Most firms that are leaders in any segment of the computing and communications ecosystems eventually find they must consider moving into new segments of their existing value chains to maintain growth. “Up the stack” or “across the value chain” are typical options.

For suppliers positioned high in the value stack (application providers, for example) movement down the value chain also makes sense. The older notion of “vertical integration” applies, even when there is no attempt to completely vertically integrate operations.

For connectivity providers, the movement is almost always going to involve moving up the stack, from physical layer IP connectivity towards application and platform supply roles. It almost never makes much sense to integrate “lower” in the value chain by becoming a manufacturer of radios, cable, fittings, connectors, servers, chipsets or other infrastructure used to create and support IP connections.

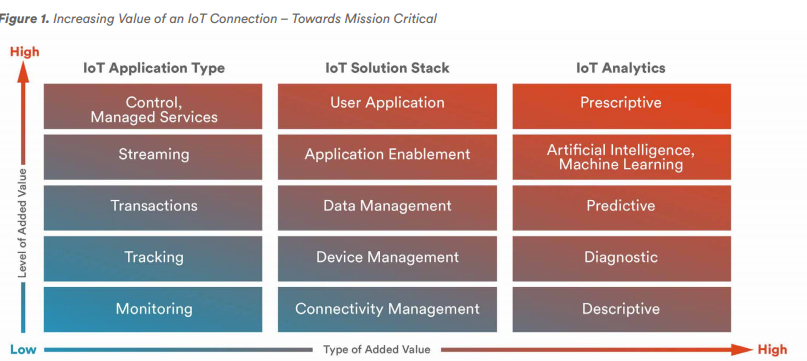

Generally speaking, that also is the route for adding new value to internet of things business operations, argue researchers at Beecham Research, in a paper prepared for Sierra Wireless. That path corresponds to the way greater value can be added to any connectivity-oriented service, others might add.

To the extent that solutions to business problems ultimately drive the value of any information technology or communications investment by enterprises and businesses, the more complete and simple a solution, the higher the value to the customer.

In other words, people want connections with other people, so they buy iPhones, not chipsets. People want transportation, so they buy automobiles, not tires, batteries and engines.

Though all IP communications require access to IP networks, and therefore internet service provider connections, nobody buys broadband except as a means to use higher-value applications for communications, e-commerce, entertainment, discovery or learning.

Beecham researchers argue that “as the application becomes more important to the business operations, it is increasingly important to manage all aspects of the connectivity (Connectivity Management) to ensure the application is not disrupted by the connection being broken, not working correctly or being hacked.”

Beecham Research, Sierra Wireless

In other words, a mission-critical function requires mission-critical reliability. And that might extend beyond the physical internet connection to the device and the applications and insight built on the generated data.

There is another way to phrase this observation: value is generated at many points in a complete value chain, for IoT or any other solution or product. Entities can generate more value and revenue by supplying greater portions of the value chain.