Amazon, the Wall Street Journal reports, is hoping to sell retailers a Kindle-based retail checkout system, likely positioned like Square and other providers of mobile credit card reader systems.

The attraction would seem to be the access to customer data, not so much the lucrative payment terminal business.

But Amazon might also be thinking it can bring other "value add" to the systems, compared to existing offers from other established payment system providers. The immediate inducements could relate to offers, promotions or discounts, especially related to retailer sales on Amazon.com

Longer term, Amazon might eventually leverage other assets. Amazon Web Services could come into play, or possibly logistics support.

Amazon also reportedly is considering a mobile wallet service that would be used by consumers.

Wednesday, January 29, 2014

Amazon to Enter Retail Payments Business

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Google Selling Motorola Mobility

Google says it is selling what remains of Motorola Mobility--while retaining the patent portfolio, to PC maker Lenovo for $2.9 billion.

Google, which bought Motorola Mobioity for $12.5 billion in May 2012, already had sold off the part of the business building cable set-top boxes, and seems now to retain what it really wanted: the patent portfolio.

The move does not completely address the channel conflict of Google being in some parts of the device market, such as it now is with Nest, the home automation supplier. But the move does ease the channel conflict potential to a significant extent.

Google, which bought Motorola Mobioity for $12.5 billion in May 2012, already had sold off the part of the business building cable set-top boxes, and seems now to retain what it really wanted: the patent portfolio.

The move does not completely address the channel conflict of Google being in some parts of the device market, such as it now is with Nest, the home automation supplier. But the move does ease the channel conflict potential to a significant extent.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

U.S. Justice Department "Skeptical" About Possible Sprint Acquisition of T-Mobile UA

Sprint's Possible T-Mobile US acquisition, to nobody's surprise, is viewed "skeptically" by U.S. Department of Justice officials, Sprint board members Masayoshi Son and Dan Hesse apparently have been told at a meeting.

But nothing is ever as it appears on the surface, where it comes to key communications developments. AT&T, in formally announcing it has no plans to make an immediate bid for Vodafone, might trigger thinking that AT&T does not want to make such a bid.

That undoubtedly is the wrong way to view the declaration. By law, AT&T, when asked by U.K. authorities, whether it planned to make such a bid in the next 30 days, had to answer "no," and thereby wait at least six months before making any such bid.

But AT&T would not have made such a bid within the next 30 days. Too much depends on how European regulators treat other pending deals, in particular consolidation in Germany. AT&T had no choice but to respond the way it did.

Likewise, some might think Sprint could not win approval for a deal to buy T-Mobile US, no matter what the concessions. That probably also is not entirely certain.

The Justice Department, though having a view that the U.S. mobile market already is too concentrated, and though it favors a minimum of four providers, might also be presented with an acquisition plan that maintains four providers, and especially the robust attacks T-Mobile US is making.

It could happen.

But nothing is ever as it appears on the surface, where it comes to key communications developments. AT&T, in formally announcing it has no plans to make an immediate bid for Vodafone, might trigger thinking that AT&T does not want to make such a bid.

That undoubtedly is the wrong way to view the declaration. By law, AT&T, when asked by U.K. authorities, whether it planned to make such a bid in the next 30 days, had to answer "no," and thereby wait at least six months before making any such bid.

But AT&T would not have made such a bid within the next 30 days. Too much depends on how European regulators treat other pending deals, in particular consolidation in Germany. AT&T had no choice but to respond the way it did.

Likewise, some might think Sprint could not win approval for a deal to buy T-Mobile US, no matter what the concessions. That probably also is not entirely certain.

The Justice Department, though having a view that the U.S. mobile market already is too concentrated, and though it favors a minimum of four providers, might also be presented with an acquisition plan that maintains four providers, and especially the robust attacks T-Mobile US is making.

It could happen.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

AT&T Pays $100 Credit for Every New Line Added

Market observers who were worried about the implications of a new marketing war in the U.S. mobile business have new reason to worry.

AT&T now is offering all new and existing AT&T customers a $100 bill credit for each new smartphone, tablet, feature phone, mobile hotspot or Wireless Home Phone line of service they add.

The offer is said to be good through March 31, 2014.

The latest incentive comes on top of rival offers by T-Mobile US and AT&T that pay off any early termination fees customers might face when changing service providers before the end of a contract term.

AT&T now is offering all new and existing AT&T customers a $100 bill credit for each new smartphone, tablet, feature phone, mobile hotspot or Wireless Home Phone line of service they add.

The offer is said to be good through March 31, 2014.

