Despite continuing challenges in its consumer segment, namely net customer losses, Time Warner Cable managed to grow full-year 2013 revenue 3.4 percent year over year.

Business customer revenues grew 21.6 percent, while consumer high speed Internet access revenues grew 14.4 percent.

Fourth-quarter 2013 average monthly revenue per residential customer relationship (ARPU) grew 2.2 percent to $106.03, the highest rate of growth since the first quarter of 2012, Time Warner Cable says.

Residential high-speed data ARPU increased 12.4 percent to $46.21. Time Warner Cable says it now offers residential high-speed data speeds of 100 Mbps in several cities and regions, including Los Angeles, Kansas City and Hawaii.

Residential wideband high-speed data subscribers (which includes the 30, 50, 75 and 100 Mbps tiers) more than doubled year over year to 910,000 subscribers.

But consider that Time Warner Cable has 11.08 million total residential high speed Internet access customers, meaning that just eight percent of Time Warner Cable customers actually buy a tier of service at 30 Mbps or higher.

It isn't that the higher speeds are unavailable; just that consumers apparently do not see the value-price relationship of the faster tiers as providing good value, at the moment.

And that is a key point: whether high speed Internet access services are available for purchase is one issue. Whether people actually buy those services is a separate issue. One might argue that only eight percent of Time Warner Cable customers buy 30 Mbps, 50 Mbps, 75 Mbps or 100 Mbps service because it is not provided. That largely is untrue.

What is true is that people are choosing to buy service at lower speeds. That means Time Warner Cable has a demand issue, not a supply issue, even if some would say Time Warner Cable has lagged in investment that would boost speeds higher.

Some might argue investment is not the immediate issue. Instead, consumer demand is too low. That is a far-different sort of problem than lack of supply.

Thursday, January 30, 2014

Business Segment Drives Time Warner Cable Growth

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Telecom Industry is Backwards Looking: Government Makes it So

Mobile networks have experienced four complete transitions of network technology in a few decades, doing so about once every 10 years.

The fixed network has been through a couple of network eras, without completely revamping the whole platform.

Looking at switching, it moved from simple crossbar switches to analog electronic switches to digital switches. In access technology, it has begun to move from copper wires to optical fiber.

The biggest single transition, though, is the move from time division multiplexing to Internet Protocol, a subject the Federal Communications Commission will address at its Jan. 30, 2014 meeting, taking up an AT&T request to run trials related to the transition from TDM to IP.

Many of the issues are largely "social" rather than "technical" in nature, relating to how universal service and consumer protections are maintained. Emergency calling and preservation of competition likewise will have to be addressed, though none of those issues is fundamentally a technology issue.

It is fair enough to criticize large telcos for not moving fast enough. Sometimes they can't help it. The government makes them move slow.

The fixed network has been through a couple of network eras, without completely revamping the whole platform.

Looking at switching, it moved from simple crossbar switches to analog electronic switches to digital switches. In access technology, it has begun to move from copper wires to optical fiber.

The biggest single transition, though, is the move from time division multiplexing to Internet Protocol, a subject the Federal Communications Commission will address at its Jan. 30, 2014 meeting, taking up an AT&T request to run trials related to the transition from TDM to IP.

Many of the issues are largely "social" rather than "technical" in nature, relating to how universal service and consumer protections are maintained. Emergency calling and preservation of competition likewise will have to be addressed, though none of those issues is fundamentally a technology issue.

It is fair enough to criticize large telcos for not moving fast enough. Sometimes they can't help it. The government makes them move slow.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Wednesday, January 29, 2014

Amazon to Enter Retail Payments Business

Amazon, the Wall Street Journal reports, is hoping to sell retailers a Kindle-based retail checkout system, likely positioned like Square and other providers of mobile credit card reader systems.

The attraction would seem to be the access to customer data, not so much the lucrative payment terminal business.

But Amazon might also be thinking it can bring other "value add" to the systems, compared to existing offers from other established payment system providers. The immediate inducements could relate to offers, promotions or discounts, especially related to retailer sales on Amazon.com

Longer term, Amazon might eventually leverage other assets. Amazon Web Services could come into play, or possibly logistics support.

