Wednesday, May 29, 2013

Smart Phone Adoption Growing at 42% Annually

The smart phone growth rate globally stands at 42 percent annually, according to the Kleiner Perkins Caufield Byers Internet Trends analysis.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

98% of U.S. Smart Phone Users Do Not Watch Mobile Video

A recent study by Experian Marketing Services suggests nearly 98 percent of U.S. smart phone users do not watch any video on a typical day.

Perhaps you are as surprised as I was to read that statistic, given all the statistics it would be easy to find suggesting that mobile video is growing really fast. The Experian data suggests high rates of growth coexist with low rates of usage because the growth of mobile video consumption is coming from a very low base of users and usage.

To be sure, other studies might suggest that mobile video consumption already is higher than found by the Experian study. Flurry, for example, found that mobile video consumption was nearly eight minutes a day, in March 2012.

Compare that to the two percent of users who do report using video, for five minutes a day, spread over 4.2 sessions, as the Experian study found.

That study suggests tablets are a more frequent screen used for consuming video, than the smart phone.

But a study Flurry suggested just the opposite trend, namely that smart phones were generating more video viewing than tablets.

Older data actually tends to support the Experian study’s finding that mobile video usage remains quite low.

In 2011, 91 percent of mobile device users did not watch video on a particular day, using their mobile device. But other studies suggest average consumption average consumption of nearly 10 minutes a day on mobile devices.

The point would seem to be that the impact of mobile video consumption is yet to be seen on most mobile networks.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Tuesday, May 28, 2013

BYOD Does Not Seem to Have Harmed the Enterprise Phone System Market

At least so far, the "bring your own device" trend in business does not seem to have affected enterprise demand for business phone systems, though pricing seems to be under pressure.

The global enterprise PBX market (TDM, hybrid, and pure PBXs) represented $1.8 billion in sales in first quarter of 2013, down nine percent from the previous quarter, and down 10 percent from the first quarter of 2012, according to Infonetics Research.

Price pressure seems to be the big problem, though, since demand in North America and Asia seems either flat or slightly up, in terms of shipments. “The big squeeze is coming from hyper-competitive price pressure all over, with average revenue per line down across the board,” said Diane Myers, Infonetics Research principal analyst.

Analysts at Dell’Oro Group think it is possible that generally flat revenue trends in the broader enterprise voice markets could change over the next few years, though. “Our view is that the calculation for enterprises has changed, thanks to BYOD and a younger generation of employees comfortable with social media and communicating without a desk phone,” Dell'Oro Group researchers say.

“As a result of this shift, many premise-based customers may adopt “Voice as a SaaS” solution in a hosted/cloud infrastructure in the near future,” Dell’Oro Group says.

Separately, a study sponsored by Cisco suggests that bring your own device policies already are embraced by 89 percent of organizations, principally meaning those organizations allow their workers to bring their own devices for work.

The Cisco financial analysis was conducted across six countries--Brazil, China, Germany, India, the United Kingdom, and the United States--and suggests BYOD employees are gaining a global average of 37 minutes of productive time per week.

The time savings range from 81 minutes per week in the United States to just four minutes per week in Germany, where BYOD is viewed more skeptically.

On average, the current median level of BYOD implementation—what Cisco calls “Basic BYOD”—generates $350 of value each year per mobile employee.

The number of BYOD devices in the countries surveyed expected to more than double, from 198 million in 2013 to 405 million by 2016, Cisco says.

Smart phones are the overwhelming choice of BYOD employees, who own an average of 1.7 devices for work and have paid $965 in out-of-pocket costs for them.

The global enterprise PBX market (TDM, hybrid, and pure PBXs) represented $1.8 billion in sales in first quarter of 2013, down nine percent from the previous quarter, and down 10 percent from the first quarter of 2012, according to Infonetics Research.

Price pressure seems to be the big problem, though, since demand in North America and Asia seems either flat or slightly up, in terms of shipments. “The big squeeze is coming from hyper-competitive price pressure all over, with average revenue per line down across the board,” said Diane Myers, Infonetics Research principal analyst.

Analysts at Dell’Oro Group think it is possible that generally flat revenue trends in the broader enterprise voice markets could change over the next few years, though. “Our view is that the calculation for enterprises has changed, thanks to BYOD and a younger generation of employees comfortable with social media and communicating without a desk phone,” Dell'Oro Group researchers say.

“As a result of this shift, many premise-based customers may adopt “Voice as a SaaS” solution in a hosted/cloud infrastructure in the near future,” Dell’Oro Group says.

