U.S. telecommunications service providers lost about 10.5 percent of their current installed base of voice access lines in 2009, Fitch Ratings estimates. The bad news is that losses will increase to 12 percent in 2010.

The good news is that business line losses, which accelerated during 2009, will stabilize. Also, market share gains by cable competitors lessened in 2009.

But pressure from wireless substitution and weak housing starts will continue in 2010. And there is a statistical headwind as well: as the installed base of lines shrinks, the loss of any given number of lines automatically represents a bigger percentage.

Business and residential access line losses should stabilize in 2010 and continue in the range of 3 million to 3.2 million per quarter. That's a bit better than has been the case over the last year or so. The bad news is that because the denominator (installed base) now is a smaller number, even a smaller numerator (lost lines) will result in a higher rate of loss.

Like cable companies, the growth rates for new broadband access subscribers has been slowing, and will slow further in 2010.

Fitch estimates that broadband access subscriber growth slowed in 2009 to 1.7 million net subscribers. Fitch forecasts that total broadband net subscriber additions will slow in 2010 to approximately 1.4 million. The slowing growth is reflective of higher penetration of these services and to a lesser extent a growing substitution by wireless data.

With regard to network-based video, Fitch estimates that offerings by AT&T, Inc. and Verizon Communications Inc. will grow by 2 million subscribers in 2009, but this rate will likely slow in 2010 to approximately 1.5 million. The slowing growth rate reflects increasing penetration and a slowing of coverage growth as these operators enter their final phase of deployment.

Finally, business and commercial service revenue erosion peaked in first-quarter 2009 and Fitch expects the total 2009 decline to be over six percent for wireline companies with this trend the result of growing unemployment.

It is likely that the unemployment rate is near its high so Fitch believes that reductions in business and commercial revenues should be modest, in the range of one percent, in 2010.

In total, Fitch estimates that aggregate wireline revenues will decline in 2010 near the mid-single-digit range, a modest improvement over 2009. Operators with a larger growth services revenue mix should experience revenue erosion in the low single-digit range. EBITDA will similarly fall in aggregate by a low- to mid-single-digit range for the industry as benefits from headcount reductions offset losses of high-margin legacy services.

Thursday, December 3, 2009

What's in Store for Telcos in 2010?

Labels:

telecom revenue,

wireline market forecast

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Big Churn Potential in Wireless Business?

Despite the fact that AT&T and Verizon have low churn rates, while Sprint and T-Mobile have churn higher than they would like, the potential for huge share shifts remains latent, if consumer satisfaction bears any meaningful relationship to actual churn behavior.

Nearly half of readers surveyed by Consumer Reports are unhappy with their cell phone service. Nearly two thirds had at least one major complaint about their cell phone carrier, with about 20 percent naming price as the chief irritant.

But here's the caveat. Most surveys taken over the last couple of decades suggested there was high dissatisfaction with cable TV service, for example. And, to be sure, consumers began to churn away as first satellite and now telco video alternatives are available. Until satellite became a viable option, though, high dissatisfaction was not accompanied by high churn.

The U.S. mobile industry, though, is among the most competitive in the world, so consumers do have lots of choices. So one wonders why more do not act as theory suggests they will, which is that unhappiness will lead them to try another provider. Maybe they are churning, and maybe their continued unhappiness means the new carriers aren't demonstrably and clear better than the carriers they left.

Apparently, neither better coverage nor new smartphones have been enough to change consumer satisfaction all that much, the report suggests, with the salient exception of the Apple iPhone. So will the latent unhappiness translate into higher churn? It's harder to decipher than one might initially think.

If consumers believe all the carriers have some gaps in coverage, have roughly similar or somewhat distinct retail offers, have adequate bandwidth and availability, and all of them will experience congestion during rush hour, consumers might not be extremely motivated to change providers, even if they are unhappy to some degree. The bad news for service providers might be that network quality and reputation have some effect, but not overwhelming effect on churn behavior.

But handsets are a huge motivator of change, it appears. About 38 percent of consumers who switched phones in the past two years did so to get the phone they wanted.

