As a U.S. District Court weighs a legal challenge to the Federal Communications Commission’s authority to promulgate network neutrality rules, European regulators are tussling with the same issues. One wonders whether the debate also misses a much larger point.

The future communications ecosystem might in fact require the creation and use of many quality-enhancing mechanisms, used to support services created and delivered (assembled) dynamically, to support both end user application requirements, application innovation and service provider financial health.

In other words, some of the key network neutrality concepts, especially quality of service mechanisms that discriminate between packets, could be a foundation for tomorrow’s sustainable ecosystems.

If one assumes that the revenue required to sustain continuous investment in next generation networks always is generated by revenues earned by serving end users and business partners, then it is axiomatic that if the current revenue underpinning is threatened by changing demands, then new revenue mechanisms will have to be created.

Some might argue that is not the public’s problem. Such people also likely see no problem were a major trade union to prefer the death of its members’ jobs by causing an entity bankruptcy, rather than modify their wage and benefit demands.

This actually happens. Eastern Airlines unions in the late 1980s had a choice: agree to contracts they apparently abhorred, and keep Eastern Airlines flying, or refuse, and see Eastern go bankrupt. The union chose bankruptcy .

Assuming an observer is not such a nihilist, the health of the ISP and the communications infrastructure matters to everyone, since all useful and entertaining applications require a fast, low latency, affordable, capable and flexible network.

Let us assume that today’s access provider business model is unsustainable, driven by erosion of the legacy revenue model, competitive impact on retail pricing and a shift of value to “over the top” applications whose key characteristic is that the value and revenue is mostly captured by third parties using access and communication networks.

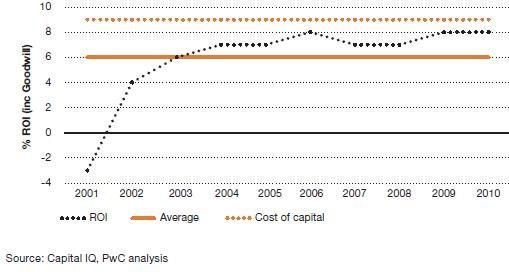

PwC, for example, has argued that massive telecom network investments over the past decade or so have failed to generate a financial return. In fact, PwC argues that the average long-term return has been a mere six percent or just 300 basis points less than its cost of capital.

If you think there is no problem, you might not care about ISP survival and flourishing. The rest of us ultimately do have a stake in this matter.

Many would argue that ISPs need to create new sources of value derived from more flexible use of their networks. In the past, some have argued that “bandwidth on demand” could be part of the answer.

Others prefer something more along the lines of applications or computing resources on demand, or end user information (location, type of device now connected, preferences and past behavior) on demand, but you get the point: flexible networks able to create customizable features and services often are seen as one key way access networks will provide new value.

It is difficult to envision how quality, not just flexibility, would fail to be part of the raw material for such an approach to creating network value.

Resources that are “what you want, when you want them, the way you want them” would seem to require some assurance of quality, especially if rated (priced) on an “on demand” basis.

Users already assume Internet connections are relatively ubiquitous, rather reliable and reasonably affordable.

Beyond that, they have few expectations. And that is the value ISPs must create.

The telecom business used to exist to make its own apps work. Now the telecom business exists to enable third party applications. That is a huge shift.

And it is hard to see how that works very well as a revenue model for the access providers unless they have something more valuable to provide their application providers. Quality of service attributes would seem to be one of the more promising avenues.

In that sense, network neutrality is an impediment. Without packet shaping, quality of service features are hard to create. Sooner or later, that will become obvious.