Microsoft will be looking for a new CEO to replace Steve Ballmer. Microsoft has bought Nokia's entire handset business. That, in turn, means Nokia CEO Stephen Elop is an "internal" candidate for the job of Microsoft CEO, but might also make his selection harder, ironically.

Elop has been mentioned as among the logical candidates to replace Ballmer. Some have argued Microsoft needs somebody "from the outside" to reposition the company. Whether Elop should have been seen as "external" or "internal" was an issue before.

Elop is well versed about Microsoft, and apparently already is returning to Microsoft as head of the devices team.

But some investors and observers believe Microsoft needs an "outside" perspective. Now that Elop is back "inside" Microsoft, that could be a complication.

How quickly events can turn.

Tuesday, September 3, 2013

Microsoft Steve Ballmer Succession Now Could be Affected by Acquisition of Nokia Handset Business

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Verizon Purchase of Vodafone Verizon Wireless Assets Might Highlight Strategic Value of Fixed Networks

Assuming the proposed Vodafone sale of its 45 percent stake in Verizon Wireless is completed and approved by regulators, observers wonder what Vodafone will do with the proceeds.

Many assume much of the proceeds will be given directly to shareholders. Some think as much as $90 billion or so will be distributed in that way, leaving perhaps a war chest of $40 billion for acquisitions and infrastructure investment.

Some have suggested Vodafone will try to buy fixed network assets in Europe so that it can offer bundles of broadband, mobile and TV services.

That, some might argue, suggests something about the strategic value of fixed network assets, namely its value in supporting quadruple-play services. Others might point to the growing value of mobile offload capabiltiies as well.

On the other hand, many also would say there are clear differences of opinion about the value of fixed network assets. Verizon, one might say, is making a statement about growth opportunities in the U.S. mobile market.

Others might disagree. Much depends on one's assessment of where growth can be found in the global telecom business.

Many assume much of the proceeds will be given directly to shareholders. Some think as much as $90 billion or so will be distributed in that way, leaving perhaps a war chest of $40 billion for acquisitions and infrastructure investment.

Some have suggested Vodafone will try to buy fixed network assets in Europe so that it can offer bundles of broadband, mobile and TV services.

That, some might argue, suggests something about the strategic value of fixed network assets, namely its value in supporting quadruple-play services. Others might point to the growing value of mobile offload capabiltiies as well.

On the other hand, many also would say there are clear differences of opinion about the value of fixed network assets. Verizon, one might say, is making a statement about growth opportunities in the U.S. mobile market.

Others might disagree. Much depends on one's assessment of where growth can be found in the global telecom business.

One way of looking at the matter is that Verizon sees revenue growth in the European and U.S. mobile businesses, and likes what it sees. Others are worried that Verizon is banking too much on continued strong rates of revenue growth in the U.S. market.

On one hand, it is hard to argue with the facts, at the moment. In Europe, wireless revenue declined 4.3 percent in 2012, while U.S. revenue growth accelerated about nine percent, according to CTIA.

So it makes sense, in that view, to capture more of the value of the growth by getting full ownership of the Verizon Wireless asset.

AT&T, on the other hand, is said to be looking at global assets, indicating a less sanguine view of the U.S. market, in terms of revenue growth. Of course, AT&T has a bigger footprint in the U.S. market than does Verizon, so AT&T might reasonably conclude it has less room to grow domestically.

There are other differences as well. Vodafone has indicated it wants to buy fixed network assets in Europe, to complement its mobile assets. Basically, Vodafone wants to replicate the Verizon Communications and AT&T strategy in the United States, where those firms are able to sell quadruple play offers.

AT&T, on the other hand, is said to be exclusively interested in acquiring mobile assets in Europe, where the belief is, new Long Term Evolution networks will reignite revenue growth.

So where Vodafone is thinking quad play, AT&T is thinking “mobile only.”

