Drawing valid comparisons between countries, in terms of communications development, quality and pricing are difficult for any number of reasons. Some measures of “development” or usage are relevant on a household basis. But differing average housing densities materially affect per-capita metrics.

Drawing valid comparisons between countries, in terms of communications development, quality and pricing are difficult for any number of reasons. Some measures of “development” or usage are relevant on a household basis. But differing average housing densities materially affect per-capita metrics.

Average national revenue and cost of living indices likewise affect price levels. Average loop lengths and population densities affect the costs of deploying networks, both mobile or fixed.

Large continent-sized countries will tend to lag small, highly-dense countries and city-states on most measures of network performance or advanced network deployment, simply because of scale issues.

Regulatory and national investment priorities likewise will have a material effect on the quality and speed of advanced networks and services. Also, nations differ in ability to use infrastructure for maximum economic effect.

Even allowing for such important differences, relative rankings can change, and significantly, over time. Not so long ago, many critics pointed out that U.S. consumers lagged far behind Japan, South Korea and most Western European countries on any number of metrics, ranging from use of mobile services to use of mobile messaging to magnitude of Internet speeds.

Even allowing for such important differences, relative rankings can change, and significantly, over time. Not so long ago, many critics pointed out that U.S. consumers lagged far behind Japan, South Korea and most Western European countries on any number of metrics, ranging from use of mobile services to use of mobile messaging to magnitude of Internet speeds.

Critics still point out that U.S. prices for any number of services are higher than elsewhere, or that average access speeds are lackluster. All that said, we should not be too alarmed that new studies suggest Europe is “falling behind” the United States in the use of mobile networks, especially the next generation of networks.

Over time, the differences will evaporate, just as differences have evened out in the past. And some differences principally are caused by prevailing levels of wages and prices in any particular country. In most countries, for example, when Internet access prices are three percent or less of typical household income, broadband adoption soars.

What matters is the retail price of broadband as a percentage of household income, not the absolute price.

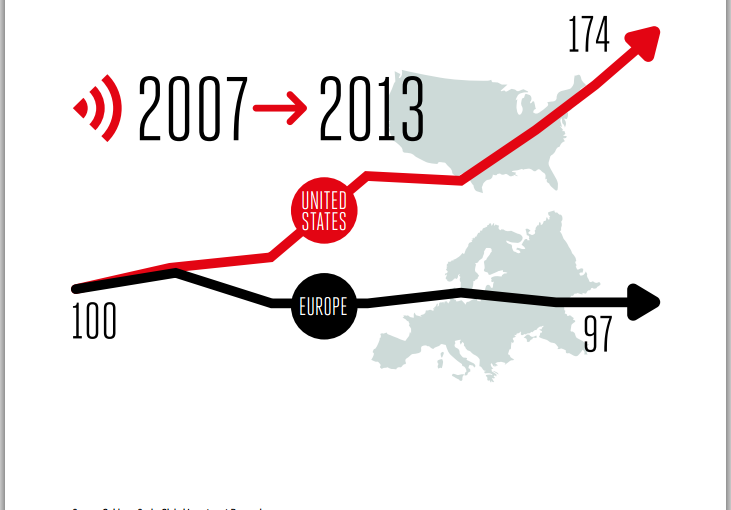

As recently as five years ago, the European mobile market was performing as well as, or even better than, the United States, any observer can conclude, looking at mobile service adoption or consumption of mobile services such as voice, texting or mobile Internet.

However, since then, the situation has dramatically reversed, a study sponsored by the GSM Association suggests.

However, since then, the situation has dramatically reversed, a study sponsored by the GSM Association suggests.

The United States has opened up a “large lead in deployment of next-generation technologies,” the study suggests. By the end of 2013, nearly 20 percent of U.S. connections will be on Long Term Evolution networks, compared to fewer than two per cent in the European Union, the study suggests.

U.S. mobile access speeds are now 75 percent faster than the EU average, and the gap is

expected to grow.

Also, the United States is deploying LTE at a much faster pace than the EU, the study argues. By the end of 2013, 19 percent of U.S. connections will be on LTE networks compared to less than two percent in the EU.

Some of us would say the problem will be rectified soon enough, and that the “gaps” will narrow to the point of meaninglessness, as similar gaps between Western European and U.S. markets were erased in the past.

Also, many studies are commissioned for some business or political purpose. The GSMA study is no different. It occurs in the context of a heated struggle to convince EU regulators to allow much more market consolidation, to allow faster innovation in next-generation networks.

That isn't to dispute the findings; simply to note the context.