. But a decade period to reach perhaps 10 to 20 percent adoption is hardly unusual.

That is not much of an issue for point solutions like computers that can be used without lots of additional change in infrastructure. That is not true for highly-complex ecosystems such as payments, though.

ATM card adoption provides one example, where "decades" is a reasonable way of describing adoption of some new technologies, even those that arguably are quite useful.

Debit cards provide another example. It can take two decades for adoption to reach half of U.S. households, for example.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gartner Forecasts Android Tie With Windows By 2016

Android suppliers will collectively hold second place, with 109 million in unit sales. Microsoft will grow from 2.3 million units in 2012 and 9.3 million in 2013 to 34.4 million by 2016 for third place. The total tablet market may reach 364 million units by 2016, Gartner predicts.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

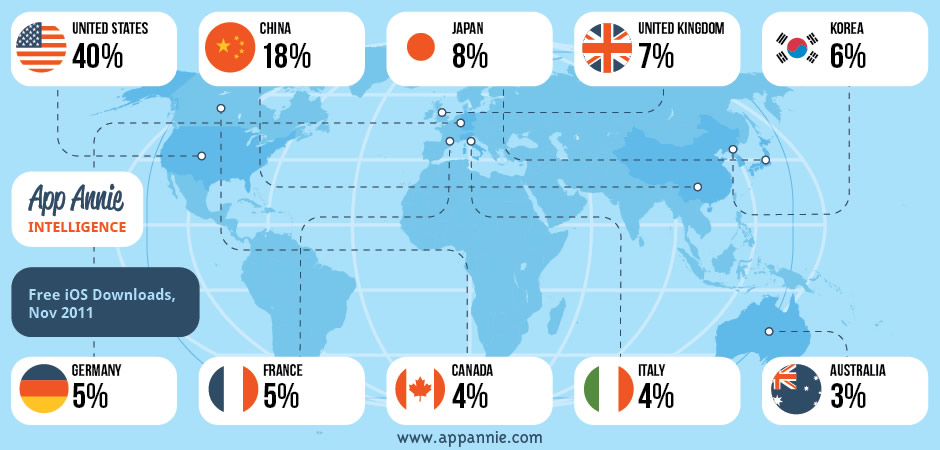

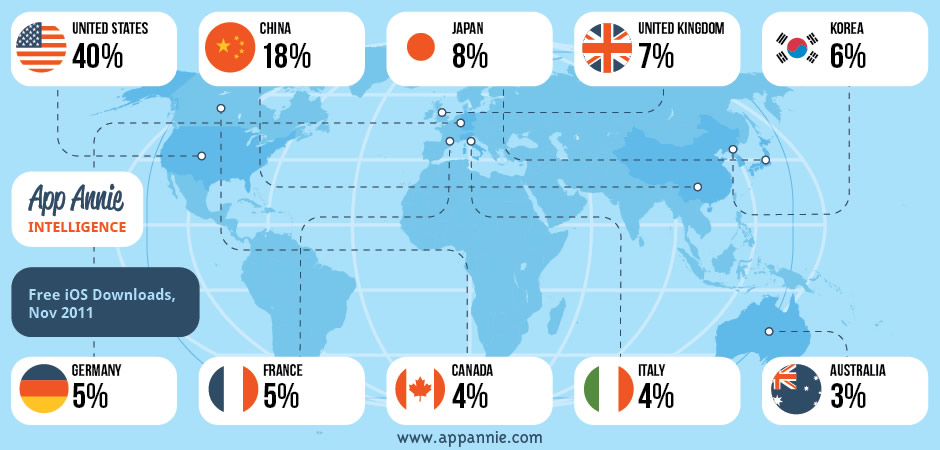

Freemium Works: Leads App Store Revenue Sources

If you look at revenue being earned by mobile apps, the "freemium" approach seems to be working. In fact, actual revenue earned by app providers leans heavily in "in direct" revenue earned from users paying for content or products supplied by "free" apps, compared to direct revenue earned by selling those apps to use.

Over the last two years, global revenues for freemium apps on iOS have more than quadrupled. In 2012, worldwide freemium revenues on Google Play have grown 3.5 times, according to App Annie.

Those revenue growth figures do not tell the full story, unless you compare the growth and absolute revenue figures with the revenue created by apps whose revenue model is "you buy the app."

Over the last two years, global revenues for freemium apps on iOS have more than quadrupled. In 2012, worldwide freemium revenues on Google Play have grown 3.5 times, according to App Annie.

Those revenue growth figures do not tell the full story, unless you compare the growth and absolute revenue figures with the revenue created by apps whose revenue model is "you buy the app."

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Apple Understands Product Life Cycle and Executes

Despite some complaints from iPad users upset about Apple introducing a new and "better" iPad at intervals of less than a year, Apple does cannibalize its own products at a prodigious rate, and has done so for some time.

While cynical observers might say cannibalization is a great way to force customers to upgrade, others might also argue that Apple cannibalizes products and models as a way of protecting its overall share in the device market.

Others might say Apple under Steve Jobs, at least, understood the notion of a product life cycle and executed on its with perfection. Apple further seems to have understood and implemented product strategies that match the ways customer adoption changes over time from early adopters to majority.

Starting with the iPod, Apple has lead with its most powerful, most expensive model first, aiming at early adopters, then introducing less costly versions as the market grows, capturing larger segments of the consumer base that do not value technology prowess so much as value.

The iPhone launched as Apple was achieving peak iPod sales of about 22 million units. It was exactly the right time for Apple to cannibalize its own business, in that view.

While cynical observers might say cannibalization is a great way to force customers to upgrade, others might also argue that Apple cannibalizes products and models as a way of protecting its overall share in the device market.

