Competition has changed just about everything in the connectivity business except that connectivity services drive the revenue model. And that conditions most of everything else about the business: growth rates; profitability; valuation of public firms; even ability to retain and attract human capital.

But after nearly 40 years (in lead markets) of life after monopoly regulation, some things still have not changed. Despite the best efforts of leaders and firms to change cultures; tempos; revenue models and sources; roles in the ecosystem and value in the eyes of customers, connectivity remains utility-like.

There is no other way to explain valuation metrics, growth rates, profits or even the interest of institutional investors in owning access networks. To the extent that fixed access networks serving mass markets have value, it is as “alternative assets” producing steady or at least predictable cash flow, with at least some elements of a business moat that keeps competitors away and non-correlated with stocks and bonds.

That is often why assets in wholesale-oriented markets, where a single network owner provides services to any and all retail providers, are preferred to ownership of the retail providers.

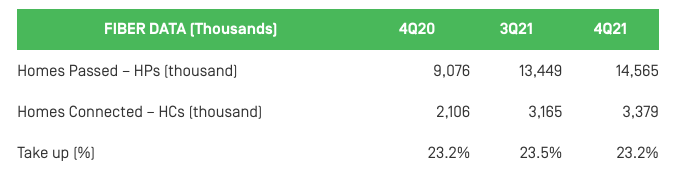

The retail end of the business often has limited moats. In Brazil, Oi, the former incumbent, has about 23 percent to 30 percent take rates of homes passed by fiber. Some of that might be attributed to demand side issues, but over the long term, results will be dictated by the ability of competitors to use a single wholesale network, rather than building their own networks.

source: Oi

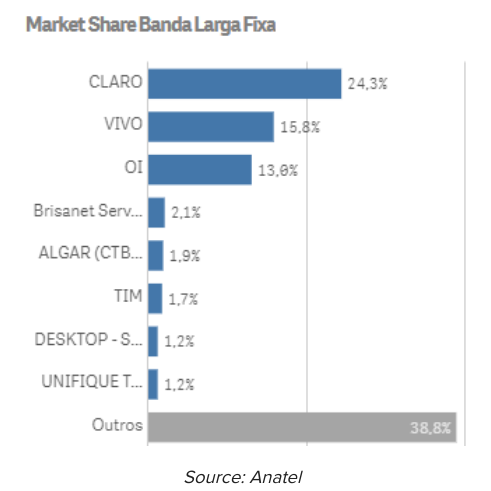

Looking at market shares of fixed network internet access, Oi has about 13 percent share, trailing Claro and Vivo.

source: Anatel

In the total market, including fixed and mobile services, Oi has about 23 percent share. In part, facilities-based competition shapes results. Traditionally, mobile competition has been facilities-based, and mobility drives overall revenue.

In most fixed network settings, only one network exists, and competition largely comes from wholesale mechanisms. In relatively few markets is fixed network competition substantially based on diverse facilities ownership.

source: Researchgate

Owners’ economics are the upside; stranded assets the downside in such markets.

Far better, institutional investors believe, to own the scarce access networks rather than the retail service providers.

That leaves retail service providers with difficult challenges. As profit margins in the core business shrink while capital investment demands rise, there is only so much any competent management team can do to optimize the core business by cutting costs, modernizing processes and platforms and improving customer experience.

source: AD Little

Historically, growth has come from acquisitions and mergers. Product sets have changed, but growth in new areas basically has only offset losses in legacy lines of business. Mobility now is the global driver of revenue, for example, not fixed network services. Within the fixed network segment, home broadband now drives revenue, not voice.

And leaders still search for ways to create growth opportunities in adjacent parts of the ecosystem, as difficult a task as that has proven to be, over time. As one veteran of the connectivity business quipped recently after bolting for the data center business, “it’s nice to be in a business where prices do not continually drop.”

It remains unclear if there is one common model for the “telco of the future,” beyond the supply of retail connectivity services to businesses and consumers. Some will likely be more utility-like while others are more diversified in additional ecosystem roles.

Some will be retailers; others more wholesalers. But the anchor of “connectivity services” will keep most from fundamental changes. That role cannot be avoided without leaving the business altogether.

Despite all the “evolve and change” advice of four decades, it still appears the leopard cannot change its spots.