When connectivity providers serving retail customers are urged to become digital service providers or techcos, they are being urged to move into new areas of the ecosystem (applications, use cases, roles, value, products.

Such calls, make no mistake, are for “telcos” to become something else. What precisely such terms mean is a matter of interpretation. For some, it means “revamping operations to reduce costs; digitally transforming the customer experience and service development processes; and developing a differentiated value proposition that leverages 5G, IoT, and edge investments and capabilities.”

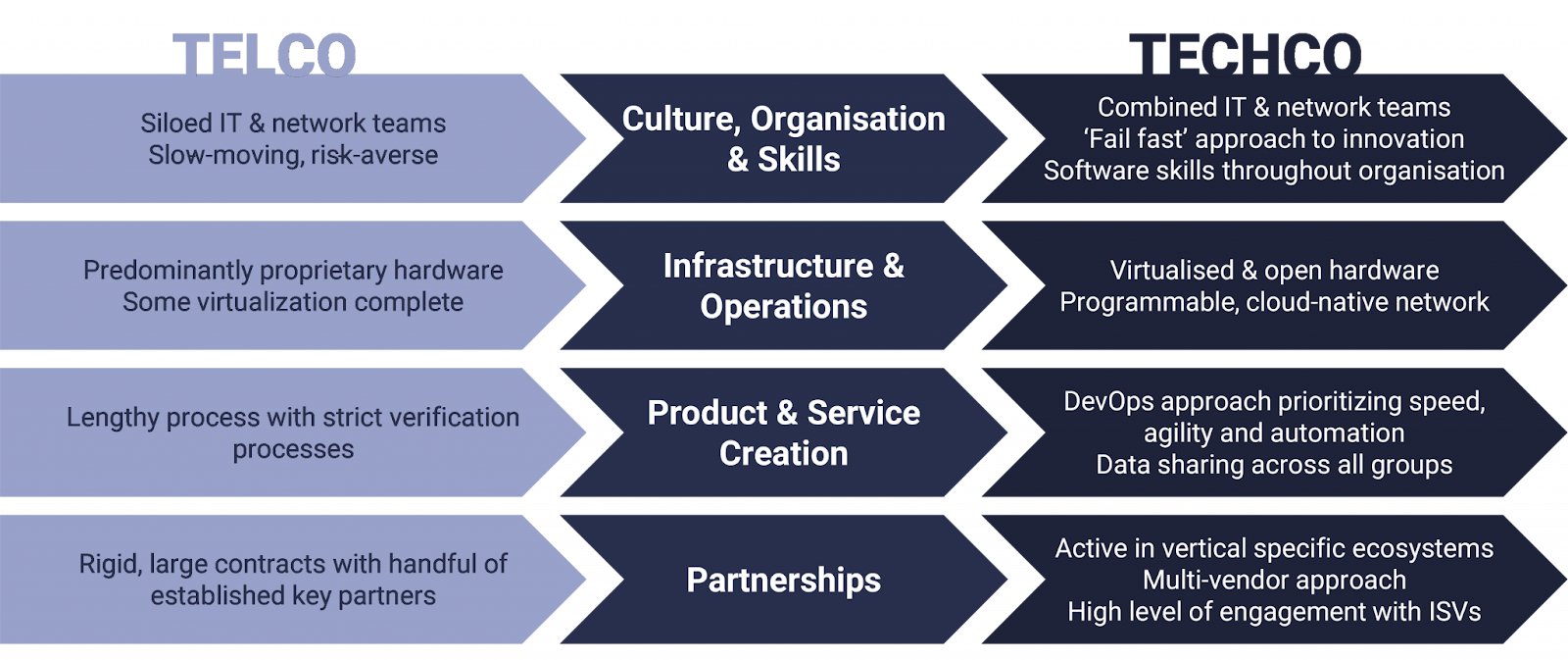

source: STL Partners

Organization culture designed to encourage experimentation, “digital” solutions, partnerships and virtualized and open infra approaches are a good thing.

Those all are laudable goals, to be sure. Lower costs, better customer experience and faster product development times are good things. “Differentiated value propositions” building on the core network and core revenue model likewise are good things.

Skeptics might ask why any of those objectives are not simply sound management. What business leader does not want higher value, lower costs, better customer experience and faster product development times?

