Wednesday, August 1, 2012

"Payments," As Such Are Not What Consumers Value

“Consumers do not have much interest in payments," says James Le Brocq, managing director at O2 Money. "They want to do things in their everyday lives conveniently: travel to work, buy lunch, buy a gift."

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

New Cloud-Based Google Wallet App Released

Google has released a new, cloud-based version of the Google Wallet app that supports all credit and debit cards from Visa, MasterCard, American Express, and Discover. Now, users can choose to pa with any of those card brands when shopping in-store or online with Google Wallet.

The new version also allows users to remotely disable their mobile wallet apps. If a Google wallet user loses a phone, they can use the ‘Devices’ section in the online wallet to disable all cards used with the wallet.

When a user disables their wallet on a device, Google Wallet will not authorize any transactions attempted with that device. If the Google Wallet online service can establish a connection to your device, it will remotely reset your mobile wallet, clearing it of card and transaction data.

The Google Wallet app now stores user payment cards on highly secure Google servers, instead of in the secure storage area on your phone. A wallet ID (virtual card number) is stored in the secure storage area of the phone, and this is used to facilitate transactions at the point of sale.

This new approach also speeds up the integration process for banks so they can add their cards to the Wallet app in just a few weeks. Banks that want to help their customers save cards to Google Wallet, including their custom card art, can apply here.

The new Google Wallet app is available now on Google Play.

The new version also allows users to remotely disable their mobile wallet apps. If a Google wallet user loses a phone, they can use the ‘Devices’ section in the online wallet to disable all cards used with the wallet.

When a user disables their wallet on a device, Google Wallet will not authorize any transactions attempted with that device. If the Google Wallet online service can establish a connection to your device, it will remotely reset your mobile wallet, clearing it of card and transaction data.

The Google Wallet app now stores user payment cards on highly secure Google servers, instead of in the secure storage area on your phone. A wallet ID (virtual card number) is stored in the secure storage area of the phone, and this is used to facilitate transactions at the point of sale.

This new approach also speeds up the integration process for banks so they can add their cards to the Wallet app in just a few weeks. Banks that want to help their customers save cards to Google Wallet, including their custom card art, can apply here.

The new Google Wallet app is available now on Google Play.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

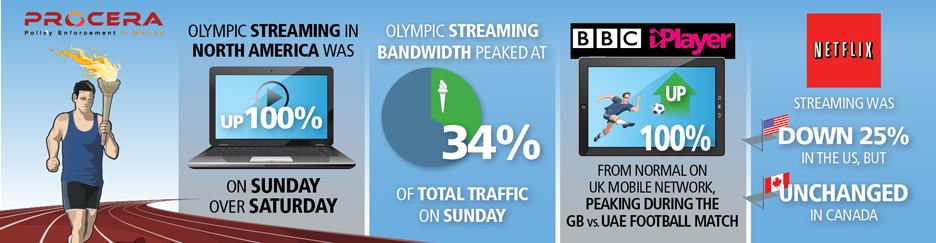

Olympics Streaming Seems to Hit Netflix Streaming

ISP technology provider Procera Networks reports that Netflix streaming was down a quarter from normal levels in the U.S. Sunday, even though overall streaming video traffic was way up, according to Procera Networks.

Procera Networks notes that Netflix streaming was down 25 percent on July 29, 2012, for example.

Netflix CEO Reed Hastings had suggested this would happen. “This quarter the Olympics are likely to have a negative impact on Netflix viewing and sign-ups,” Reed Hastings has said, in setting third quarter 2012 guidance at one million to 1.8 million domestic net adds.

Procera Networks notes that Netflix streaming was down 25 percent on July 29, 2012, for example.

Netflix CEO Reed Hastings had suggested this would happen. “This quarter the Olympics are likely to have a negative impact on Netflix viewing and sign-ups,” Reed Hastings has said, in setting third quarter 2012 guidance at one million to 1.8 million domestic net adds.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

U.S. Becomes Biggest Global Market for Mobile Internet Advertising in 2012

Until this year, Japan was the world’s largest market for mobile advertising, with spending reaching $1.36 billion in 2011, up from $1.01 billion in 2010, eMarketer also says.