The latest incentive comes on top of rival offers by T-Mobile US and AT&T that pay off any early termination fees customers might face when changing service providers before the end of a contract term.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

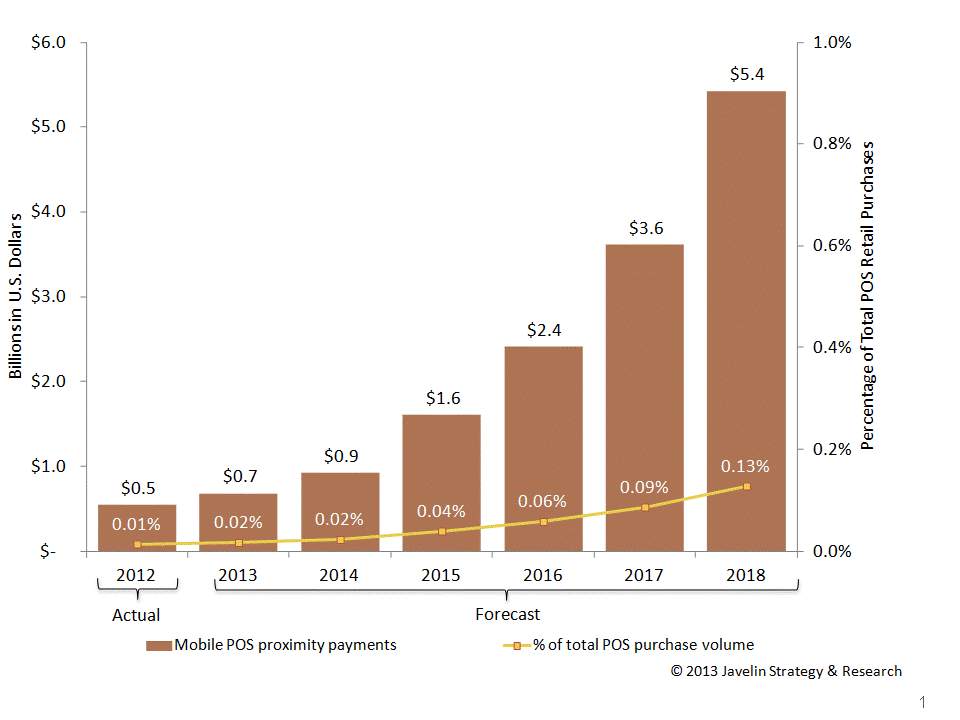

Retailer Mobile Card Readers are the Acknowledged Success in Mobile Payments Field

The usefulness of mobile payment services, as used by consumers, might be hard to ascertain.

But it is clear that retailer adoption is accelerating

Mobile transactions will account for about two percent of all credit and debit card volume in the United States in 2013 and four percent globally, according to BI Intelligence.

Just what percentage of small retailers have adopted mobile card readers such as Square is a matter of debate. What is not debatable is that mobile card readers such as those offered by Square have become a big deal.

By some estimates, 40 percent of retailers already are using mobile card readers.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

U.K. Market Illustrates Rule that Household Spending on Communications is Highly Stable

Consumer spending on communications and video entertainment tends to be stable. In other words, households tend to spend about the same percentage of household income on communications and video entertainment services every year.

The variables are changes in household income, and changes in prices for the purchased items.

That implies any increase in household spending in one category likely is balanced by reduced spending in some other category, unless the prices of purchased goodds decreases.

In the U.K. market, households spend between three percent and four percent of household income on communications and video entertainment services. The sole exception is the highest 10th of U.K. households, ranked by household income, where spending is between two percent and three percent.

That is what one would expect. Households with higher incomes can buy a fixed set of services for a smaller percentage of total household income.

Over the years 2001 to 2013, U.K. households began spending more money on mobile services, and less on fixed voice, while also increasing consumption of broadband Internet access. In other words, demand shifted to mobile and broadband, even when unit prices fell.

Mobile accounts in the United Kingdom surpassed fixed network voice accounts in early 2009, according to Ofcom, the U.K. communications regulator. Between 2001 and 2013, U.K. household penetration of fixed line voice dropped from 93 percent to 84 percent, while use of mobile increased from 67 percent to 92 percent.

Fixed line broadband, meanwhile, grew from three percent in 2001 up to 72 percent of U.K. households

That appears to be what happened in the U.K. fixed Internet access business. The average price of a broadband package decreased by 48 percent between 2004 and 2012.

In fact, since 2008, when Virgin Media began offering its 50 Mbps service, declining prices have been matched almost exactly as economics would indicate.

As price declined, demand increased in linear fashion, exactly what one would expect, if basic economic principles relating to supply and demand have validity.

In the U.K. market, average household spending on broadband has been roughly flat since about 2006, even as households have been increasing their consumption of higher speed services. The reason is lower retail prices.

And even though U.K. consumers are buying “more mobile service,” they also are spending a stable amount of money, as prices have fallen. The volume of voice calls made using a mobile device has more than doubled in the past ten years, while the volume of text messages has increased from 24 billion to over 170 billion, Ofcom notes.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Tuesday, January 28, 2014

Text Messaging Decline Can Be Slowed, in Many Mobile Markets

Most observers would agree that over the top alternatives are cannibalizing direct carrier revenues to some degree, though reasonable observers might disagree about the extent of such shifts of end user spending.

At the same time, most observers would agree that those alternatives also can stimulate carrier revenue, principally by increasing spending on Internet access services.

