Wednesday, September 7, 2011

How Much Social Content Gets Created Every 60 Seconds?

What happens on the internet in 60 seconds? 1,500 new blog posts, 60 new blogs are created, 98,000 tweets happen, 20,000 posts are made on Tumblr, 600 new videos are uploaded to YouTube, 6,600 images are uploaded to Flickr, 79,000 Facebook wall posts are made nd over 695,000 Facebook status updates are made.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

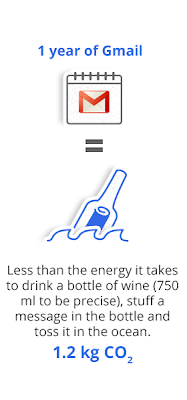

Cloud email, video impact

A recent report by the Carbon Disclosure Project (CDP) and Verdantix estimates that cloud computing has the potential to reduce global carbon emissions by millions of metric tons.

A recent report by the Carbon Disclosure Project (CDP) and Verdantix estimates that cloud computing has the potential to reduce global carbon emissions by millions of metric tons. Comparing Gmail to the traditional enterprise email solutions, switching to Gmail can be almost 80 times more energy efficient than running in-house email. This is because cloud-based services are typically housed in highly efficient data centers that operate at higher server utilization rates and use hardware and software that’s built specifically for the services they provide, conditions that small businesses are rarely able to create on their own.

A similar calculation for YouTube shows the servers needed to play one minute of YouTube consume about 0.0002 kWh of energy. To put that in perspective, it takes about eight seconds for the human body to burn off that same amount. You’d have to watch YouTube for three straight days for our servers to consume the amount of energy required to manufacture, package and ship a single DVD.

Labels:

cloud computing,

GMail

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

France Telecom Readies for Price War

France Telecom has launched a new low-cost mobile brand, the latest sign that Europe's second largest mobile market is bracing itself for a price war.

France Telecom said the new brand, called "Sosh"—short for social—was aimed at young adults and would be exclusively sold over the Internet. France Telecom, which has 27 million mobile subscribers here, predicted that the set of lower-cost offers will attract half-a-million clients over the next year.

The contract, which starts at €19.90 ($28) for two hours of calls a month, is roughly €5 cheaper than France Telecom's existing similar mobile offer, a spokesman for the group said. France Telecom's Sosh offer allows subscribers to pay on a-month-by- month basis, without any long-term commitment.

France Telecom's new offer comes just months before competitor Iliad SA launches the country's fourth mobile-phone service. Iliad has pledged to drastically cut the cost of subscriptions and gain a significant share of France's €20 billion mobile-phone market.

France Telecom said the new brand, called "Sosh"—short for social—was aimed at young adults and would be exclusively sold over the Internet. France Telecom, which has 27 million mobile subscribers here, predicted that the set of lower-cost offers will attract half-a-million clients over the next year.

The contract, which starts at €19.90 ($28) for two hours of calls a month, is roughly €5 cheaper than France Telecom's existing similar mobile offer, a spokesman for the group said. France Telecom's Sosh offer allows subscribers to pay on a-month-by- month basis, without any long-term commitment.

France Telecom's new offer comes just months before competitor Iliad SA launches the country's fourth mobile-phone service. Iliad has pledged to drastically cut the cost of subscriptions and gain a significant share of France's €20 billion mobile-phone market.

France Telecom Readies for Price War (Wall Street Journal subscription required)

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Rogers Communications Seeks Bank Status

Rogers Communications has applied to become a bank under the Canadian federal Bank Act. If approved, the proposed "Rogers Bank" will focus mainly on credit, payment and charge card services. In one sense, the move is similar to any other large retail brand creating a branded charge card.

In other ways the move is more significant. Large tier-one service providers might start to find they cannot gain significant revenue growth without moving into adjacent businesses of some size and scope, already dominated by other providers. To be sure, Rogers is proceeding carefully.

"We have no plans to become a full-service deposit-taking financial institution," Rogers Public Affairs Manager Carly Suppa said. "The license, if granted, would give us the flexibility to pursue a niche credit card opportunity to our customers should this make sense at a future date."

"We have no plans to become a full-service deposit-taking financial institution," Rogers Public Affairs Manager Carly Suppa said. "The license, if granted, would give us the flexibility to pursue a niche credit card opportunity to our customers should this make sense at a future date."

In other words, Rogers doesn't want to become a full-fledged retail bank. But becoming a credit card issuer does set Rogers up for a smooth transition to becoming a mobile payments provider in the future.

Credit cards present a distinct opportunity for Rogers to expand its reach, as the media, cable and wireless giant also owns the Toronto Blue Jays and has direct relationships with millions of customers, including many who pay bills using credit or direct-deposit accounts. So there is an incremental opportunity to capture some of the current transaction revenue, at the very least.

Credit cards present a distinct opportunity for Rogers to expand its reach, as the media, cable and wireless giant also owns the Toronto Blue Jays and has direct relationships with millions of customers, including many who pay bills using credit or direct-deposit accounts. So there is an incremental opportunity to capture some of the current transaction revenue, at the very least.

Beyond that, analysts say the company can build a broader card business by leveraging those relationships to market its brand of cards, especially by reaching out to customers who have good credit standing in its database. That would create a new revenue stream for the broader number of retail transactions for which its customers use credit cards. Rogers to become a bank

The move by Rogers is highly significant, as it illustrates an important point about where large tier-one providers must look for revenue growth. For an organization such as Rogers, which might book $12 billion in 2011 revenue, even interesting new lines of business that produce scores of millions to hundreds of millions worth of new revenue are too small to "move the needle" overall.