Amazon also reportedly is considering a mobile wallet service that would be used by consumers.

The attraction would seem to be the access to customer data, not so much the lucrative payment terminal business.

But Amazon might also be thinking it can bring other "value add" to the systems, compared to existing offers from other established payment system providers. The immediate inducements could relate to offers, promotions or discounts, especially related to retailer sales on Amazon.com

Longer term, Amazon might eventually leverage other assets. Amazon Web Services could come into play, or possibly logistics support.

Amazon also reportedly is considering a mobile wallet service that would be used by consumers.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Google Selling Motorola Mobility

Google says it is selling what remains of Motorola Mobility--while retaining the patent portfolio, to PC maker Lenovo for $2.9 billion.

Google, which bought Motorola Mobioity for $12.5 billion in May 2012, already had sold off the part of the business building cable set-top boxes, and seems now to retain what it really wanted: the patent portfolio.

The move does not completely address the channel conflict of Google being in some parts of the device market, such as it now is with Nest, the home automation supplier. But the move does ease the channel conflict potential to a significant extent.

Google, which bought Motorola Mobioity for $12.5 billion in May 2012, already had sold off the part of the business building cable set-top boxes, and seems now to retain what it really wanted: the patent portfolio.

The move does not completely address the channel conflict of Google being in some parts of the device market, such as it now is with Nest, the home automation supplier. But the move does ease the channel conflict potential to a significant extent.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

U.S. Justice Department "Skeptical" About Possible Sprint Acquisition of T-Mobile UA

Sprint's Possible T-Mobile US acquisition, to nobody's surprise, is viewed "skeptically" by U.S. Department of Justice officials, Sprint board members Masayoshi Son and Dan Hesse apparently have been told at a meeting.

But nothing is ever as it appears on the surface, where it comes to key communications developments. AT&T, in formally announcing it has no plans to make an immediate bid for Vodafone, might trigger thinking that AT&T does not want to make such a bid.

That undoubtedly is the wrong way to view the declaration. By law, AT&T, when asked by U.K. authorities, whether it planned to make such a bid in the next 30 days, had to answer "no," and thereby wait at least six months before making any such bid.

But AT&T would not have made such a bid within the next 30 days. Too much depends on how European regulators treat other pending deals, in particular consolidation in Germany. AT&T had no choice but to respond the way it did.

Likewise, some might think Sprint could not win approval for a deal to buy T-Mobile US, no matter what the concessions. That probably also is not entirely certain.

The Justice Department, though having a view that the U.S. mobile market already is too concentrated, and though it favors a minimum of four providers, might also be presented with an acquisition plan that maintains four providers, and especially the robust attacks T-Mobile US is making.

It could happen.

But nothing is ever as it appears on the surface, where it comes to key communications developments. AT&T, in formally announcing it has no plans to make an immediate bid for Vodafone, might trigger thinking that AT&T does not want to make such a bid.

That undoubtedly is the wrong way to view the declaration. By law, AT&T, when asked by U.K. authorities, whether it planned to make such a bid in the next 30 days, had to answer "no," and thereby wait at least six months before making any such bid.

But AT&T would not have made such a bid within the next 30 days. Too much depends on how European regulators treat other pending deals, in particular consolidation in Germany. AT&T had no choice but to respond the way it did.

Likewise, some might think Sprint could not win approval for a deal to buy T-Mobile US, no matter what the concessions. That probably also is not entirely certain.

The Justice Department, though having a view that the U.S. mobile market already is too concentrated, and though it favors a minimum of four providers, might also be presented with an acquisition plan that maintains four providers, and especially the robust attacks T-Mobile US is making.

It could happen.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

AT&T Pays $100 Credit for Every New Line Added

Market observers who were worried about the implications of a new marketing war in the U.S. mobile business have new reason to worry.

AT&T now is offering all new and existing AT&T customers a $100 bill credit for each new smartphone, tablet, feature phone, mobile hotspot or Wireless Home Phone line of service they add.