Others might say Apple under Steve Jobs, at least, understood the notion of a product life cycle and executed on its with perfection. Apple further seems to have understood and implemented product strategies that match the ways customer adoption changes over time from early adopters to majority.

Starting with the iPod, Apple has lead with its most powerful, most expensive model first, aiming at early adopters, then introducing less costly versions as the market grows, capturing larger segments of the consumer base that do not value technology prowess so much as value.

The iPhone launched as Apple was achieving peak iPod sales of about 22 million units. It was exactly the right time for Apple to cannibalize its own business, in that view.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Friday, October 26, 2012

A Look at "Post PC" Device Sales

By 2016, tablet sales are projected to exceed sales of PCs, according to NPD.

Overall mobile PC shipments will grow from 347 million units in 2012 to 809 million units by 2017.

Gartner projects worldwide media tablet sales to end users are forecast to total 118.9 million units in 2012, a 98 percent increase from 2011 sales of 60 million units, for example.

Overall mobile PC shipments will grow from 347 million units in 2012 to 809 million units by 2017.

Notebook PC shipments are expected to increase from 208 million units in 2012 to 393 million units by 2017, while tablet PC shipments are expected to grow from 121 million units to 416 million units in this period, for a compound annual growth rate of 28 percent.

A key driver for tablet PC growth is adoption in mature markets (including North America, Japan and Western Europe), which will account for 66 percent of shipments in 2012 and remain in the 60 percent range throughout the forecast period.

Tablet PC shipments into mature markets will grow from 80 million units in 2012 to 254 million units by 2017.

Worldwide Mobile PC Shipment Forecast (000s)

Source: NPD

“Consumer preference for mobile computing devices is shifting from notebook to tablet PCs, particularly in mature markets,” said Richard Shim, NPD senior analyst . “While the lines between tablet and notebook PCs are blurring, we expect mature markets to be the primary regions for tablet PC adoption.

Emerging and Mature Market Tablet Shipments (000s)

Source: NPD

Gartner projects worldwide media tablet sales to end users are forecast to total 118.9 million units in 2012, a 98 percent increase from 2011 sales of 60 million units, for example.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Service Providers Clearly are Cutting Spending

What seems like an endless wave of job cuts in the telecom equipment supplier industry has been going on for more than a year, separate from the background shrinkage that has been going on for more than a decade.

Among the latest is Ericsson, the largest global supplier of mobile network infrastructure, according to Bloomberg.

Ericsson AB reported a 43 percent decline in third-quarter profit as wireless operators curbed spending in a sputtering economy.

Net income fell to 2.18 billion kronor ($324 million) from 3.82 billion kronor, Stockholm-based Ericsson said today. Gross margin, or the percentage of sales remaining after production costs, slid to 30.4 percent from 35 percent, missing the 32.2 percent average of analysts’ estimates.

The clear evidence of investment in Long Term Evolution notwithstanding, it is clear enough that other projects are being postponed. Telecom capex fell in the wake of the Great Recession of 2008, as would be expected. Spending picked up by 2010, but it now appears more stringency has returned.

The problems arguably are centered in the European markets.

Severe competition between smart phone and tablet makers will intensify in the period leading up to the Christmas and holiday season, likely signaling a tougher earnings climate.

Apple, Samsung and HTC gave cautious guidance on their fourth quarter prospects. Major new device launches and the impact of a slowing global economy are seen as issues.

Total worldwide handset shipments reached 410 million units in the third quarter of 2012, Strategy Analytics says.Overall global shipments of mobile handsets were virtually flat in the second quarter, rising only one percent to 362 million units, according to Strategy Analytics.

But some might note that smart phone sales in some markets, such as the United States, have been slowing for years

Among the latest is Ericsson, the largest global supplier of mobile network infrastructure, according to Bloomberg.

Ericsson AB reported a 43 percent decline in third-quarter profit as wireless operators curbed spending in a sputtering economy.

Net income fell to 2.18 billion kronor ($324 million) from 3.82 billion kronor, Stockholm-based Ericsson said today. Gross margin, or the percentage of sales remaining after production costs, slid to 30.4 percent from 35 percent, missing the 32.2 percent average of analysts’ estimates.

The clear evidence of investment in Long Term Evolution notwithstanding, it is clear enough that other projects are being postponed. Telecom capex fell in the wake of the Great Recession of 2008, as would be expected. Spending picked up by 2010, but it now appears more stringency has returned.

The problems arguably are centered in the European markets.

Severe competition between smart phone and tablet makers will intensify in the period leading up to the Christmas and holiday season, likely signaling a tougher earnings climate.

Apple, Samsung and HTC gave cautious guidance on their fourth quarter prospects. Major new device launches and the impact of a slowing global economy are seen as issues.

Total worldwide handset shipments reached 410 million units in the third quarter of 2012, Strategy Analytics says.Overall global shipments of mobile handsets were virtually flat in the second quarter, rising only one percent to 362 million units, according to Strategy Analytics.

But some might note that smart phone sales in some markets, such as the United States, have been slowing for years

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Subscribe to:

Posts (Atom)

DIY and Licensed GenAI Patterns Will Continue

As always with software, firms are going to opt for a mix of "do it yourself" owned technology and licensed third party offerings....

-

We have all repeatedly seen comparisons of equity value of hyperscale app providers compared to the value of connectivity providers, which s...

-

It really is surprising how often a Pareto distribution--the “80/20 rule--appears in business life, or in life, generally. Basically, the...

-

One recurring issue with forecasts of multi-access edge computing is that it is easier to make predictions about cost than revenue and infra...