Spending on mobile internet ads in Japan will grow 27.2 percent to $1.74 billion in 2012, versus 35.4 percent growth in 2011, eMarketer reports.

Mobile internet advertising spending in the United States, by comparison, will grow 96.6 percent to $2.29 billion in 2012, up from $1.16 billion last year, according to eMarketer.

North America also will surpass Asia-Pacific in 2013 as the world’s largest regional market for.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Comcast, European Cable Operator Growth Strategies Diverge

Virtually all existing communications and video entertainment businesses are in a time of transition from older revenue patterns to new business models that inevitably will include a mix of products, often sold to different customers than in the past.

Beyond that, it remains unclear what revenue contributions might in the future be made by entirely new lines of business. But Comcast’s second quarter 2012 earnings report suggests the upside potential and downside risks.

Also, the latest Solon Survey of European cable operators illustrates a couple salient points about the near term growth drivers for North American and European cable operators. Wireless appears to be a bigger factor for European cable operators, while Comcast’s approach now suggests content will be a bigger source of revenue for the larger U.S. cable providers.

In the near term, European cable operator growth now comes from broadband access, mobile services and business-to-business services.

The key trends are the importance of mobility and services aimed at business customers, which In the 2009 survey were not firmly embraced by cable operators in Europe.

By 2011, sentiment had changed, with operators across Europe highlighting the importance of

commercial and mobile segments in driving near term revenue growth.

On average, cable operators expect to double the share of revenues generated through mobile offerings, while the revenue contribution from business and wholesale activities is forecast to increase by approximately 33 percent. For a business historically serving the consumer segment, the expansion of services to business and enterprise customers is significant.

By 2014, a typical European cable operator will be earning 12 percent of its revenues from business customers. Some cable operators, though, already earn more than 30 percent of total revenues from B2B services.

European cable operators surveyed expect revenue growth of over five percent per year until 2014 and further EBITDA margin expansion by two percentage points up to 48 percent, on average, to 2014.

In large part, that is due to gains in broadband access revenue, which remains the main source of revenue growth for European cable operators, the report suggests. In fact, Solon attributes broadband access revenue for a rebound in operator average revenue per user, which had been dropping.

Revenue earned by offering or higher access speeds, at an average broadband access ARPU of approximately 20€ per month, is the primary reason ARPU now is stable, the Solon report indicates.

Comcast’s revenue, on the other hand, now has tipped towards content. Comcast video revenues have shrunk to about 52 percent of total Comcast revenue, while other access network services now contribute 48 percent, and are growing.

At some point, Comcast will earn less than half its revenue from its legacy video entertainment business. And that is to focus only on Comcast’s “local access” business.

In fact, including the NBC Universal contributions, it already is true that Comcast earns less than half its total revenue from cable TV distribution. In fact, cable TV video distribution operations now account for only 33 percent of total Comcast revenue.

For anybody who has followed the U.S. video entertainment market for some decades, that U.S. cable operator video penetration is as low as 44 percent of TV homes is a shocking statistic. There was a time when penetration was as high as 70 to 80 percent of homes in some areas.

Competition from satellite and telco competitors is the reason for the sharp reversal.

Some 97 percent of U.S. homes own a TV, and about 90 percent of all U.S. homes buy a subscription TV service.

Telco IPTV penetration on a global basis, measured agains the installed base of worldwide broadband subscribers, reached 15 percent in the first quarter of 2012, representing 67 million subscribers and eight percent of the world’s 812 million video entertainment service subscribers, according to TeleGeography.

North American telcos, led by Verizon and AT&T, have succeeded in selling IPTV service to almost 40 percent of their broadband subscriber base. That is not to say telco TV now reaches 40 percent of homes. That statistic means the tier one telcos are selling video entertainment to 40 percent of their customers who buy broadband access.

Since telcos have almost half of all broadband customers, and since broadband is purchased by about 80 percent of U.S. households, you can roughly estimate that telcos now sell video services to perhaps 20 percent of U.S. households.

But keep in mind that telcos are not able to sell video to many locations, using their fixed networks, for technology reasons. Where they can do so, market share could be in the 30 percent range.

Generally speaking, getting a video customer means taking that customer away from a cable TV or satellite TV provider who already had the customer, as household penetration of subscription TV is over 80 percent. The market, in other words, is saturated.