Those strategy differences have become increasingly obvious in a business that once featured virtually homogenous strategies by all leading providers in the monopoly era. Since the advent of deregulation, the disruptive influence of the Internet and the rise of mobile services and video entertainment, companies increasingly have chosen distinct business models.

Vodafone originally had a “mobile only” approach but gradually has taken on more fixed network assets. Both Verizon and AT&T once were primarily fixed network service providers but have evolved to the point where mobile services drive revenue growth at both firms.

Vodafone, on the other hand, also has seen first hand the impact of a disruptive assault from a firm such as SoftBank, which bought Vodafone’s Japan operation and proceeded to attack retail pricing levels.

“Vodafone’s management may be looking at the U.S. and saying to itself, ‘We’ve seen this movie before,’” Craig Moffett, principal of Moffett Research, has said.

At least for the moment, those differences in assessment of market potential are going to have clear impact on firm strategies.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Microsoft to Buy Nokia's Handset Business

So much for avoiding channel conflict: Microsoft is buying Nokia's handset business in a Microsoft $7.2 billion deal that makes Microsoft a direct competitor to its Windows licensees.

Microsoft already had taken some steps in that direction earlier, by creating its own gaming business and platform. Microsoft then created its own branded tablet. Now Microsoft has moved directly into the branded mobile phone business, a move that finally makes Microsoft a supplier of branded phones, at retail, in competition with its operating system licensees.

To be sure, such channel conflict has been growing in the mobile ecosystem for some time. Google has had to face the challenge in supporting Android and also owning Motorola, which has made Google a competitor of device firms using Android.

So far, the channel conflicts primarily have been an issue for operating system providers and their licensees. But application providers generally increasingly looking at getting into the branded device business. Barnes and Noble and Amazon are the best examples in the tablet business.

What hasn't yet happened, but would take the channel conflict further, is a move by a major application provider directly into the mobile access provider business. On the fixed network side of the business, Google already has made that conceptual leap with Google Fiber, and now as a supplier of Wi-Fi at U.S. Starbucks locations.

Some observers think Microsoft Mobile will have to rely on the Nokia assets to win a bigger share of the mobile OS market. The acquisition essentially confirms that thesis.

The other angle is what Nokia will do, after the sale. Nokia then becomes a mobile infrastructure supplier, through Nokia Siemens Networks. That is a huge shift.

But some think BlackBerry will have to make some similar change as well, becoming a more focused supplier of services infrastructure, and less a supplier of handsets, if in fact BlackBerry can stay in the handset business at all.

Microsoft already had taken some steps in that direction earlier, by creating its own gaming business and platform. Microsoft then created its own branded tablet. Now Microsoft has moved directly into the branded mobile phone business, a move that finally makes Microsoft a supplier of branded phones, at retail, in competition with its operating system licensees.

To be sure, such channel conflict has been growing in the mobile ecosystem for some time. Google has had to face the challenge in supporting Android and also owning Motorola, which has made Google a competitor of device firms using Android.

So far, the channel conflicts primarily have been an issue for operating system providers and their licensees. But application providers generally increasingly looking at getting into the branded device business. Barnes and Noble and Amazon are the best examples in the tablet business.

What hasn't yet happened, but would take the channel conflict further, is a move by a major application provider directly into the mobile access provider business. On the fixed network side of the business, Google already has made that conceptual leap with Google Fiber, and now as a supplier of Wi-Fi at U.S. Starbucks locations.

Some observers think Microsoft Mobile will have to rely on the Nokia assets to win a bigger share of the mobile OS market. The acquisition essentially confirms that thesis.

The other angle is what Nokia will do, after the sale. Nokia then becomes a mobile infrastructure supplier, through Nokia Siemens Networks. That is a huge shift.

