Cloud computing was the fastest-growing category of U.S. service provider infrastructure spending in 2011, with a 28.4 percent increase, according to the Telecommunications Industry Association.

The TIA also expects cloud computing will continue to be the fastest-growing category of network and facilities investment during the next four years, averaging 20.3 percent compounded annually.

As new cloud-based end-user services emerge and as existing services expand, end user spending will more than double to $12.1 billion in 2015 from $5.8 billion in 2011, according to the TIA.

So cloud computing is a slam dunk opportunity for service providers? Opportunity, yes. "Slam dunk," perhaps not. Some reasonable caution always is in order when looking at cloud computing revenue.

For starters, there are multiple types of revenue, not all easily earned directly by service providers. There is a reason industry observers talk about "infrastructure as a service," "platform as a service" and software as a service." They are different businesses.

Also, there are some businesses underpinning cloud computing, such as hosting, broadband access and transport, that might always represent more accessible revenue, in the cloud computing space, than the infrastructure, platform or software offerings.

In fact, most of the revenue upside appears likely to accrue to hardware and software suppliers, at least initially, according to a Morgan Stanley analysis.

In other words, if Salesforce.com books revenue for sales to end users, can telecom service providers tap in? Maybe. But not automatically.

In the infrastructure end of the business, telecom service providers might make a business out of rental of computing cycles, storage and ancillary services. But what has to be done to market and support that business, and should effort be put elsewhere?

Keep in mind that cloud computing also is likely to reduce some existing telecom revenue streams, making its net revenue contribution more speculative. Any "cloud" moves by business customers that reduce needs to buy local access services or wide area private line services are examples.

In the telecom space, the analysts expect key winners to include Rackspace, Equinix and competitive local exchange carriers and metro bandwidth suppliers. In other words, hosting and access will be where the telecom revenue lies, possibly not in the infrastructure, platform or software as a service businesses.

The point is that assessing cloud computing revenue contributions for various ecosystem participants is complicated.

The core "cloud computing" business is about rental of computing cycles and storage, rental of development platforms, and rental of actual business apps. It isn't always clear that telcos have clear advantages, compared to other suppliers, in these businesses.

The software as a service business means suppliers will have to master what we used to call the packaged software business. Historically, telco and cable personnel haven’t been notably good at that.

That is not to deny the attraction. One reason content delivery networks are an attractive business is that CDNs provide a new reason to buy transport services. It might turn out that cloud computing is interesting for telcos precisely because it increases demand for transport and access, and not because telcos actually sell so much IaaS, PaaS or SaaS.

Friday, April 13, 2012

Ways Cloud Computing Is, and Isn't a Big Revenue Driver for Telcos

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Businesses of all Sizes are Adopting Cloud Apps, Studies Find

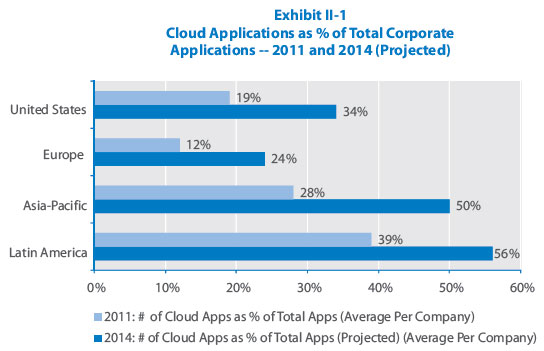

Cloud-based applications are 39 percent of Latin American enterprise apps, 19 percent of the average large U.S. company’s applications, 12 percent of European enterprise apps and 28 percent of Asia-Pacific enterprise apps, according to a survey by Tata Consultancy Services.

But other studies also show that small businesses and medium-sized businesses also are adopting cloud-based apps at a significant level.

Some 39 percent of small and medium-sized businesses are expected to be paying for one or more cloud services within three years, an increase of 34 percent from the current 29 percent, according to a Microsoft study.

The clear majority of enterprise applications used in 2011, including 81 percent of apps used by U.S. companies and 88 percent of European cloud apps, were resident on computers located on enterprise premises, the Tata study suggests.

In Asia-Pacific, on-premises applications were 72 percent of all applications in 2011, while 28 percent were based in the cloud. In Latin America, 61 percent of all corporate applications software were on-premises, compared to 39 percent that were in the cloud.

Tata expects matters to change by 2014, though. American company executives projected cloud applications to increase from 19 percent of all applications (cloud and on-premises) to 34 percent by 2014.