There are some important implications. You might well argue that 40 percent video penetration of a service provider’s own customer base is “about as good as it is going to be,” when strong cable TV and satellite TV competitors own the rest of the customers, and when taking a customer therefore is tough.

In any market with three dominant and well-heeled contestants, you might expect an ultimate market share distribution that could easily be split three ways, with any single contestant getting 20 percent to 40 percent share.

If telcos have 20 percent share, could that share double? In principle, yes. If telcos get 30 percent share, could share then double again? Probably not, if the other two contestants (satellite and cable) continue to perform at a high level.

But there is one big change in potential market share structure that long has been speculated, namely a purchase of both U.S. satellite companies by one of the tier-one U.S. telcos. That, in principle, could mean telcos then would have as much as 60 percent share of video service customers.

For the moment, telcos are doing about as well as they can, using only their fixed networks.

IPTV and Pay-TV Penetration Rates, Q1 2012

Source:TeleGeography

Beyond that, it remains unclear what revenue contributions might in the future be made by entirely new lines of business. But Comcast’s second quarter 2012 earnings report suggests the upside potential and downside risks.

Also, the latest Solon Survey of European cable operators illustrates a couple salient points about the near term growth drivers for North American and European cable operators. Wireless appears to be a bigger factor for European cable operators, while Comcast’s approach now suggests content will be a bigger source of revenue for the larger U.S. cable providers.

In the near term, European cable operator growth now comes from broadband access, mobile services and business-to-business services.

The key trends are the importance of mobility and services aimed at business customers, which In the 2009 survey were not firmly embraced by cable operators in Europe.

By 2011, sentiment had changed, with operators across Europe highlighting the importance of

commercial and mobile segments in driving near term revenue growth.

On average, cable operators expect to double the share of revenues generated through mobile offerings, while the revenue contribution from business and wholesale activities is forecast to increase by approximately 33 percent. For a business historically serving the consumer segment, the expansion of services to business and enterprise customers is significant.

By 2014, a typical European cable operator will be earning 12 percent of its revenues from business customers. Some cable operators, though, already earn more than 30 percent of total revenues from B2B services.

European cable operators surveyed expect revenue growth of over five percent per year until 2014 and further EBITDA margin expansion by two percentage points up to 48 percent, on average, to 2014.

In large part, that is due to gains in broadband access revenue, which remains the main source of revenue growth for European cable operators, the report suggests. In fact, Solon attributes broadband access revenue for a rebound in operator average revenue per user, which had been dropping.

Revenue earned by offering or higher access speeds, at an average broadband access ARPU of approximately 20€ per month, is the primary reason ARPU now is stable, the Solon report indicates.

Comcast’s revenue, on the other hand, now has tipped towards content. Comcast video revenues have shrunk to about 52 percent of total Comcast revenue, while other access network services now contribute 48 percent, and are growing.

At some point, Comcast will earn less than half its revenue from its legacy video entertainment business. And that is to focus only on Comcast’s “local access” business.

In fact, including the NBC Universal contributions, it already is true that Comcast earns less than half its total revenue from cable TV distribution. In fact, cable TV video distribution operations now account for only 33 percent of total Comcast revenue.

For anybody who has followed the U.S. video entertainment market for some decades, that U.S. cable operator video penetration is as low as 44 percent of TV homes is a shocking statistic. There was a time when penetration was as high as 70 to 80 percent of homes in some areas.

Competition from satellite and telco competitors is the reason for the sharp reversal.

Some 97 percent of U.S. homes own a TV, and about 90 percent of all U.S. homes buy a subscription TV service.

Telco IPTV penetration on a global basis, measured agains the installed base of worldwide broadband subscribers, reached 15 percent in the first quarter of 2012, representing 67 million subscribers and eight percent of the world’s 812 million video entertainment service subscribers, according to TeleGeography.

North American telcos, led by Verizon and AT&T, have succeeded in selling IPTV service to almost 40 percent of their broadband subscriber base. That is not to say telco TV now reaches 40 percent of homes. That statistic means the tier one telcos are selling video entertainment to 40 percent of their customers who buy broadband access.

Since telcos have almost half of all broadband customers, and since broadband is purchased by about 80 percent of U.S. households, you can roughly estimate that telcos now sell video services to perhaps 20 percent of U.S. households.

