Basically, no more than six percent of retail connections are supplied by MVNOs.

Thursday, July 2, 2015

U.S. MVNOs Have Less than 6% Market Share

The mobile virtual network operator business in the United States isn't all that big, according to the latest data published by the Federal Communications Commission.

Basically, no more than six percent of retail connections are supplied by MVNOs.

Basically, no more than six percent of retail connections are supplied by MVNOs.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

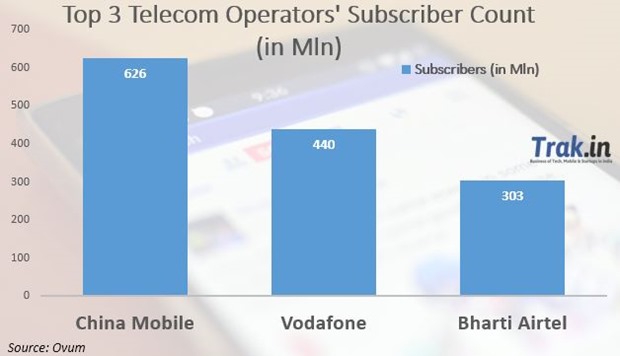

Bharti Airtel Is Now World’s 3rd Largest Telecom Company

Bharti Airtel has passed China Unicom to become World’s third-largest telecom company in the world, based on subscribers. Airtel now has 303 million subscribers, while China Unicom has 299 million subscribers, according to WCIS (World Cellular Information Service).

WCIS is a global telecom research tool powered by data analysis firm Informa Telecoms and Media (ITM) Research.

Out of 303 million customers of Bharti Airtel, 228.25 million are based in India, and the rest are from 17 countries in Africa, Sri Lanka and Bangladesh.

Globally, the largest telecom company is China Mobile, with 626 million customers. Vodafone is second largest, with 440 million customers.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

India Mobile Ops Raising Data Prices

Higher revenues are what many expect for Bharti Airtel, which is investing $1 billion to upgrade its networks for 3G services.

Bharti Airtel has hiked mobile data prices for 2G and 3G services by 13 percent to 18 percent for its prepaid customers. The 3G charges for 1GB have been raised to Rs 299 against Rs 255 earlier valid for a period of 28 days.

Further, Bharti Airtel 2G charges for 1GB plans have been raised to Rs 199 compared with Rs 176 valid for a period of 28 days.

Nokia will be a major supplier for the 3G upgrades.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

NTT Docomo Earns 15% of Revenue from Non-Traditional Sources

NTT Docomo earns 15 percent of its revenues from non-traditional sources, the largest proportion of any telco worldwide, and largely earned from various “Smart Life” apps and services.

Revenues from Docomo Smart Life businesses, which provide consumers with advice, information, security, cloud storage and other lifestyle services, grew 22 percent to 421 billion yen (US$3.5 billion) in the year ending March 2015.

Those initiatives are important because Docomo has seen its revenue from telecom services decline every year since 2006, making Docomo a key test of how a mobile service provider can create brand new revenue streams to displace declining legacy revenues.

In part, that growth has been fueled by third party content providers on the “dmenu” portal.

Suppliers grew from 700 in March 2012 to 3,000 in March 2016.

Monthly users of dmarket grew to 20 million by March 2016, up from 1.5 million in March 2012.

Beyond dmarket, Docomo has also deployed other value added services including navigation, local information, NFC-based wallet and information services, credit card and carrier-billing-based payments, translation apps, health and wellness services, insurance, pet and child tracking. DOCOMO also provides an i-concierge service as well.

However one wished to describe the strategy--moving up the value chain, creating a platform or becoming an app enabler--Docomo is a pioneer for other mobile service providers also forced to explore growth strategies based on brand new services.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Global IT Spending Under Pressure, Currency Largely the Reason

Communications services will remain the largest information technology spending segment in 2015, rising to nearly $1.5 trillion, according to the latest forecast by Gartner.

But this segment is also experiencing the strongest decline among the five IT sectors. Price erosion and competitive threats are preventing revenue growth in proportion to increasing use within most national markets.

Also, global IT spending is on pace to total $3.5 trillion in 2015, a 5.5 percent decline from 2014, Gartner says, largely an effect of a stronger U.S. dollar.

In constant-currency terms, the market is projected to grow 2.5 percent.

"We want to stress that this is not a market crash. Such are the illusions that large swings in the value of the U.S. dollar versus other currencies can create," said John-David Lovelock, research vice president at Gartner. "However, vendors do have to raise prices to protect costs and margins of their products, and enterprises and consumers will have to make new purchase decisions in light of the new prices."

Worldwide IT Spending Forecast by Sector (Billions of U.S. Dollars)

2014

|

2014

|

2015

|

2015

| |

Spending

|

Growth (%)

|

Spending

|

Growth (%)

| |

Devices

|

693

|

2.4

|

654

|

-5.7

|

Data Centre Systems

|

142

|

1.8

|

136

|

-3.8

|

Enterprise Software

|

314

|

5.7

|

310

|

-1.2

|

IT Services

|

955

|

1.9

|

914

|

-4.3

|

Communications Services

|

1,607

|

0.2

|

1,492

|

-7.2

|

Overall IT

|

3,711

|

1.6

|

3,507

|

-5.5

|

Source: Gartner (June 2015)

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Subscribe to:

Comments (Atom)

At Alphabet, AI Correlates with Higher Revenue

Though many of the revenue-lifting impacts of artificial intelligence arguably are indirect, as AI fuels the performance of products using ...

-

We have all repeatedly seen comparisons of equity value of hyperscale app providers compared to the value of connectivity providers, which s...

-

It really is surprising how often a Pareto distribution--the “80/20 rule--appears in business life, or in life, generally. Basically, the...

-

One recurring issue with forecasts of multi-access edge computing is that it is easier to make predictions about cost than revenue and infra...