Microsoft predicts that the number of cloud services SMBs pay for will nearly double in most countries over the next three years.

The findings show an increasing opportunity for hosting service providers to profit in the cloud from offering services such as collaboration, data storage and backup, or business-class email.

SMBs paying for cloud services will be using 3.3 services, up from fewer than two services today.

The study also suggests that past experience with support from a service provider is a key driver of service provider selection among SMBs. Some 82 percent of SMBs say buying cloud services from a provider with local presence is critical or important.

The larger the business, the more likely it is to pay for cloud services. Some 56 percent of companies with 51 to 250 employees will pay for an average of 3.7 services within three years.

Within three years, 43 percent of workloads will become paid cloud services, but 28 percent will remain on-premises, and 29 percent will be free or bundled with other services, Microsoft also predicts.

The European companies surveyed by Tata expected that cloud applications as a percent of total applications would double, from 12 percent in 2011 to 24 percent by 2014.

In Asia-Pacific and Latin America, cloud applications are expected to be at least half of total corporate applications by 2014, including 50 percent for Asia-Pacific companies and 56 percent for Latin American firms.

Precisely what that might mean for service providers offering cloud computing infrastructure is not so clear. Even where a service provider does not offer any hosting services, it gains when enterprises adopt cloud computing approaches, since cloud computing tends to increase the need for broadband in several forms.

Demand for mobile broadband grows, while fixed network capacity needs also tend to grow. In that sense, cloud computing drives bandwidth requirements and access and transport revenues.

When a service provider offers rack space and hosting services, it might benefit from customers using “private cloud services.” In other cases, some providers might offer customers rental of computing cycles and storage (infrastructure as a service).

But most of the revenue in cloud computing will be sales of hosted applications. In that case, a service provider has to become a retailer of business apps. The issue is whether this will prove to be a substantial opportunity for service providers, or not.

The Tata study predicts that, by 2014, 25 percent of all corporate applications will be in the cloud in Europe; about 33 percent of U.S. companies and about 50 percent of enterprise apps in Asia-Pacific and Latin American regions.

source: Tata

source: Tata

I

source: Tata

But other studies also show that small businesses and medium-sized businesses also are adopting cloud-based apps at a significant level.

Some 39 percent of small and medium-sized businesses are expected to be paying for one or more cloud services within three years, an increase of 34 percent from the current 29 percent, according to a Microsoft study.

The clear majority of enterprise applications used in 2011, including 81 percent of apps used by U.S. companies and 88 percent of European cloud apps, were resident on computers located on enterprise premises, the Tata study suggests.

In Asia-Pacific, on-premises applications were 72 percent of all applications in 2011, while 28 percent were based in the cloud. In Latin America, 61 percent of all corporate applications software were on-premises, compared to 39 percent that were in the cloud.

Tata expects matters to change by 2014, though. American company executives projected cloud applications to increase from 19 percent of all applications (cloud and on-premises) to 34 percent by 2014.

Microsoft predicts that the number of cloud services SMBs pay for will nearly double in most countries over the next three years.

The findings show an increasing opportunity for hosting service providers to profit in the cloud from offering services such as collaboration, data storage and backup, or business-class email.

SMBs paying for cloud services will be using 3.3 services, up from fewer than two services today.

The study also suggests that past experience with support from a service provider is a key driver of service provider selection among SMBs. Some 82 percent of SMBs say buying cloud services from a provider with local presence is critical or important.

The larger the business, the more likely it is to pay for cloud services. Some 56 percent of companies with 51 to 250 employees will pay for an average of 3.7 services within three years.

Within three years, 43 percent of workloads will become paid cloud services, but 28 percent will remain on-premises, and 29 percent will be free or bundled with other services, Microsoft also predicts.

The European companies surveyed by Tata expected that cloud applications as a percent of total applications would double, from 12 percent in 2011 to 24 percent by 2014.

In Asia-Pacific and Latin America, cloud applications are expected to be at least half of total corporate applications by 2014, including 50 percent for Asia-Pacific companies and 56 percent for Latin American firms.

Precisely what that might mean for service providers offering cloud computing infrastructure is not so clear. Even where a service provider does not offer any hosting services, it gains when enterprises adopt cloud computing approaches, since cloud computing tends to increase the need for broadband in several forms.

Demand for mobile broadband grows, while fixed network capacity needs also tend to grow. In that sense, cloud computing drives bandwidth requirements and access and transport revenues.

When a service provider offers rack space and hosting services, it might benefit from customers using “private cloud services.” In other cases, some providers might offer customers rental of computing cycles and storage (infrastructure as a service).