The problem is even worse for organizations such as AT&T or Verizon that book $30 billion to $40 billion a year in revenue. Simply put, there are few realistic new lines of business large enough to matter. That is why you hear so much about machine-to-machine communications, mobile advertising, mobile banking and enterprise-oriented cloud services. Each of those businesses could, in principle, produce $1 billion a year in incremental revenue for any single contestant in a national market.

Keep in mind the scale requirements. A business has to be big enough to produce $1 billion in incremental revenue for each contestant that wishes to compete in the business. By definition, any new line of business must be capable of generating global revenue in the scores of billions of dollars.

To repeat, Rogers will become a bank. It will do so because even "mobile payments" might not produce enough incremental revenue to be interesting. Instead, Rogers will have to explore ways to earn incremental revenue in a range of traditional banking services that match its capabilities in mobile services.

There are some obvious implications. Isis, the joint venture between AT&T, Verizon Wireless and T-Mobile USA, has shifted from a "mobile payments" to a "mobile wallet" focus. The implication is that Isis has decided it does not have time nor money to challenge Visa and MasterCard directly, which it was its original plan.

Even though that is an arguably wise move, the point remains that even a mobile wallet model might not produce revenue large enough to matter. That is not to say a wallet effort could not do so, but that it would have to create a huge advertising ecosystem.

At some point, even Isis might have to consider whether it must become a bank, or that its partners separately might have to become banks. That would still leave them as partners with Visa and MasterCard. But it would not allow Isis to completely avoid all conflict with banks.

Many service providers outside the United States probably are "running the numbers" and coming to similar conclusions.

Rogers applies to become a bank

The move by Rogers is highly significant, as it illustrates an important point about where large tier-one providers must look for revenue growth. For an organization such as Rogers, which might book $12 billion in 2011 revenue, even interesting new lines of business that produce scores of millions to hundreds of millions worth of new revenue are too small to "move the needle" overall.

The problem is even worse for organizations such as AT&T or Verizon that book $30 billion to $40 billion a year in revenue. Simply put, there are few realistic new lines of business large enough to matter. That is why you hear so much about machine-to-machine communications, mobile advertising, mobile banking and enterprise-oriented cloud services. Each of those businesses could, in principle, produce $1 billion a year in incremental revenue for any single contestant in a national market.

Keep in mind the scale requirements. A business has to be big enough to produce $1 billion in incremental revenue for each contestant that wishes to compete in the business. By definition, any new line of business must be capable of generating global revenue in the scores of billions of dollars.

To repeat, Rogers will become a bank. It will do so because even "mobile payments" might not produce enough incremental revenue to be interesting. Instead, Rogers will have to explore ways to earn incremental revenue in a range of traditional banking services that match its capabilities in mobile services.

There are some obvious implications. Isis, the joint venture between AT&T, Verizon Wireless and T-Mobile USA, has shifted from a "mobile payments" to a "mobile wallet" focus. The implication is that Isis has decided it does not have time nor money to challenge Visa and MasterCard directly, which it was its original plan.

Even though that is an arguably wise move, the point remains that even a mobile wallet model might not produce revenue large enough to matter. That is not to say a wallet effort could not do so, but that it would have to create a huge advertising ecosystem.

At some point, even Isis might have to consider whether it must become a bank, or that its partners separately might have to become banks. That would still leave them as partners with Visa and MasterCard. But it would not allow Isis to completely avoid all conflict with banks.

Many service providers outside the United States probably are "running the numbers" and coming to similar conclusions.

Rogers applies to become a bank

Labels:

Isis,

mobile banking,

mobile money,

mobile payments,

Rogers

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Yahoo Needs Help in Mobile

Efforts to launch new display ad formats and more localized content may have given a boost to its ad business but the benefits would have only been seen on its own properties, rather than the long tail of wider internet content. How Bartz Didn’t Help Yahoo Mobile

Yahoo!, the most-visited U.S. Web portal, reported second quarter 2011 revenue that missed estimates as marketers favored competing sites and a sales-team shakeup made it harder to clinch advertising orders.

Excluding sales passed on to partner sites, second-quarter revenue slipped 4.6 percent from a year earlier to $1.08 billion, Sunnyvale, California-based Yahoo said in a statement. Analysts surveyed by Bloomberg had estimated $1.11 billion. Yahoo misses ad targets

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

OHands-On With The Motorola Droid Bionic For Verizon - TechCrunch

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Video Game Sales to Grow

Video game sales are expected to grow from $66 billion worldwide in 2010 to $81 billion by 2016, boosted by a shift to online delivery, according to DFC Intelligence.

Online sales of games are the largest area of growth and they could surpass retail sales as early as 2013, said David Cole, DFC analyst. Games also are shifting away from dedicated game consoles and to multi-purpose devices such as smart phones.

Online sales of games are the largest area of growth and they could surpass retail sales as early as 2013, said David Cole, DFC analyst. Games also are shifting away from dedicated game consoles and to multi-purpose devices such as smart phones.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Subscribe to:

Comments (Atom)

Access Network Limitations are Not the Performance Gate, Anymore

In the communications connectivity business, mobile or fixed, “more bandwidth” is an unchallenged good. And, to be sure, higher speeds have ...

-

We have all repeatedly seen comparisons of equity value of hyperscale app providers compared to the value of connectivity providers, which s...

-

It really is surprising how often a Pareto distribution--the “80/20 rule--appears in business life, or in life, generally. Basically, the...

-

One recurring issue with forecasts of multi-access edge computing is that it is easier to make predictions about cost than revenue and infra...