But some think BlackBerry will have to make some similar change as well, becoming a more focused supplier of services infrastructure, and less a supplier of handsets, if in fact BlackBerry can stay in the handset business at all.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Monday, September 2, 2013

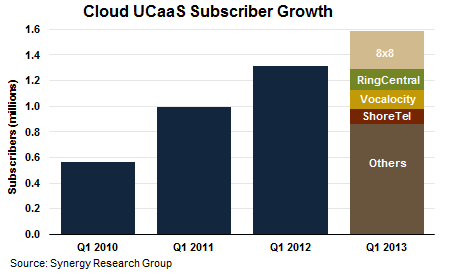

Cloud-Based UC is Growing in U.S., Still Lags Globally

The cloud-based “unified communications as a service” business remains a market heavily tilted to the United States. In fact, the leaders of the UCaaS business globally are determined in large part by their market positions in North America, and in particular, U.S. market share.

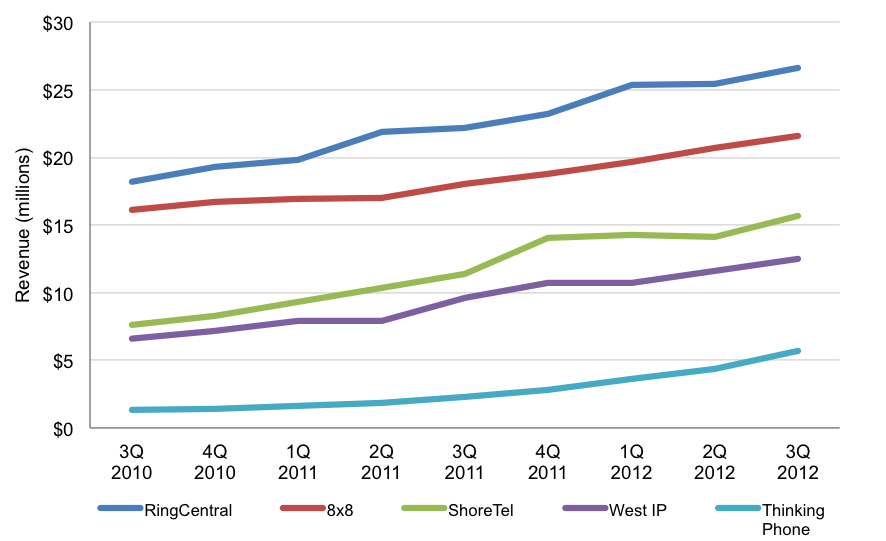

UCAAS BUSINESS SUITE WORLDWIDE REVENUES, Q3 2010-Q3 2012

For some of us, the big question is why cloud-based UC resonates in the U.S. and North American market so well, and yet appears to lag so much in most other world markets.

Each of the top four global UCaaS providers by market share hold the same position in North America. North America accounted for 87 percent of UCaaS subscribers in the first quarter of 2013, followed by the EMEA(Europe, Middle East, and Africa) region, which had 10 percent of worldwide UCaaS subscribers.

One would be very hard pressed to name another communications service that is so concentrated in terms of buyers (by region). One would therefore be tempted to say that cloud-based UC has not yet gotten much traction anywhere outside North America.

Whether that means there is huge unmet potential (undoubtedly true) or huge indifference, is hard to say. If the cloud trend is real, and most would agree that it is, then most of the eventual sales have yet to be made.

Cloud computing is important, some might argue, because cloud computing represents the next wave of computing architecture, as there were earlier waves of mainframe, minicomputer and PC-based computing.

IDC predicts that the collaborative applications segment of the U.S. SaaS applications market grew 10.6 percent year over year in 2012 to over $2.6 billion in revenue.

Current market research indicates that Web conferencing and videoconferencing and UC are at or near the top of the list of applications most likely to move to the cloud, IDC says.

IDC estimates that collaborative applications (including instant communications,

enterprise social software, conferencing, team collaboration, and email) account for 14 percent of the total U.S. cloud applications market and 51 percent of the total U.S. collaborative applications segment revenue in 2012.