The offer is said to be good through March 31, 2014.

The latest incentive comes on top of rival offers by T-Mobile US and AT&T that pay off any early termination fees customers might face when changing service providers before the end of a contract term.

AT&T now is offering all new and existing AT&T customers a $100 bill credit for each new smartphone, tablet, feature phone, mobile hotspot or Wireless Home Phone line of service they add.

The offer is said to be good through March 31, 2014.

The latest incentive comes on top of rival offers by T-Mobile US and AT&T that pay off any early termination fees customers might face when changing service providers before the end of a contract term.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

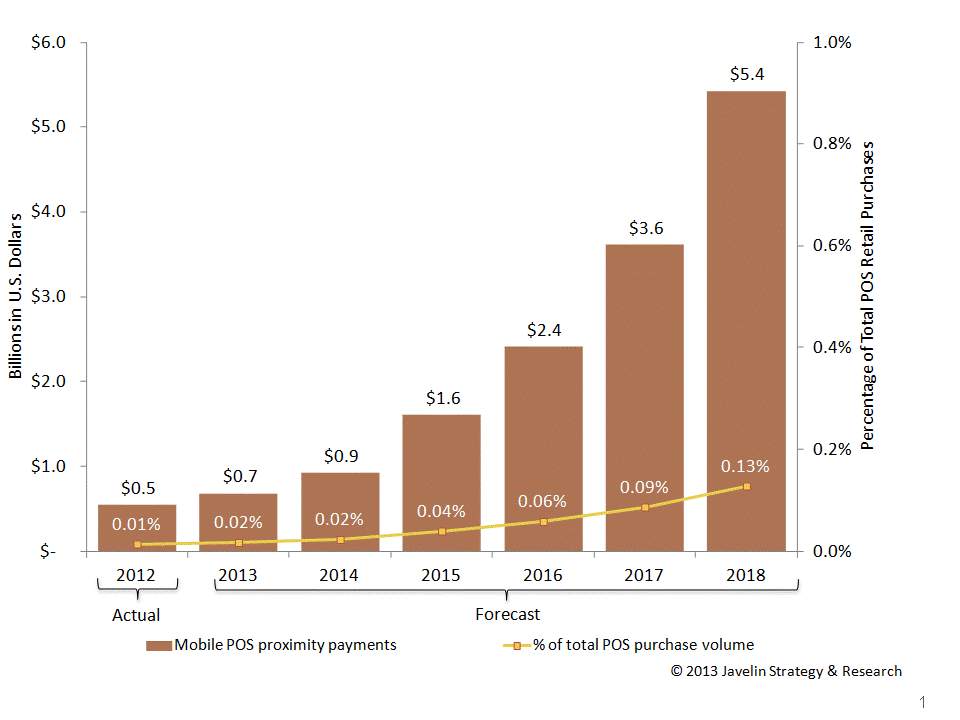

Retailer Mobile Card Readers are the Acknowledged Success in Mobile Payments Field

The usefulness of mobile payment services, as used by consumers, might be hard to ascertain.

But it is clear that retailer adoption is accelerating

Mobile transactions will account for about two percent of all credit and debit card volume in the United States in 2013 and four percent globally, according to BI Intelligence.

Just what percentage of small retailers have adopted mobile card readers such as Square is a matter of debate. What is not debatable is that mobile card readers such as those offered by Square have become a big deal.

By some estimates, 40 percent of retailers already are using mobile card readers.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Subscribe to:

Posts (Atom)

Directv-Dish Merger Fails

Directv’’s termination of its deal to merge with EchoStar, apparently because EchoStar bondholders did not approve, means EchoStar continue...

-

We have all repeatedly seen comparisons of equity value of hyperscale app providers compared to the value of connectivity providers, which s...

-

It really is surprising how often a Pareto distribution--the “80/20 rule--appears in business life, or in life, generally. Basically, the...

-

One recurring issue with forecasts of multi-access edge computing is that it is easier to make predictions about cost than revenue and infra...