More than 27 percent went shopping with a specific phone in mind, in fact. About 98 percent of iPhone users said they would purchase the phone again. To point out the obvious, some people might be really happy about their handsets, and simply put up with their service providers.

But there is another way to look at matters. If half of consumers are unahppy to some degree, and that leads them to churn, what would one expect to see? At churn rates about 1.5 percent a month,. one would expect roughly 18 percent annual churn. That would roughly equate to 100 percent churn about every five years or so.

If one assumes only half of consumers are motivated to churn, existing churn rates easily could amount to churn of half the entire customer base about every two and a half years.

So maybe those unhappy consumers are in fact deserting their current providers. The reason they remain unhappy? One explanation could be that none of the providers they are trying are demonstrably better than the carriers they left. One often encounters consumers who say "we've tried them all, and all of them have some problems."

Nearly half of readers surveyed by Consumer Reports are unhappy with their cell phone service. Nearly two thirds had at least one major complaint about their cell phone carrier, with about 20 percent naming price as the chief irritant.

But here's the caveat. Most surveys taken over the last couple of decades suggested there was high dissatisfaction with cable TV service, for example. And, to be sure, consumers began to churn away as first satellite and now telco video alternatives are available. Until satellite became a viable option, though, high dissatisfaction was not accompanied by high churn.

The U.S. mobile industry, though, is among the most competitive in the world, so consumers do have lots of choices. So one wonders why more do not act as theory suggests they will, which is that unhappiness will lead them to try another provider. Maybe they are churning, and maybe their continued unhappiness means the new carriers aren't demonstrably and clear better than the carriers they left.

Apparently, neither better coverage nor new smartphones have been enough to change consumer satisfaction all that much, the report suggests, with the salient exception of the Apple iPhone. So will the latent unhappiness translate into higher churn? It's harder to decipher than one might initially think.

If consumers believe all the carriers have some gaps in coverage, have roughly similar or somewhat distinct retail offers, have adequate bandwidth and availability, and all of them will experience congestion during rush hour, consumers might not be extremely motivated to change providers, even if they are unhappy to some degree. The bad news for service providers might be that network quality and reputation have some effect, but not overwhelming effect on churn behavior.

But handsets are a huge motivator of change, it appears. About 38 percent of consumers who switched phones in the past two years did so to get the phone they wanted.

More than 27 percent went shopping with a specific phone in mind, in fact. About 98 percent of iPhone users said they would purchase the phone again. To point out the obvious, some people might be really happy about their handsets, and simply put up with their service providers.

But there is another way to look at matters. If half of consumers are unahppy to some degree, and that leads them to churn, what would one expect to see? At churn rates about 1.5 percent a month,. one would expect roughly 18 percent annual churn. That would roughly equate to 100 percent churn about every five years or so.

If one assumes only half of consumers are motivated to churn, existing churn rates easily could amount to churn of half the entire customer base about every two and a half years.

So maybe those unhappy consumers are in fact deserting their current providers. The reason they remain unhappy? One explanation could be that none of the providers they are trying are demonstrably better than the carriers they left. One often encounters consumers who say "we've tried them all, and all of them have some problems."

Labels:

att Wireless,

churn,

Sprint,

TMobile,

Verizon Wireless

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

What Users Do on the Mobile Web

About 29 percent of mobile phone users logged on to the mobile Web at least once per month in 2009, up from 22 percent in 2008, say researchers at Marketer.

So what do those people use the mobile Web? About 19 percent search for local products and services. About 16 percent say they get information about movies and entertainment.

About 13 percent get information about restaurants and bars. Some 11 percent search fro products or services outside the immediate local area.

About four percent made a purchase of a physical items that had to be shipped, while three percent used a mobile coupon.

According to BIA/Kelsey and ConStat, many of those qualify as “heavy” users—those who go online via mobile more than 10 times each week. BIA/Kelsey and ConStat say heavy mobile Internet users represent about 21 percent of the total U.S. mobile population in October 2009, up from less than 15 percent a year earlier. And the overall average number of monthly mobile Web sessions has doubled in that time period.

