The U.S. Justice Department has asked the Federal Communications Commission to to defer consideration of the Softbank acquisition of Sprint to give DoJ time to review the deal from a national security perspective, Bloomberg reports.

Separately, Dish Network Corp., which has submitted a bid of its own for parts of Clearwire, and also has asked for a careful review of the proposed Softbank acquisition of Sprint, said it won’t seek regulatory action to block the transaction. Dish still is pursuing its own deal to buy parts of Clearwire.

Some observers might argue that the Dish decision not to try and block the Softbank deal is a signal that what Dish really wants is a business deal with Sprint, not an actual takeover of Clearwire. By that line of thinking, Dish really is seeking leverage to convince Sprint to partner with Dish to help Dish build its own Long Term Evolution network.

Tuesday, January 29, 2013

Justice Department Asks FCC for Time to Review Softbank Acquisition of Sprint

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Tablets Outsell PCs 4:1 in 2012

Tablet sales for the full year of 2012 were 267 percent higher compared to 2011. December 2012 alone saw more tablets sold in GfK’s tracked retail channels than notebook sales in the whole of the fourth quarter of 2012, according to researchers at GfK. So you might roughly say that tablets outsold notebooks roughly four to one.

Lower average selling prices might have helped. ASPs declined 23 percent year over year from 2011 to 2012, GfK says.

Lower average selling prices might have helped. ASPs declined 23 percent year over year from 2011 to 2012, GfK says.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

YouTube to Introduce Paid Subscriptions

YouTube reportedly will launch paid subscriptions for individual channels, perhaps as early as the second quarter of 2013, according to Advertising Age. It appears that the first paid channels will cost somewhere between $1 and $5 a month, and likely will be created by programmers already producing original content successfully for YouTube.

YouTube is treating paid subscriptions as an experiment. much like video rentals when it began in 2010. The initial group of channels will be small, likely about 25 at the outset. The revenue split from subscriptions is expected to be similar to the 45-55 split that is common for ads on YouTube. Partners will also have the option to include ads in their pay channels, but its unclear what form those will take.

Machinima, Maker Studios and Fullscreen are likely among the programmers YouTube has asked to submit ideas for paid channels.

YouTube would initially launch around 25 paid channels.

In the past, observers have argued that YouTube could represent the "cable TV of the future." That might be stretching matters, at least for the moment. But if YouTube's new test proves successful, many smaller and niche programmers could find such YouTube distribution appealing.

With constantly climbing programming costs, distributors will be under pressure to pare back offerings to create lower-cost tiers of service. Those tiers will not include many niche or specialized channels.

That inability to obtain significant carriage on video subscription networks will force budding networks to look elsewhere for audiences, and YouTube might then prove appealing.

YouTube is treating paid subscriptions as an experiment. much like video rentals when it began in 2010. The initial group of channels will be small, likely about 25 at the outset. The revenue split from subscriptions is expected to be similar to the 45-55 split that is common for ads on YouTube. Partners will also have the option to include ads in their pay channels, but its unclear what form those will take.

Machinima, Maker Studios and Fullscreen are likely among the programmers YouTube has asked to submit ideas for paid channels.

YouTube would initially launch around 25 paid channels.

In the past, observers have argued that YouTube could represent the "cable TV of the future." That might be stretching matters, at least for the moment. But if YouTube's new test proves successful, many smaller and niche programmers could find such YouTube distribution appealing.

With constantly climbing programming costs, distributors will be under pressure to pare back offerings to create lower-cost tiers of service. Those tiers will not include many niche or specialized channels.

That inability to obtain significant carriage on video subscription networks will force budding networks to look elsewhere for audiences, and YouTube might then prove appealing.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Global Telecom Revenue Will Grow 3.8% Annually, to 2018

Forecasting is a hazardous business. Though one analysis shows European telecom service provider revenues have fallen for three straight years, other analysts continue to show steady growth, in ways that obscure the more granular trends.

Overall growth is undoubtedly a correct way to characterize the global business. It is just that growth will not be universal, for every service, in every country, for every provider, in every region.

Insight Research projects that global carrier revenue will grow from $2.2 trillion in 2013 to $2.7 trillion in 2018, at a compounded annual growth rate (CAGR) of 3.8 percent.