But most of the revenue in cloud computing will be sales of hosted applications. In that case, a service provider has to become a retailer of business apps. The issue is whether this will prove to be a substantial opportunity for service providers, or not.

The Tata study predicts that, by 2014, 25 percent of all corporate applications will be in the cloud in Europe; about 33 percent of U.S. companies and about 50 percent of enterprise apps in Asia-Pacific and Latin American regions.

source: Tata

source: Tata

I

source: Tata

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Global Consumers Increasingly Trust Earned and Owned Media

Consumer reliance on word-of-mouth in the shopping process, on a global basis, has increased significantly over the last year, Nielsen reports. For marketers, the implications are that earned media and owned media potentially are more effective than ever.

According to Nielsen’s latest Global Trust in Advertising report, which surveyed more than 28,000 Internet respondents in 56 countries, 92 percent of consumers around the world say they trust earned media, such as recommendations from friends and family, above all other forms of advertising, an increase of 18 percent since 2007.

Online consumer reviews are the second most trusted source of brand information and messaging, with 70 percent of global consumers surveyed online indicating they trust messages on this platform, an increase of 15 percent in four years.

The survey also showed that nearly six-in-10 global online consumers (58%) trust messages found on company websites, and half trust email messages that they signed up to receive.

On the Web, four-in-10 respondents rely on ads served alongside search engine results, 36 percent trust online video advertisements, and one-third believe the messages in online banner ads—an increase of 27 percent since 2007. Sponsored ads on social networks, a new format included in the 2011 Nielsen survey, are credible among 36 percent of global respondents.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

"Post-PC" Era Doesn't Slow PC Sales, Data Shows

Global tablet sales to end users are forecast to total 118.9 million units in 2012, a 98 percent increase from 2011 sales of 60 million units, according to researchers at Gartner. At the same time, it appears that traditional PC sales also have grown. .

PC shipments worldwide, expected to grow 4.4 percent in 2012, will grow 10 percent in 2013, according to Gartner. That is a bit of a surprise, with all the attention now focused on tablet sales.

In the first quarter of 2012, PC shipments climbed nearly two percent to 89 million units, thogh analysts had predicted a 1.2 percent drop. Those figures might suggest that tablets and PCs now are distinct products in the marketplace. Though substitution will occur in some cases, much as smart phones displace PCs in some cases, all the products will develop specific niches in the computing appliance market, one might argue.

Apple's iOS continues to be the dominant media tablet operating system, as it is projected to account for 61.4 percent of worldwide media tablet sales to end users in 2012, with Android-powered units representing about 32 percent of sales, Gartner says. By 2016, some 369 million tablets will be sold, Gartner estimates.

By way of contrast, IDC predicts that PC shipments will climb from 353.3 million to more than 500 million in 2016. However, the bulk of the growth will come from "emerging markets" not "mature markets", and from portable PCs rather than desktops, IDC forecasts.

In fact, IDC predicts that shipments of portable PCs in "emerging markets" will almost double from 110.0 million in 2011 to 214.7 million in 2016.

One might therefore infer that tablets will represent about 25 percent of “PC” sales in 2012. By 2016, one might argue, tablets will represent 42 percent of “PC” sales.

"Despite PC vendors and phone manufacturers wanting a piece of the pie and launching themselves into the media tablet market, so far, we have seen very limited success outside of Apple with its iPad," said Carolina Milanesi, research vice president at Gartner.

"As vendors struggled to compete on price and differentiate enough on either the hardware or ecosystem, inventories were built and only 60 million units actually reached the hands of consumers across the world. The situation has not improved in early 2012, when the arrival of the new iPad has reset the benchmark for the product to beat."

Global Tablet Sales to End Users (Thousands of Units)

Source: Gartner (April 2012)

PC shipments worldwide, expected to grow 4.4 percent in 2012, will grow 10 percent in 2013, according to Gartner. That is a bit of a surprise, with all the attention now focused on tablet sales.

In the first quarter of 2012, PC shipments climbed nearly two percent to 89 million units, thogh analysts had predicted a 1.2 percent drop. Those figures might suggest that tablets and PCs now are distinct products in the marketplace. Though substitution will occur in some cases, much as smart phones displace PCs in some cases, all the products will develop specific niches in the computing appliance market, one might argue.

Apple's iOS continues to be the dominant media tablet operating system, as it is projected to account for 61.4 percent of worldwide media tablet sales to end users in 2012, with Android-powered units representing about 32 percent of sales, Gartner says. By 2016, some 369 million tablets will be sold, Gartner estimates.