Separately, a study sponsored by Cisco suggests that bring your own device policies already are embraced by 89 percent of organizations, principally meaning those organizations allow their workers to bring their own devices for work.

The Cisco financial analysis was conducted across six countries--Brazil, China, Germany, India, the United Kingdom, and the United States--and suggests BYOD employees are gaining a global average of 37 minutes of productive time per week.

The time savings range from 81 minutes per week in the United States to just four minutes per week in Germany, where BYOD is viewed more skeptically.

On average, the current median level of BYOD implementation—what Cisco calls “Basic BYOD”—generates $350 of value each year per mobile employee.

The number of BYOD devices in the countries surveyed expected to more than double, from 198 million in 2013 to 405 million by 2016, Cisco says.

Smart phones are the overwhelming choice of BYOD employees, who own an average of 1.7 devices for work and have paid $965 in out-of-pocket costs for them.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Monday, May 27, 2013

Indoor Wi-Fi Vexes U.K. Enterprise Managers

About 39 percent of U.K. large business managers with information technology decision making responsibility say poor indoor mobile coverage or capacity are problems they have faced.

That is hardly surprising, given the important role Wi-Fi networks already have assumed in supporting mobile device Internet access.

The survey also reveals that 35 percent of IT managers say that they would be prepared to move to a wireless carrier that could guarantee a better indoor solution.

About 40 percent of IT managers also had interest in Wi-Fi as a service from their operator.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

What Would it Take for Google Fiber to Attract Investors Formerly Funding Cable and Telco Networks?

A reasonable argument can be made that the actual primary and intended purpose of Google Fiber is to cause other major ISPs to vastly increase their own investment in access networks.

But there could be other eventual outcomes. Google Fiber might become something else, namely a sustainable business. You might argue that Google would not want the huge distraction of creating a huge new ISP business.

But it might not have to. Google Fiber could conceivably become so successful that it could attract the same sorts of investors that traditionally have invested in telco or cable TV networks.

Google Fiber potential hinges on penetration rates, one might argue. In other words, if Google Fiber does only as well as the best traditional “overbuilders,” getting possibly 20 percent of homes as customers, it might be a sustainable business, but just barely.

That might make Google Fiber something that can be replicated on a wide scale, attracting the same sorts of investors that previously might have funded telco and cable TV networks.

But there could be other eventual outcomes. Google Fiber might become something else, namely a sustainable business. You might argue that Google would not want the huge distraction of creating a huge new ISP business.

But it might not have to. Google Fiber could conceivably become so successful that it could attract the same sorts of investors that traditionally have invested in telco or cable TV networks.

Google Fiber potential hinges on penetration rates, one might argue. In other words, if Google Fiber does only as well as the best traditional “overbuilders,” getting possibly 20 percent of homes as customers, it might be a sustainable business, but just barely.

But if Google Fiber were to reach much higher levels of adoption, up to perhaps 50 percent, it would have financial prospects vastly better than any other overbuilder has achieved.

Google Fiber's core network will cost between $674 and $500 per passing, the former representing Kansas City, Kan. costs, the latter Kansas City, Mo. costs.

It will cost Google $464 to actually connect an Internet access customer, and $794 to connect a customer buying both video and Internet access. Those figures are roughly in line with what other telcos might expect to invest in a similar market.

The key variable is degree of customer penetration, not so much cost of infrastructure.

Assume it costs $600 to build the network passing every location, and then about $450 to connect each actual customer.

At 20 percent penetration, the cost per customer is $450 plus the value of the capital invested to build of the rest of the network that is not serving actual customers. At 20 percent penetration, that means the cost of the network per customer is $3,000. So the cost of serving each customer is $3,450.

For simplicity, ignore the potential value of customers who opt for the “free” access option, and the potential value to Google Fiber if each of those “free” nodes includes a public Wi-Fi element.

At 50 percent penetration, the cost per customer (including both network and customer premises capital) is $1650. At 50 percent adoption, revenue is more than twice as high as at 20 percent penetration and capital investment per customer is nearly 50 percent lower.

Were Google Fiber to reach 50 percent penetration, profit margin might also improve by as much as 100 percent over the 20-percent penetration level.