Insight Research, for example, lumps the “Middle East” region with “Europe” and “Africa.” It is a standard way of reporting the data, if increasingly inaccurate, given growth in Africa and Middle East, and shrinkage in Europe.

Since 2010, revenue has been declining in Europe, according to the European Telecommunications Network Operators Association. Declines continued in 2011 and 2012.

As you would guess, mobile service revenue will outpace revenue from fixed network services. From 2013 to 2018, wireline carrier revenue will grow from $1.0 trillion to $1.1 trillion

at a CAGR of 1.5 percent, while mobile carrier revenue will grow from $1.2 trillion to $1.6 trillion at a CAGR of 5.5 percent, Insight Research predicts.

North American carrier revenue will grow from $547 billion to $635 billion at a CAGR of three percent, Insight Research predicts. The EMEA region will do slightly better than North America, as the strength of growth in Africa and the Middle East. From 2013 to 2018 EMEA carrier revenue will grow from $661 billion to $772 billion at a CAGR of 3.2 percent.

Asia and the Pacific Rim (AP) and Latin America and the Caribbean (LA) are the

fastest-growing regions.

From 2013 to 2018 Asia Pacific carrier revenue will grow from $832 billion to $1,047 billion at a CAGR of 4.7 percent, while Latin American carrier revenue will grow from $175 billion to $214 billion at a CAGR of 4.1 percent.

Overall growth is undoubtedly a correct way to characterize the global business. It is just that growth will not be universal, for every service, in every country, for every provider, in every region.

Insight Research projects that global carrier revenue will grow from $2.2 trillion in 2013 to $2.7 trillion in 2018, at a compounded annual growth rate (CAGR) of 3.8 percent.

Insight Research, for example, lumps the “Middle East” region with “Europe” and “Africa.” It is a standard way of reporting the data, if increasingly inaccurate, given growth in Africa and Middle East, and shrinkage in Europe.

Since 2010, revenue has been declining in Europe, according to the European Telecommunications Network Operators Association. Declines continued in 2011 and 2012.

As you would guess, mobile service revenue will outpace revenue from fixed network services. From 2013 to 2018, wireline carrier revenue will grow from $1.0 trillion to $1.1 trillion

at a CAGR of 1.5 percent, while mobile carrier revenue will grow from $1.2 trillion to $1.6 trillion at a CAGR of 5.5 percent, Insight Research predicts.

North American carrier revenue will grow from $547 billion to $635 billion at a CAGR of three percent, Insight Research predicts. The EMEA region will do slightly better than North America, as the strength of growth in Africa and the Middle East. From 2013 to 2018 EMEA carrier revenue will grow from $661 billion to $772 billion at a CAGR of 3.2 percent.

Asia and the Pacific Rim (AP) and Latin America and the Caribbean (LA) are the

fastest-growing regions.

From 2013 to 2018 Asia Pacific carrier revenue will grow from $832 billion to $1,047 billion at a CAGR of 4.7 percent, while Latin American carrier revenue will grow from $175 billion to $214 billion at a CAGR of 4.1 percent.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Monday, January 28, 2013

What "Grow Internationally" Might Mean, for AT&T

Neither Verizon Wireless, nor AT&T Mobile, currently earns significant international revenue (aside from some roaming revenue or some enterprise accounts). But that could change in the future. AT&T has been talking more than Verizon about such potential developments.

The issue is what form such initiatives might take, or what the revenue drivers might be. Most observers would simply observe that "consolidation" has been a feature of nearly every segment of the communications business, for some decades.

There perhaps is a "negative" way to characterize consolidation, and a "positive" way. One would expect any executive at a public company to take the "positive" approach.

AT&T might see LTE as a significant enabling event. "There are probably some opportunities to create some unique roaming arrangements, roaming each other’s networks at different cost structures," said AT&T CEO Randall Stephenson, on AT&T's fourth quarter 2012 earnings call.

That is not necessarily the same thing as investing in the equity of another service provider, at least not in the sense of "controlling interest." On the other hand, roaming agreements would not be seen as global expansion, either, so AT&T has to be looking at something more substantial than "mere" roaming agreements.

Though it is helpful to create more "on-network" traffic at a global or regional level, for reasons of better operating cost, that is logically a different question than investing in asset growth overseas because domestic opportunities are growing constrained.