But keep in mind that telcos are not able to sell video to many locations, using their fixed networks, for technology reasons. Where they can do so, market share could be in the 30 percent range.

Generally speaking, getting a video customer means taking that customer away from a cable TV or satellite TV provider who already had the customer, as household penetration of subscription TV is over 80 percent. The market, in other words, is saturated.

There are some important implications. You might well argue that 40 percent video penetration of a service provider’s own customer base is “about as good as it is going to be,” when strong cable TV and satellite TV competitors own the rest of the customers, and when taking a customer therefore is tough.

In any market with three dominant and well-heeled contestants, you might expect an ultimate market share distribution that could easily be split three ways, with any single contestant getting 20 percent to 40 percent share.

If telcos have 20 percent share, could that share double? In principle, yes. If telcos get 30 percent share, could share then double again? Probably not, if the other two contestants (satellite and cable) continue to perform at a high level.

But there is one big change in potential market share structure that long has been speculated, namely a purchase of both U.S. satellite companies by one of the tier-one U.S. telcos. That, in principle, could mean telcos then would have as much as 60 percent share of video service customers.

For the moment, telcos are doing about as well as they can, using only their fixed networks.

IPTV and Pay-TV Penetration Rates, Q1 2012

Source:TeleGeography

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Vivotech to Abandon NFC Terminal Business

No new business lead by start-ups ever seems to reach fullness and fruition with some failures. So it is that contactless reader and NFC software vendor Vivotech has become an early casualty of the contactless mobile payment business.

NFC Times reports that the firm plans to cease operations and sell at least some of its assets. Sources say Vivotech is in talks to sell its reader business to PAX Global Technology, owner of Shenzhen, China-based PAX Technology, a maker of point-of-sale terminals.

Vivotech’s software business, though, might be retained.

Some would argue that Vivotech simply was too early, a common problem when whole new industries are being born.

In part, the problem seems to have been that the original business was built around sales of NFC-capable terminals, but that point-of-sale business has suffered from margin compression.

Software and services used for payments and other features, such as tracking and redeeming mobile offers, now are viewed as adding more value.

Vivotech had shipped nearly one million terminals globally over the past several years.

NFC Times reports that the firm plans to cease operations and sell at least some of its assets. Sources say Vivotech is in talks to sell its reader business to PAX Global Technology, owner of Shenzhen, China-based PAX Technology, a maker of point-of-sale terminals.

Vivotech’s software business, though, might be retained.

Some would argue that Vivotech simply was too early, a common problem when whole new industries are being born.

In part, the problem seems to have been that the original business was built around sales of NFC-capable terminals, but that point-of-sale business has suffered from margin compression.

Software and services used for payments and other features, such as tracking and redeeming mobile offers, now are viewed as adding more value.

Vivotech had shipped nearly one million terminals globally over the past several years.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Triple Digit Increases in Social Media, Video Consumption During Olympics

Twitter peaked at 137 percent of typical use during the opening ceremony and grew to 413 percent by day three of the games.

QQIM, the Chinese instant messaging service, grew over 300 percent by day three of the games.

Instant Messaging increased 182 percent, on average, during the opening ceremony, Allot says.

WhatsApp posted a 430 percent increase during opening ceremony.

Online video peaked at 217 percent during the first official day of competition, growing to 408 percent of typical levels by day three of the London Olympics.

Facebook traffic posted an 87 percent increase during the first two days of the games and moved up to 162 percent by day three of the Olympics.

YouTube traffic grew 40 percent during the first official day of competition and moved up to 153 percent of typical levels by day three of the games, Allot says.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Subscribe to:

Comments (Atom)

On the Use and Misuse of Principles, Theorems and Concepts

When financial commentators compile lists of "potential black swans," they misunderstand the concept. As explained by Taleb Nasim ...

-

We have all repeatedly seen comparisons of equity value of hyperscale app providers compared to the value of connectivity providers, which s...

-

It really is surprising how often a Pareto distribution--the “80/20 rule--appears in business life, or in life, generally. Basically, the...

-

One recurring issue with forecasts of multi-access edge computing is that it is easier to make predictions about cost than revenue and infra...