By way of contrast, IDC predicts that PC shipments will climb from 353.3 million to more than 500 million in 2016. However, the bulk of the growth will come from "emerging markets" not "mature markets", and from portable PCs rather than desktops, IDC forecasts.

In fact, IDC predicts that shipments of portable PCs in "emerging markets" will almost double from 110.0 million in 2011 to 214.7 million in 2016.

One might therefore infer that tablets will represent about 25 percent of “PC” sales in 2012. By 2016, one might argue, tablets will represent 42 percent of “PC” sales.

"Despite PC vendors and phone manufacturers wanting a piece of the pie and launching themselves into the media tablet market, so far, we have seen very limited success outside of Apple with its iPad," said Carolina Milanesi, research vice president at Gartner.

"As vendors struggled to compete on price and differentiate enough on either the hardware or ecosystem, inventories were built and only 60 million units actually reached the hands of consumers across the world. The situation has not improved in early 2012, when the arrival of the new iPad has reset the benchmark for the product to beat."

Global Tablet Sales to End Users (Thousands of Units)

| OS |

2011

|

2012

|

2013

|

2016

|

| iOS |

39,998

|

72,988

|

99,553

|

169,652

|

| Android |

17,292

|

37,878

|

61,684

|

137,657

|

| Microsoft |

0

|

4,863

|

14,547

|

43,648

|

| QNX |

807

|

2,643

|

6,036

|

17,836

|

| Other Operating Systems |

1,919

|

510

|

637

|

464

|

| Total Market |

60,017

|

118,883

|

182,457

|

369,258

|

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Thursday, April 12, 2012

Verizon, Time Warner Cross sell in Kansas City, Cincinnati and Columbus, Ohio and Raleigh, N.C.

Verizon Wireless and Time Warner Cable are offering financial inducements to new or existing customers of either company in Kansas City, Cincinnati and Columbus, Ohio and Raleigh, N.C. Both firms are selling video, mobile, Internet and TV services offered by either firm.

But the deals seem to be aimed as much at encouraging existing customers to buy additional products from each of the companies, as the offers are aimed new customers.

Either firm earns a commission if it sells the other company's products. But the structure of the deals also encourages purchasing of incremental services by any current customer.

The initial markets are, as one would expect, places where Verizon does not compete with the cable operators for fixed network services.

But the deals seem to be aimed as much at encouraging existing customers to buy additional products from each of the companies, as the offers are aimed new customers.

Either firm earns a commission if it sells the other company's products. But the structure of the deals also encourages purchasing of incremental services by any current customer.

The initial markets are, as one would expect, places where Verizon does not compete with the cable operators for fixed network services.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

For Better or Worse, People Want to Use Their Own Devices at Work

Enterprises are seeing the same trend, according to Juniper Research.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Why "Over the Top" Mobile Voice Isn't Growing as Fast as it Could

Mobile VoIP provided by over the top providers are as big a revenue threat as over the top services are for fixed network providers. But some would argue that adoption of mobile over the top voice faces headwinds for a reason shared by other apps on mobile phones, namely the drain on batteries.

Softphones aren’t making inroads onto smartphones or the desktop because the former lacks battery life and the latter take too long to start up, according to Jamie Romanin, ShoreTel regional director for Australasia.

Battery life now appears to be a constraint for VoIP clients as it already is for users who avoid using other smart phone features to save their batteries.

But those same behaviors might well help mobile service providers provide another element of value for using carrier-provided voice services.

Softphones aren’t making inroads onto smartphones or the desktop because the former lacks battery life and the latter take too long to start up, according to Jamie Romanin, ShoreTel regional director for Australasia.

Battery life now appears to be a constraint for VoIP clients as it already is for users who avoid using other smart phone features to save their batteries.

But those same behaviors might well help mobile service providers provide another element of value for using carrier-provided voice services.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Subscribe to:

Comments (Atom)

On the Use and Misuse of Principles, Theorems and Concepts

When financial commentators compile lists of "potential black swans," they misunderstand the concept. As explained by Taleb Nasim ...

-

We have all repeatedly seen comparisons of equity value of hyperscale app providers compared to the value of connectivity providers, which s...

-

It really is surprising how often a Pareto distribution--the “80/20 rule--appears in business life, or in life, generally. Basically, the...

-

One recurring issue with forecasts of multi-access edge computing is that it is easier to make predictions about cost than revenue and infra...