That might also be true for some "applications" such as AT&T's home security and home monitoring platforms. In fact, AT&T has licensed its U-Verse platform to Frontier Communications domestically. And AT&T, which provides the "Whispernet" service for Amazon's Kindle devices, might see similar business-to-business opportunities overseas, as well.

But should AT&T's board of directors be looking to authorize some equity-based acquisitions internationally, one factor would be the current state of European equity prices for telecom assets. Some would say some European telco assets are more affordable than in the past.

But the "negative" argument for global expansion also makes sense. The Federal Communications Commission essentially has said, by denying the T-Mobile USA acquisition, that AT&T cannot hope to grow larger by making big asset acquisitions in the United States.

If you believe opportunities for organic growth are going to contract, as smart phone penetration reaches saturation, and if you assume regulators will not allow domestic growth through acquisition, then a growing global footprint makes eminent sense.

The issue is what form such initiatives might take, or what the revenue drivers might be. Most observers would simply observe that "consolidation" has been a feature of nearly every segment of the communications business, for some decades.

There perhaps is a "negative" way to characterize consolidation, and a "positive" way. One would expect any executive at a public company to take the "positive" approach.

AT&T might see LTE as a significant enabling event. "There are probably some opportunities to create some unique roaming arrangements, roaming each other’s networks at different cost structures," said AT&T CEO Randall Stephenson, on AT&T's fourth quarter 2012 earnings call.

That is not necessarily the same thing as investing in the equity of another service provider, at least not in the sense of "controlling interest." On the other hand, roaming agreements would not be seen as global expansion, either, so AT&T has to be looking at something more substantial than "mere" roaming agreements.

Though it is helpful to create more "on-network" traffic at a global or regional level, for reasons of better operating cost, that is logically a different question than investing in asset growth overseas because domestic opportunities are growing constrained.

That might also be true for some "applications" such as AT&T's home security and home monitoring platforms. In fact, AT&T has licensed its U-Verse platform to Frontier Communications domestically. And AT&T, which provides the "Whispernet" service for Amazon's Kindle devices, might see similar business-to-business opportunities overseas, as well.

But should AT&T's board of directors be looking to authorize some equity-based acquisitions internationally, one factor would be the current state of European equity prices for telecom assets. Some would say some European telco assets are more affordable than in the past.

But the "negative" argument for global expansion also makes sense. The Federal Communications Commission essentially has said, by denying the T-Mobile USA acquisition, that AT&T cannot hope to grow larger by making big asset acquisitions in the United States.

If you believe opportunities for organic growth are going to contract, as smart phone penetration reaches saturation, and if you assume regulators will not allow domestic growth through acquisition, then a growing global footprint makes eminent sense.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Android, Apple Account for 92% of Global Smart Phone Shipments

You might say a business lead by two firms with 92 percent market share fits the notion of "market domination." And by that definition, the global smart phone market is dominated by Apple and Samsung.

According to the latest research from Strategy Analytics, global smart phone shipments grew 38 percent annually to reach 217 million units in the fourth quarter of 2012.

To the point, Android and Apple iOS together accounted for 92 percent share of all smart phones shipped worldwide, representing the largest market share the two firms ever have had.

Global shipment growth slowed from 64 percent in 2011 to 43 percent in 2012 as penetration of smart phones began to mature in developed regions such as North America and Western Europe,” says Neil Shah, Senior Analyst at Strategy Analytics.

Strategy Analytics estimates 152.1 million Android smart phones were shipped globally in the fourth quarter of 2012, nearly doubling from 80.6 million units in the fourth quarter of 2011.

Android’s share of the global smart phone market has surged from 51 percent to 70 percent over the past year.

Almost half-a-billion Android smartphones were shipped in total worldwide during 2012.

Apple grew 29 percent annually and shipped 47.8 million smart phones worldwide for 22 percent market share in the fourth quarter of 2012, dipping slightly from 24 percent a year earlier.

"The worldwide smart phone industry has effectively become a duopoly as consumer demand has polarized around mass-market Android models and premium Apple designs,” Strategy Analytics says.

That is not to say the smart phone market is immutable, either in terms of operating system share or device manufacturer share. In fact, one can already note that Samsung perhaps is the only profitable Android handset manufacturer.