Heavy users of text messaging and mobile e-mail have also increased over the past year. Nearly one half of mobile users text more than 10 times weekly, while 20 percent send and receive more than 10 mobile emails each week.

Non-local product searches seem not be as prevalent as local searches, which about 20 percent of users report they did in the last month.

Basically, consumers have doubled their use of the mobile platform for non-voice communications,” says Rick Ducey, BIA/Kelsey chief strategy officer.

So what do those people use the mobile Web? About 19 percent search for local products and services. About 16 percent say they get information about movies and entertainment.

About 13 percent get information about restaurants and bars. Some 11 percent search fro products or services outside the immediate local area.

About four percent made a purchase of a physical items that had to be shipped, while three percent used a mobile coupon.

According to BIA/Kelsey and ConStat, many of those qualify as “heavy” users—those who go online via mobile more than 10 times each week. BIA/Kelsey and ConStat say heavy mobile Internet users represent about 21 percent of the total U.S. mobile population in October 2009, up from less than 15 percent a year earlier. And the overall average number of monthly mobile Web sessions has doubled in that time period.

Heavy users of text messaging and mobile e-mail have also increased over the past year. Nearly one half of mobile users text more than 10 times weekly, while 20 percent send and receive more than 10 mobile emails each week.

Non-local product searches seem not be as prevalent as local searches, which about 20 percent of users report they did in the last month.

Basically, consumers have doubled their use of the mobile platform for non-voice communications,” says Rick Ducey, BIA/Kelsey chief strategy officer.

Labels:

local search,

mobile Web,

smart phone

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

What Does Comcast-NBC Universal Merger Mean?

The Comcast merger with NBC Universal will be viewed in many ways: a way for Comcast to move upstream in the content business or a chance to grow the "digital" or "new media" side of the merged company's operations.

The merger also is about protecting the value of the exsiting video distribution ecosystem from destabilizing change. "TV Everywhere," the cable industry approach to enabling use of paid-for video content on any screen, is a similar initiative.

The move also suggests a view on the part of Comcast management that the cable TV distribution business has limited upside left. Revenue growth for virtually all of the cable companies now is coming from voice and high-speed data services, with the emphasis now shifting to business customers, as even the consumer elements of that business are seeing slower growth.

One might question the ultimate value of the move, either as a way of growing revenues near term, or as a strategic bridge to the future. The near term value is clearer, though.

Essentially, the attempt is to provide low-cost or no-incremental cost, convenient access to large quantities of popular professional video while baking in an indirect business model. If you think about the way metro Wi-Fi hotspot access now is positioned by cable and telco service providers, you'll get the idea. The direct revenue actually is produced by purchases of fixed broadband access service.

Then Wi-Fi access is added as a "no incremental charge" enhancement. In the same way, some mobile broadband plans might be pitched as fees for "mobile Internet" access, but then also allow no-incremental cost email access.

In other words, Comcast wants to hang onto the proven business it has--all it "cable TV"--while merchandising "new media" access to that content on smartphones and PCs, for example.

Perhaps Comcast and others would prefer to keep the old business while growing a new one with a direct revenue model, but that seems problematic for most content distributors and owners.

Some studies suggest users will pay some amount for mobile or on-demand video and TV. The issue is how much such users would be willing to pay. Consider a scenario where a typical user pays $10 a month for mobile and other on-demand access, and where the typical household consists of three people, for a total revenue of $30 a month.

Consider that for most households, multi-channel video now costs between $70 and $100 a month, and that is a flat charge for all users in the home. That works out fine if there is no cannibalization of the fixed connection.

But it won't take much substitution to wipe out all the gains from the incremental on-demand revenue. Unless, of course, the different approach is taken: keep your regular subscription and we'll give you the additional on-demand capbility for no incremental cost or low cost.

The merger also is about protecting the value of the exsiting video distribution ecosystem from destabilizing change. "TV Everywhere," the cable industry approach to enabling use of paid-for video content on any screen, is a similar initiative.

