The City of Fort Collins will build its own retail municipal broadband network. The city expects to build the entire network over three to four years.

Target residential pricing is $50 per month for 50-Mbps service, and $70 per month for 1-Gbps service.

An “affordable Internet” tier also will be offered, the business plan says. The city expects to borrow between $130 million and $150 million to fund network construction and activation.

The city estimates a cost per passed home to be $984, with the cost to connect a customer location at about $600 each.

It is obvious that most of the customers will come from one of the two dominant providers, Comcast and CenturyLink, as more than 91 percent of households already buy a fixed network internet connection.

Comcast has about 57 percent market share, while CenturyLink has about 37 percent share, the city says.

Comcast already has launched gigabit services in Fort Collins, ahead of the municipal network launch.

City consultants estimate the new municipal network could get as much as 30 percent share of market. That is based, in large part, on experience. Other municipal networks have gotten share in about that range.

One caveat is that it is unclear how the other networks measure penetration. One way is to count by connected homes. The other method, where a network offers multiple services, is to count “units sold” and then divide by the number of households.

In such cases, the actual number of connected homes is less than the penetration figures would suggest, as a single home, buying three services, generates three revenue units. When measuring penetration rates, that has the same impact as three homes buying one service.

So some of us would guess that the actual household penetration can range from less than 20 percent to perhaps 35 percent.

Much also will hinge on what Comcast and CenturyLink decide to do to hang on to existing customer accounts.

Comcast’s gigabit pricing originally was set at $159.95 per month without a contract, and $110 per month with a one-year contract.

But few might predict Comcast is willing to lose huge chunks of market share rather than lower its prices to about $70 a month (or whatever level is needed to remain competitive with the municipal network).

Comcast has offered $70 a month pricing in other markets where it faces serious competition for gigabit internet access.

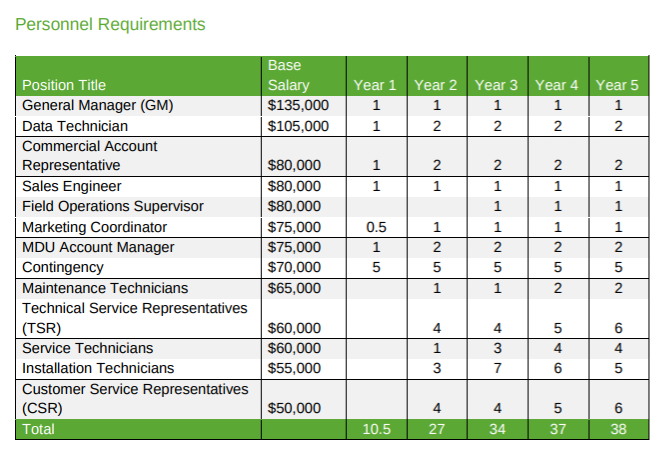

Some idea of operating costs (exclusive of marketing) can be seen in estimates for personnel.

The larger point is that more competition in the internet access space keeps coming, despite fears of a duopoly and limited consumer benefits. For most potential consumers, the real options are going to be mobile services, though, as 5G services are launched nationwide.