Explaining what is going on globally, in the communications business, sometimes is a matter of nuances, and sometimes is drop dead simple.

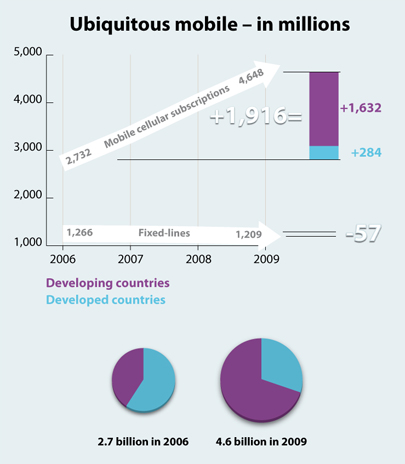

The drop dead simple part is the role played by mobile services , which outnumbered fixed voice lines by about 4.5 to one in 2009, and now outnumber fixed connections by about six to one.

ITU Access LInes (Millions)

|

|

|

|

|

2011

|

2012*

|

2013*

|

Fixed-telephone subscriptions

|

|

|

|

Developed

|

542

|

531

|

520

|

Developing

|

662

|

655

|

652

|

World

|

1,204

|

1,186

|

1,171

|

Mobile-cellular subscriptions

|

|

|

|

|

2011

|

2012*

|

2013*

|

Developed

|

1,475

|

1,538

|

1,600

|

Developing

|

4,487

|

4,872

|

5,235

|

World

|

5,962

|

6,411

|

6,835

|

The nuances come when we are looking at total fixed network lines, for several reasons. There is, for example, a difference between the number of access lines or equivalents that might be available for use, and the number that actually are in use.

That roughly corresponds to the difference between a network that could sell a customer service at a location, and the number of customers that actually do so.

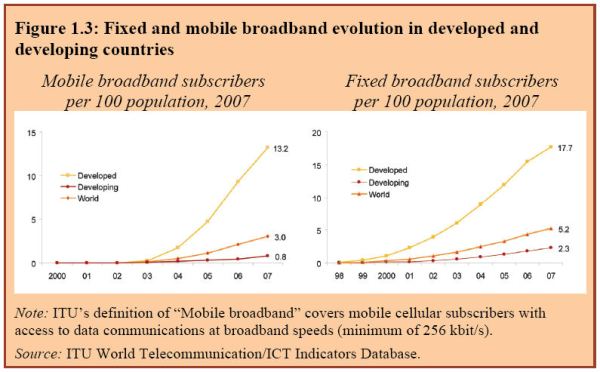

In some cases, there can be a difference between a voice line available, or in use, and a broadband line that is available, or in use.

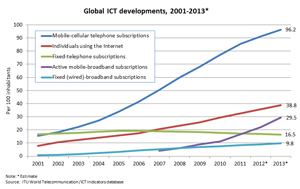

And, of course, there is a difference between trends in developed regions, where the number of voice lines being used is dropping, and the developing regions, where capacity and usage often are growing. The offset, even in developing regions, is the use of lines exclusively for Internet access, irrespective of voice.

At a high level, one might say the number of lines physically able to be used is growing, globally. The number of lines in service seems to be dropping, overall, despite growth of usage in developing regions, simply because the rate of abandonment in developed regions is greater than the number of new lines being added and used in the developing regions.

According to International Telecommunications Union data, for example, the total number of fixed lines in use has declined since about 2006. But the number of fixed broadband lines in use has grown steadily.

Overall, the number of fixed network lines has grown steadily. What has changed is the willingness of customers to pay for a fixed voice service, not fixed services of any type.