In other words, all the talk about becoming techcos might be essentially using today’s tools to manage and execute any business better. So being a “techco” means using modern software, information technology and computing as do all other well-managed companies.

Not to be critical, but if “becoming a techco” means “running one’s business well,” I’m not sure the term means very much, in terms of strategy, though it is quite important operationally.

Likewise, some might argue that being a digital service provider entails a way of doing things that emphasizes personalization or mass customization. Again, not bad things.

There are other interpretations, though. A “digital service provider” might imply selling higher-value, higher-order applications and solutions beyond mere connectivity. That also generally implies operating in different parts of the computing, software, solutions or application value chains.

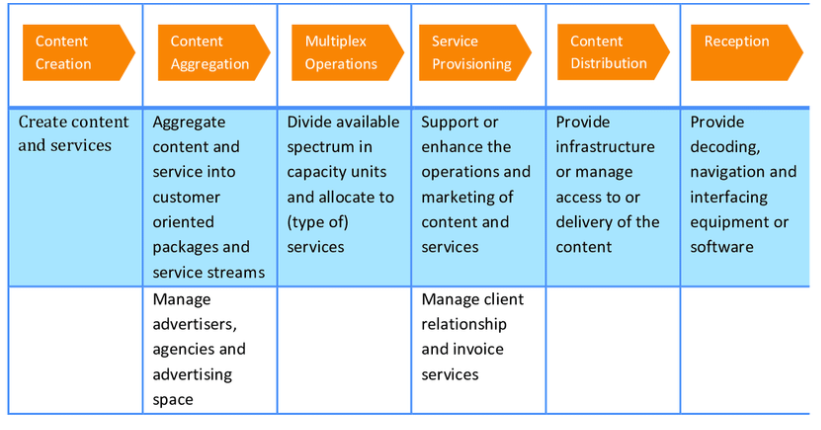

source: Researchgate

If one maps value chain roles and operations roles, it is possible to claim multiple roles for any retail connectivity provider. In fact, it is possible to argue that retail connectivity providers have many roles, at least where it comes to delivering a connectivity service.

source: Semantic Scholar

Likewise, it might be argued that a connectivity service involves multiple roles for the service provider. But those make most sense for creation and delivery of a connectivity service.

source: The New Stack

The value chain looks very different when “connectivity,” an essential part of the internet-based applications, computing or experience value chain, is viewed in context of the full value chain to deliver an experience to an end users.

In that case, the internet access function is more highly compartmentalized. So, in a context of “digital service provider,” the connectivity provider role must expand. We can argue about the logical areas for expansion, but the basic argument is that connectivity providers seeking to become digital service providers have to add roles elsewhere in the value chain.

source: On5G

So access providers might move into being operators of data centers, content delivery networks, online marketplaces, advertising venue providers, payment or transaction providers, content owners and bundlers or app providers.

That implies moving outside the area of core competence and into other realms and functions.

In essence, the call to become a “digital service provider” might also entail becoming an asset owner and supplier of all sorts of other values beyond connectivity. Financial analysts rarely praise such moves, as the track record for service providers trying to do so is spotty at best.

“Concentrate on your core business” almost always winds up being the advice. But it is nearly impossible to “become a digital service provider” without taking such risks. Rephrase slightly to “become a digital solution provider,” or “become an app provider,” or “become a platform.”

All those ideas imply becoming the owner and supplier of assets providing value in the internet-delivered application, experience or capability spaces beyond “mere” connectivity.

It implies ownership of branded apps, content, business solutions, software or computing services beyond “connectivity.”

Not to be critical, but much of the language around “becoming a techco” or “digital service provider” is more marketing hype than business strategy. Sure, managing a business well is praiseworthy. Creating personalized experiences and customized features is helpful.

But those are not the same outcomes as assuming new and broader roles in the value chain; ownership of different types of assets providing different value propositions. In the past, that has meant efforts to create branded and owned mobile app stores; data centers; cloud computing services; content networks and sites; occasionally devices.

But such efforts go far beyond internal operational measures to run the business better, improve customer experience or personalization. Basically, what connectivity providers are after is new roles in the broader value chain. Spinning new buzz words is not that.