Shockingly, it might be a myth that mobile broadband contributes to economic growth. Perhaps even more shockingly, some argue mobile broadband could, in some instances, actually retard growth.

Counter to common expectations, the relationship between expanded mobile broadband usage and economic growth is chaotic: it might help, it might have no effect, or it might, shockingly, harm economic growth. Some studies suggest relatively small effects, if we can indeed isolate broadband from all the other forces contributing to economic activity. Yet other studies interpreted as suggesting causation actually only show correlation.

The reasons for such non-correlation (ignoring for the moment causation) are likely that economic growth is the result of many interacting forces. Broadband alone is hard to isolate.

“Since broadband is an access technology for data communications, it only has an economic effect in combination with the adoption of information technology, and the implementation of organizational and process changes in enterprises,” the United Nations Broadband Commission has noted. “In other words, for broadband to have an impact on productivity, the ICT ecosystem has to be sufficiently developed.”

In other words, broadband alone does not explain very much, from an agency that believes broadband must be extended to increase economic benefits.

You might well suppose that mobile broadband, and broadband generally, has the greatest impact where information work is most intensive. Conversely, you might expect clear impact to be least where that is not the case. That is what the U.N. study found.

“This very surprising conclusion comes from Businessweek having a look at some recent UN numbers on broadband and telecoms more generally around the world,” says Forbes. “We get the highly counterintuitive result that an expansion of mobile broadband coverage leads to a reduction in the rate of economic growth.”

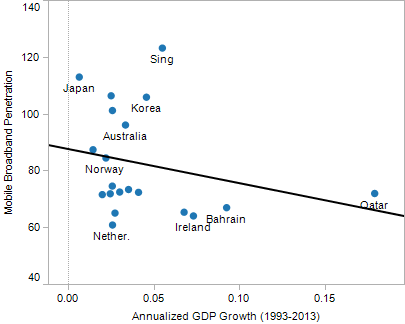

“Focusing on the top 20 leaders in the mobile group, we see there is actually a negative relationship between GDP growth and broadband penetration,” Forbes notes. “It’s not even fair to say that the fastest-growing economies are the fastest growers in broadband.”

That said, most observers instinctively believe more mobile broadband is helpful. Correlation is highest in developed countries; lower in developing countries.

“Economic benefits to sub-Saharan Africa stemming from Facebook’s connectivity initiatives can exceed USD50 billion over the next five years (2020–2024) in nominal current GDP terms,” say analysts at Analysys Mason. Most of the impact comes from the value and impact of internet traffic on the wide area and local access infrastructure Facebook has put into place.

source: Analysys Mason

Methodology and assumptions are everything in forecasts. Analysys Mason derives its estimates by applying a rule of thumb used by the International Telecommunications Union.

“A 2019 study by the ITU used econometric analysis of data from the majority of countries in Africa to determine that a 10 percent increase in mobile broadband penetration (e.g. from 20 percent to 22 percent) in Africa would yield a 2.5 percent increase in GDP per capita in a given year, over and above the baseline growth projected for the country or region,” Analysys Mason says.

Virtually nobody would disagree that having quality broadband is correlated with some amount of economic growth. The problem is that we have no certain way of knowing the full causal chain.

Would gross domestic product grow even in the absence of more-ubiquitous broadband? Almost certainly. But does more-ubiquitous broadband access “cause” faster growth, or does faster growth lead to higher demand for broadband? It is a question we cannot answer.

One must assume the ITU formula of “mobile broadband and mobile broadband adoption” illustrates a causal relationship and not merely an associative relationship. In other words, ubiquitous broadband somehow creates economic growth, rather than economic development driving demand for more broadband.

Though correlation is not causation, it might also be said that, in terms of the relationship between mobile broadband adoption and gross domestic product, the correlation might be positive, neutral or negative.

That is not what people tend to believe, or want to believe. But neither does evidence necessarily support the notion that mobile broadband causes, or leads to, economic growth.

source: Yankee Group

"There are just too many other factors that affect GDP growth for mobile broadband to have any significant and measurable effect,” said Yankee Group Research VP Declan Lonergan.

Still, it is fair to say virtually everyone wishes to believe that more-extensive mobile broadband does have a positive impact on economic and social development. We simply cannot say for sure when, and how much, mobile broadband might contribute.

Most of us believe there is a correlation between widespread broadband access and economic growth or wealth. But there also is a clear correlation between education, income and age and supply or use of broadband and the internet. It’s hard to distinguish between chickens and eggs, in terms of “which came first?”