Synergy Research Group suggests a handful of leading U.S. cloud UC services suppliers, representing about half the U.S. market, earned about $84 million a quarter in the second quarter of 2013, suggesting those firms represent an annual market north of $340 million. If one assumes that is half the U.S. cloud UC market, then annual revenues would be in the $680 million range.

New data from Synergy Research Group show that between the first quarter of 2010 and the first quarter of 2013, unified communications as a service (UCaaS) subscribers nearly tripled to reach 1.6 million, and now account for 24 percent of total cloud UC subscribers. This is up from 21 percent three years earlier, Synergy Research estimates.

Together, four providers account for nearly half of UCaaS subscribers. 8×8 is the market leader, with 19 percent of subscribers. RingCentral, Vocalocity, and ShoreTel follow, with 10 percent, nine percent, and eight percent, respectively.

While the cloud UCaaS market as a whole grew 22 percent year over year in the second quarter of 2013, Vocalocity grew 45 percent while ShoreTel grew 37 percent.

Suppliers iCore, RingCentral and 8x8 all saw year-on-year revenue growth in the 18 percent to 22 percent range. In aggregate the six market leaders accounted for 54 percent of total quarterly UCaaS revenues, with 8x8 maintaining its overall market share lead at 15 percent.

UCAAS BUSINESS SUITE WORLDWIDE REVENUES, Q3 2010-Q3 2012

source: Synergy Research

For some of us, the big question is why cloud-based UC resonates in the U.S. and North American market so well, and yet appears to lag so much in most other world markets.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Sunday, September 1, 2013

Vodafone Agrees to Sell its Stake in Verizon Wireless for $130 Billion

Vodafone and Verizon Communications seem to have agreed on a $130 billion price for the sale of Vodafone's 45 percent stake in Verizon Wireless to Verizon Communications. The deal still has to be approved the boards of both companies, but there would seem to be little danger of a complication on that front.

Verizon would pay for the stake in roughly equal portions of cash and stock, so Vodafone would become a minority investor in Verizon Communications, though holding publicly tradeable stock that could be sold gradually to liquify the rest of the sale proceeds.

The deal would not change U.S. mobile market share at all, and should not trigger unusual regulator scrutiny.

The drama might follow, though. Will Vodafone itself go on a buying spree? Will another major global carrier make a bid to buy Vodafone? And what will other European service providers conclude they must do?

At the very least, executives have to make fundamental decisions about whether they are going to be buyers or sellers.

Verizon would pay for the stake in roughly equal portions of cash and stock, so Vodafone would become a minority investor in Verizon Communications, though holding publicly tradeable stock that could be sold gradually to liquify the rest of the sale proceeds.

The deal would not change U.S. mobile market share at all, and should not trigger unusual regulator scrutiny.

The drama might follow, though. Will Vodafone itself go on a buying spree? Will another major global carrier make a bid to buy Vodafone? And what will other European service providers conclude they must do?

At the very least, executives have to make fundamental decisions about whether they are going to be buyers or sellers.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Microsoft Research Study Shows People are Rational About Internet Access Choices

A study by Microsoft Research India, while investigating one question, might also suggest an answer to other questions, among them the rationality of Internet consumers, the important role played by retail tariffs and usage caps, as well as user ability to maximize overall use of all Internet access resources available in any market, in ways that maximize end user satisfaction and value.

The specific question the researchers asked was “if you have the internet in your pocket, why do you still visit a public access venue?” They studied teenager behavior in Cape Town, South Africa.

Most grade-11 teens in low-income township schools in Cape Town have used their mobiles to access the internet since 2008, the researchers note. By 2010, South Africa had over 100 percent mobile penetration (50 million subscriptions) but only 743,000 fixed broadband subscribers, they also say.

The findings were that teenagers “who could, in theory, be ‘mobile-only’ Internet users have instead constructed a ‘mobile-centric’ repertoire.” They used their more-expensive mobile access when needed for some tasks, but shifted resource-intensive operations to public access venues, including libraries and cybercafes.