The move also suggests a view on the part of Comcast management that the cable TV distribution business has limited upside left. Revenue growth for virtually all of the cable companies now is coming from voice and high-speed data services, with the emphasis now shifting to business customers, as even the consumer elements of that business are seeing slower growth.

One might question the ultimate value of the move, either as a way of growing revenues near term, or as a strategic bridge to the future. The near term value is clearer, though.

Essentially, the attempt is to provide low-cost or no-incremental cost, convenient access to large quantities of popular professional video while baking in an indirect business model. If you think about the way metro Wi-Fi hotspot access now is positioned by cable and telco service providers, you'll get the idea. The direct revenue actually is produced by purchases of fixed broadband access service.

Then Wi-Fi access is added as a "no incremental charge" enhancement. In the same way, some mobile broadband plans might be pitched as fees for "mobile Internet" access, but then also allow no-incremental cost email access.

In other words, Comcast wants to hang onto the proven business it has--all it "cable TV"--while merchandising "new media" access to that content on smartphones and PCs, for example.

Perhaps Comcast and others would prefer to keep the old business while growing a new one with a direct revenue model, but that seems problematic for most content distributors and owners.

Some studies suggest users will pay some amount for mobile or on-demand video and TV. The issue is how much such users would be willing to pay. Consider a scenario where a typical user pays $10 a month for mobile and other on-demand access, and where the typical household consists of three people, for a total revenue of $30 a month.

Consider that for most households, multi-channel video now costs between $70 and $100 a month, and that is a flat charge for all users in the home. That works out fine if there is no cannibalization of the fixed connection.

But it won't take much substitution to wipe out all the gains from the incremental on-demand revenue. Unless, of course, the different approach is taken: keep your regular subscription and we'll give you the additional on-demand capbility for no incremental cost or low cost.

Labels:

comcast,

online video,

video on demand

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Wednesday, December 2, 2009

FCC Seeks Input on Transition to VoIP

The Federal Communications Commission wants public and industry comment on the policy framework for a transition from circuit-switched to voice services on all-IP networks. The FCC will use the comments to issue a possible "notice of inquiry" on the subject.

"In identifying the appropriate areas of inquiry, we seek to understand which policies and

regulatory structures may facilitate, and which may hinder, the efficient migration to an all IP world," the FCC says. "In addition, we seek to identify and understand what aspects of traditional policy frameworks are important to consider, address, and possibly modify in an effort to protect the public interest in an all-IP world."

Among other issues, the FCC will be looking at consumer protection issues such as how the needs of people with disabilities can be assured. A look at the role of "carrier of last resort" obligations in an all-IP framework also is expected.

All comments should refer to GN Docket Nos. 09-47, 09-51, and 09-137 and title comment filings

as “Comments – NBP Public Notice #25."

Filers using the Commission’s Electronic Comment Filing System should enter the following text in the “Custom Description” field in the “Document(s)” section of the ECFS filing page: “Comments – NBP Public Notice # 25."

"In identifying the appropriate areas of inquiry, we seek to understand which policies and

regulatory structures may facilitate, and which may hinder, the efficient migration to an all IP world," the FCC says. "In addition, we seek to identify and understand what aspects of traditional policy frameworks are important to consider, address, and possibly modify in an effort to protect the public interest in an all-IP world."

Among other issues, the FCC will be looking at consumer protection issues such as how the needs of people with disabilities can be assured. A look at the role of "carrier of last resort" obligations in an all-IP framework also is expected.

All comments should refer to GN Docket Nos. 09-47, 09-51, and 09-137 and title comment filings

as “Comments – NBP Public Notice #25."

Filers using the Commission’s Electronic Comment Filing System should enter the following text in the “Custom Description” field in the “Document(s)” section of the ECFS filing page: “Comments – NBP Public Notice # 25."

Labels:

FCC,

regulation,

voice,

VoIP

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Tuesday, December 1, 2009

Where is Unified Communications Going?

It looks like we are in the midst of yet another acronym cycle in the unified communications business. Nobody really likes "VoIP" or "IP communications." UC had been the preferred term until a year or two ago. "Collaboration" is the term some prefer. But there are other candidates.