That might make Google Fiber something that can be replicated on a wide scale, attracting the same sorts of investors that previously might have funded telco and cable TV networks.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Sunday, May 26, 2013

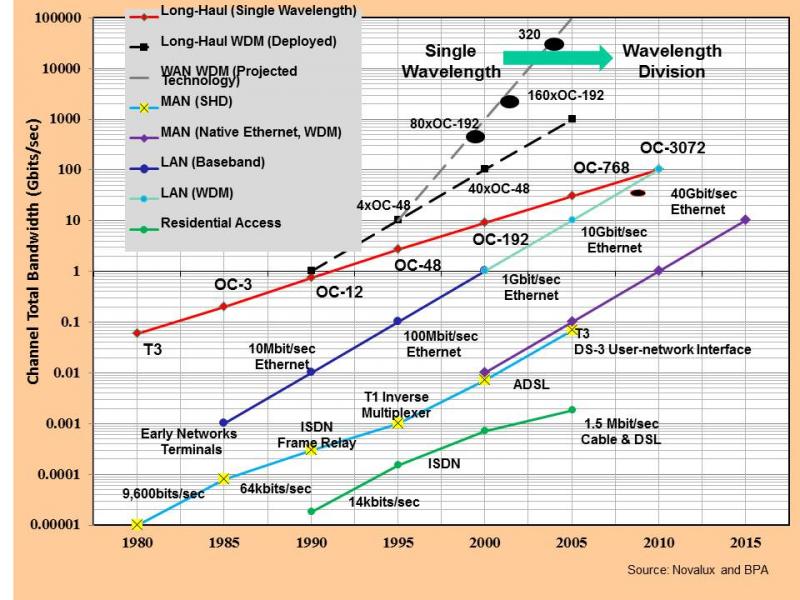

Internet Speeds Have Grown 10X Every 5 Years Since 1990

Access speeds in the U.S. and other markets have grown by an order of magnitude (10x) every five years, since about 1990. If you assume that speeds were about 10 Mbps in 2010, that suggests U.S. consumers will be buying 100 Mbps services by about 2015, and could be buying 1 Gbps services by 2020.

That will be a shock for most ISPs, but would simply follow the pattern of typical bandwidth since 1990.

And that is just what some Internet access speed forecasts would predict. As a rough rule of thumb, speeds have increased by about an order of magnitude every five years.

Availability of 100 Mbps services grew even more: 448 percent between 2010 and 2012. Availability of 50 Mbps services grew 160 percent between 2010 and 2012, the

NTIA study found.

Australian access speeds show the same trend, with access speeds doubling about every five years.

In August 2000, only 4.4 percent of U.S. households had a home broadband connection, while 41.5 percent of households had dial-up access. At that time, the effective price for a 1-Mbps connection might have been $234.

A decade later, dial-up subscribers declined to 2.8 percent of households in 2010, 68.2 percent of households subscribed to broadband service, with effective prices per Mbps of perhaps a couple to a few dollars.

The availability of 100 Mbps to 1 Gbps Internet access services grew the fastest, from 2010 to 2012, according to a new study by the National Telecommunications and Information Administration (NTIA). Though growing from a low base, availability of 1-Gbps services grew nearly 300 percent between 2010 and 2012.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

For Apple, "Winning" is Device Sales; For Google "Winning" is App Usage

There is some value in knowing the percentage of all mobile phones that are "smart," because that tells us something about the shape of "computing." But over time, all phones will be "smart," so the importance of "smart phones," as compared to "use of phones," ultimately will prove less relevant.

Nor, in one sense, do all suppliers approach the "smart phone" market the same way.

For Apple, which always has made money selling devices, revenue and profit margin matter. Samsung's concerns are similar.

For Google, what matters is the base of users of its applications. And despite the ISP concern about "share of revenue" within the Internet ecosystem, one fact remains. As has been the case since the advent of the dial-up access market, the overwhelming share of revenue earned within the ecosystem is garnered by access providers.

Nor, in one sense, do all suppliers approach the "smart phone" market the same way.

For Apple, which always has made money selling devices, revenue and profit margin matter. Samsung's concerns are similar.

For Google, what matters is the base of users of its applications. And despite the ISP concern about "share of revenue" within the Internet ecosystem, one fact remains. As has been the case since the advent of the dial-up access market, the overwhelming share of revenue earned within the ecosystem is garnered by access providers.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Subscribe to:

Comments (Atom)

At Alphabet, AI Correlates with Higher Revenue

Though many of the revenue-lifting impacts of artificial intelligence arguably are indirect, as AI fuels the performance of products using ...

-

We have all repeatedly seen comparisons of equity value of hyperscale app providers compared to the value of connectivity providers, which s...

-

It really is surprising how often a Pareto distribution--the “80/20 rule--appears in business life, or in life, generally. Basically, the...

-

One recurring issue with forecasts of multi-access edge computing is that it is easier to make predictions about cost than revenue and infra...