Doing so saves them money and also offers a better end user experience. Mobiles are used for quick, non-intensive apps. Libraries get used for quick-turnaround search-copy-paste-print operations, when sessions are limited to 15 minutes, for example.

Internet cafes tended to be used when video editing and visual design as well as integration with handwritten and photocopied material was required.

The larger point is that Internet users, one might argue, is that people in low-income parts of Cape Town, South Africa, or in developed nations, are rational and competent judges of ways they use access services.

They shape their own usage behavior based on accurate assessments of what forms of access save them money and best match the purposes for which they are using the Internet.

Some may use Internet cafes because of the better hardware (faster PCs, better printers and peripherals), since PC hardware is expensive in South Africa, due to import duties and

lack of domestic manufacturing.

Mobile coverage is good but data tariffs are relatively expensive. Usage caps for digital subscriber line services are frequently capped with monthly limits as low as 1GB.

Wireless data is purchased in a way similar to prepaid airtime, encouraging end user attention to “running meters.”

The implications are clear enough. “Broadband policy” consists of more than building faster networks of all types. The way tariffs are structured has a powerful impact on user behavior, leading people to consume access in logical ways.

That is why Wi-Fi offload has become such a pronounced activity in many developed markets.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Saturday, August 31, 2013

Verizon, Vodafone Making Different Bets on Market Growth?

Either way you look at the strategic challenges, both Vodafone and Verizon Communications are making big bets in assessing whether the U.S. or European markets are better places to invest for growth.

You might argue Verizon Communications is betting that the U.S. market is going to remain robust, so capturing all of the returns from Verizon Wireless makes sense.

You might also argue that in selling its highest-revenue operation, Vodafone is making the opposite calculation, namely that despite a clear revenue down trend in Europe, Vodafone’s prospects actually are higher in Europe than in the U.S. market, which virtually all observers currently estimate will grow revenues .

AT&T appears to agree with Vodafone, specifically because the undeveloped state of Long Term Evolution in Europe will allow for revenue growth, once the networks are activated.

Others might argue that Verizon Communications is gambling a bit that the U.S. market has not reached a revenue peak, in terms of revenues. Some would argue that increasingly competent new attacks by a revitalized T-Mobile US and a SoftBank-driven Sprint will lead to a major price war that will depress industry revenues.

In Western Europe, for example, revenue is forecast to drop through 2020, for example. Some would attribute that weakness to competitive pressures.

By way of comparison, the U.S. market is viewed as less competitive, and Verizon is betting that it will do better by essentially increasing its U.S. mobile exposure, since mobile contributes about 86 percent of total Verizon Communications revenue. Fixed network operations contribute only about 14 percent.

Keep in mind that it was Vodafone that sold its struggling Japanese asset to SoftBank in 2006. Vodafone executives might expect that something similar will happen in the U.S. market, as a SoftBank-owned Sprint attacks U.S. mobile industry pricing structure.

NTT DoCoMo was the dominant service provider then, as Verizon Wireless is now. NTT DoCoMo still holds that position, but gross revenue and profit margins have been battered.

“If you’ve watched what happens when Softbank enters a wireless market, you might not want to watch it again,” said Craig Moffett, senior analyst at Moffett Research.

Right now, observers expect U.S. mobile revenue growth, just as they expect declines in many parts of Europe.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Subscribe to:

Comments (Atom)

On the Use and Misuse of Principles, Theorems and Concepts

When financial commentators compile lists of "potential black swans," they misunderstand the concept. As explained by Taleb Nasim ...

-

We have all repeatedly seen comparisons of equity value of hyperscale app providers compared to the value of connectivity providers, which s...

-

It really is surprising how often a Pareto distribution--the “80/20 rule--appears in business life, or in life, generally. Basically, the...

-

One recurring issue with forecasts of multi-access edge computing is that it is easier to make predictions about cost than revenue and infra...