Global Smartphone Operating System Shipments and Market Share in Q4 2012

| Global Smartphone OS Shipments (Millions of Units) | Q4 '11 | 2011 | Q4 '12 | 2012 | ||||

| Android | 80.6 | 238.9 | 152.1 | 479.0 | ||||

| Apple iOS | 37.0 | 93.0 | 47.8 | 135.8 | ||||

| Others | 39.4 | 158.6 | 17.1 | 85.3 | ||||

| Total | 157.0 | 490.5 | 217.0 | 700.1 | ||||

| Global Smartphone OS Marketshare % |

Q4 '11

| 2011 | Q4 '12 | 2012 | ||||

| Android | 51.3% | 48.7% | 70.1% | 68.4% | ||||

| Apple iOS | 23.6% | 19.0% | 22.0% | 19.4% | ||||

| Others | 25.1% | 32.3% | 7.9% | 12.2% | ||||

| Total | 100.0% | 100.0% | 100.0% | 100.0% | ||||

| Total Growth Year-over-Year % | 55.9% | 63.8% | 38.2% | 42.7% |

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

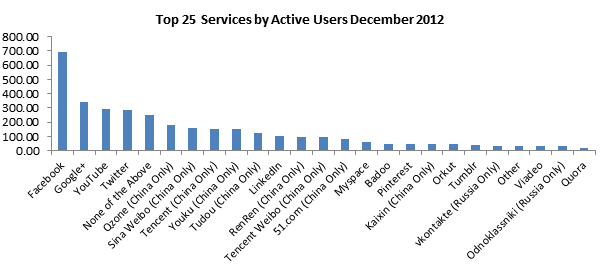

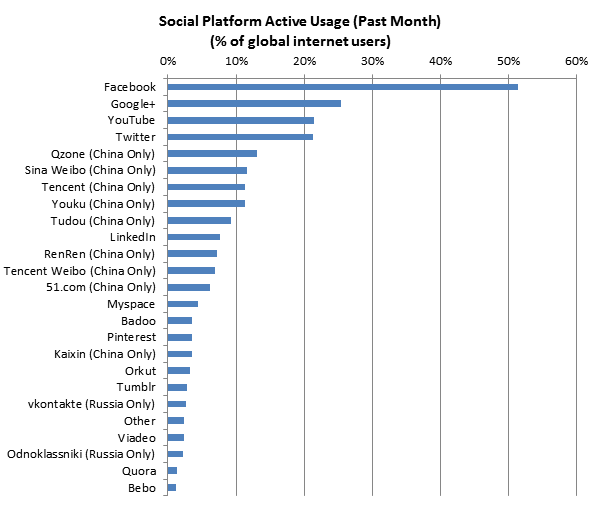

Google+ Now Second-Biggest Global Social Network?

Google+ now is the second-largest social network globally, behind Facebook, while YouTube is number three, according to Globalwebindex. Ignore for the moment whether Google+ is actually an identity service, or YouTube a video application.

Most would agree that Facebook users are more active than Google+ users, in all the ways that social network activity normally is measured.

Some will argue that Google+ "usage" is largely passive because Google is using Google+ as an identity mechanism, not a full-fledged social network, so the ranking does not necessarily mean too much.

On the other hand, it would not be hard to argue that the overall trend is that the largest networks, with scale effects, are winning share at the expense of small social networks with less scale.

Most would agree that Facebook users are more active than Google+ users, in all the ways that social network activity normally is measured.

Some will argue that Google+ "usage" is largely passive because Google is using Google+ as an identity mechanism, not a full-fledged social network, so the ranking does not necessarily mean too much.

On the other hand, it would not be hard to argue that the overall trend is that the largest networks, with scale effects, are winning share at the expense of small social networks with less scale.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Subscribe to:

Posts (Atom)

Content Does Not Monetize Itself: Others in the Value Chain are Necessary

Businesses virtually never take positions that undermine or threaten their own interests. So how does Cloudflare benefit from its new emphas...

-

We have all repeatedly seen comparisons of equity value of hyperscale app providers compared to the value of connectivity providers, which s...

-

It really is surprising how often a Pareto distribution--the “80/20 rule--appears in business life, or in life, generally. Basically, the...

-

One recurring issue with forecasts of multi-access edge computing is that it is easier to make predictions about cost than revenue and infra...