Yet others might argue that cannibalization happens, but that it is not such a threat to carrier revenue as one might think, in part because carrier text messaging is a large revenue stream, while over the top messaging is a comparably small revenue source.

The point is that the revenue impact of substitute products is complex, with some potential losses offset by indirect revenue from other sources (people need data access plans to use OTT messaging).

At least so far, text messaging is a business with direct carrier revenues two orders of magnitude greater than OTT messaging.

Informa Telecoms and Media forecasts that mobile operators will generate a total of $722.7 billion in revenues from text messaging revenues between 2011 and 2016, for example, while

third-party providers of over the top (OTT) messaging services will earn about $8.7 billion in 2016.

But Informa Telecoms & Media also has predicted that global annual SMS revenues will fall by US$23 billion by 2018, to US$96.7 billion, down from US$120 billion in 2013. The decline in global SMS revenues will largely be caused by the continuing adoption and use of over-the-top (OTT) messaging applications in both developed and emerging markets.

By region, Asia Pacific is forecast to experience the highest drop in annual SMS revenues over the forecast period, falling from US$45.8 billion in 2013, to US$38 billion in 2018, Informa predicts.

Asia Pacific is where a number of OTT messaging apps have originated, including Tencent’s WeChat (China), Kakao’s Kakao Talk (South Korea) and Naver’s Line (Japan). Much of the revenue loss in Asia Pacific will come from China, where annual SMS revenues are forecast to fall from US$25.4 billion in 2013 to US$19.6 billion in 2018.

Informa estimates that, in Western Europe, Italy will see the steepest decline in its text messaging revenues, falling to US$2.2 billion in 2018 from US$3.3 billion in 2013, representing a compound annual growth rate of minus 7.54 per cent.

On the other hand, at least some mobile operators are in position to limit losses by changing their retail packaging.

Mobile operators in markets with a high proportion of postpaid subscribers can mitigate the impact of OTT messaging applications by offering unlimited text messaging or large bundles of text messaging.

Prepaid operators in some markets also can take that tack. Scratch Wireless, a new mobile virtual network operator in the U.S. market, offers unlimited text messaging within the domestic market at no incremental change, for example.

For example, Informa forecasts that, in South Korea, where 99 percent of mobile subscribers are postpaid, text messaging revenues will decline relatively slowly over the forecast period, from US$2.51 billion in 2013 to US$2.1 billion by 2018.

This is a CAGR of minus 3.5 per cent, less than half that of Italy and despite the popularity of Kakao Talk in South Korea.

In France, where 74 per cent of subscribers are postpaid, text messaging revenues will decline at a CAGR of minus 4.1 per cent from US$4.1 billion in 2013 to US$3.3 billion in 2018.

In July 2013 and August 2013 Vodafone experienced year-over-year mobile messaging traffic declines of 35 percent in Germany and 29 percent in both Italy and Spain.

mobile operators in developed markets will offer their own IP communications apps.

In September 2013 Optimus launched a youth-oriented service in Portugal that bundles free use of OTT apps such as WhatsApp, Facebook Messenger and BBM with traditional mobile services.

One might argue about the value of such a bundle in markets where mobile Internet access is not a basic part of a subscription, but the approach can make sense in markets where mobile data is deemed relatively expensive and the lead Internet applications are social messaging related.

In a few cases, mobile service providers also have experimented with You Tube-focused mobile service plans that might appeal to heavy mobile video users who do not otherwise have high needs for general purpose Internet access.

Some leading mobile providers, such as Orange, have developed branded OTT apps. Orange operates LiBon whileTelefónica offers TUGo.

Sprint also recently launched what it calls its “Messaging Plus” app on a white label basis using Jibe Mobile.

How successful any of the operator-branded services will be, over the long term, is hard to say. In many ways, the strategic dilemma is similar to the challenge posed by over the top VoIP. Whether a service provider competes, or not, per-unit prices, and hence revenue and profit margin, evaporate.

A clear divergence of mobile service provider opinion exists about how to cope with the over the top communications threat or opportunity. Some firms think branded OTT apps will help. Others think that will not help.

Some carriers will build their own communications apps while others will white-label

existing apps from third parties. In some other cases, mobile service providers will partner with OTT apps to provide favored access.

But perhaps half of mobile service providers either believe that is not fruitful, and will not embrace OTT messaging, or have not yet concluded such an approach is necessary.

U.S. mobile operators, for the most part, are in the latter camp, while several leading European service providers are in the former group.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Subscribe to:

Posts (Atom)

Which Firm Will Use AI to Boost Revenue by an Order of Magnitude?

Ultimately, there is really only one way for huge AI infrastructure investments up by an order of magnitude over cloud computing investment ...

-

We have all repeatedly seen comparisons of equity value of hyperscale app providers compared to the value of connectivity providers, which s...

-

It really is surprising how often a Pareto distribution--the “80/20 rule--appears in business life, or in life, generally. Basically, the...

-

Is there a relationship between screen size and data consumption? One might think the answer clearly is “yes,” based on the difference bet...