Some people use the term "UC4" to describe where the next wave might be building for "unified communications, collaboration and contact center." And that wave is supposed to feature tighter communications integration with key enterprise software and job functions, as well as more use of video communications and mobile devices.

To be fair, people don't agree on what "collaboration," "unified communications" or "communications-enabled business processes" actually mean. All of those phrases include elements of VoIP, audio and video conferencing, presence, instant messaging, email, voice mail, mobility, business phone functions, unified messaging and the ability to initiate and receive voice and other communications from inside a consumer or business application.

As a general rule, when something doesn't sell well, it gets rebranded. Other times, marketing staffs want to refresh an existing product, or create a different spin, to play to a particular provider's strengths. Sometimes the buyer value proposition changes, so marketing pitches are adjusted to match the new end user priorities. Perhaps some of all those drivers now are at work.

Some people use the term "UC4" to describe where the next wave might be building for "unified communications, collaboration and contact center." And that wave is supposed to feature tighter communications integration with key enterprise software and job functions, as well as more use of video communications and mobile devices.

To be fair, people don't agree on what "collaboration," "unified communications" or "communications-enabled business processes" actually mean. All of those phrases include elements of VoIP, audio and video conferencing, presence, instant messaging, email, voice mail, mobility, business phone functions, unified messaging and the ability to initiate and receive voice and other communications from inside a consumer or business application.

As a general rule, when something doesn't sell well, it gets rebranded. Other times, marketing staffs want to refresh an existing product, or create a different spin, to play to a particular provider's strengths. Sometimes the buyer value proposition changes, so marketing pitches are adjusted to match the new end user priorities. Perhaps some of all those drivers now are at work.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

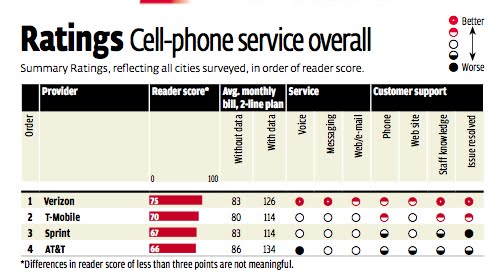

Verizon Ranked First in Consumer Reports’ "Best Wireless" Service Survey

In a survey of more than 50,000 readers spanning 26 U.S. cities, Consumer Reports found Verizon had the highest consumer satisfaction scores, while AT&T had the lowest customer-satisfaction rating in 19 cities surveyed. In fairness, the rankings are fairly close for three of the four service providers ranked.

Verizon received an overall score of 75, while T-Mobile USA got 70, Sprint got a score of 67 and AT&T got a score of 66. Consumer Reports itself says that differences of less than three points are not meaningful, so Sprint and AT&T essentially got the same score. And just three points separate T-Mobile from both Sprint and AT&T.

Another way of looking at matters is that while Verizon got scores noticeably different from the other three providers, and while T-Mobile USA was a clear number two, Sprint and AT&T were fairly close.

Verizon received an overall score of 75, while T-Mobile USA got 70, Sprint got a score of 67 and AT&T got a score of 66. Consumer Reports itself says that differences of less than three points are not meaningful, so Sprint and AT&T essentially got the same score. And just three points separate T-Mobile from both Sprint and AT&T.

Another way of looking at matters is that while Verizon got scores noticeably different from the other three providers, and while T-Mobile USA was a clear number two, Sprint and AT&T were fairly close.

Labels:

att Wireless,

Sprint,

TMobile,

Verizon Wireless

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Subscribe to:

Posts (Atom)

DIY and Licensed GenAI Patterns Will Continue

As always with software, firms are going to opt for a mix of "do it yourself" owned technology and licensed third party offerings....

-

We have all repeatedly seen comparisons of equity value of hyperscale app providers compared to the value of connectivity providers, which s...

-

It really is surprising how often a Pareto distribution--the “80/20 rule--appears in business life, or in life, generally. Basically, the...

-

One recurring issue with forecasts of multi-access edge computing is that it is easier to make predictions about cost than revenue and infra...