At least so far, it is safe to say that mobile operator value in the “payments” ecosystem has been most clear for remittances and other retail payments in developing regions and least successful in retail mobile payments.

In fact, mobile remittances might be just at the beginning of their growth curve. Already, the volume of existing mobile banking transactions for remittances is an order of magnitude higher than any other application, according to the GSMA.

The reason many are optimistic is that remittances by any means represent over $1 trillion in value annually, and only about $5 billion is transferred annually in the United States, for example, using a mobile phone.

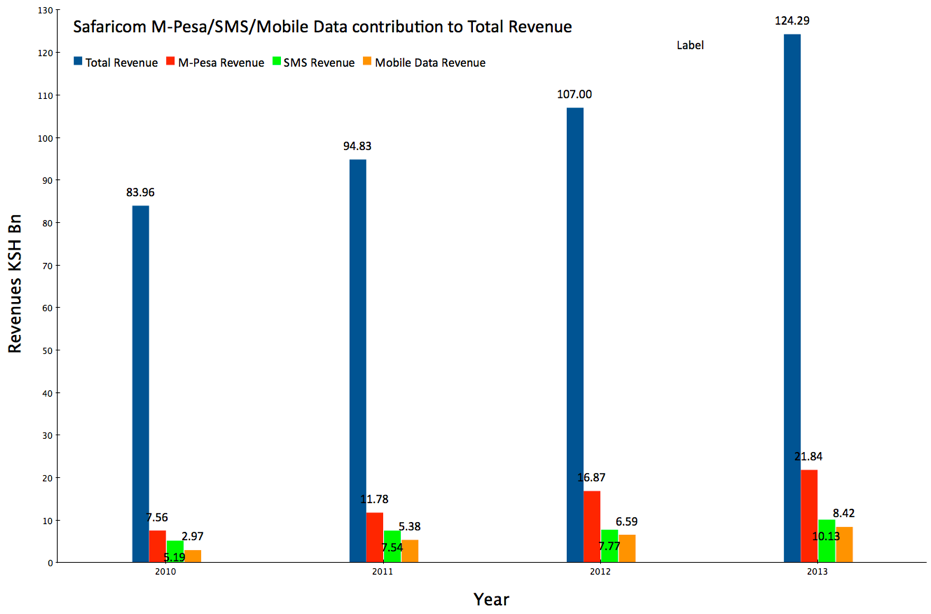

For mobile operators in some markets, revenue contributed by M-Pesa, the mobile payments system, already is greater than revenue earned from mobile data, for example. Some 18 percent of mobile operators polled by GSMA in 2014 reported that mobile money revenues represented more than 10 percent of total revenue, for example.

M-PESA represented just under 20 percent of total revenues for Safaricom in 2014, for example.

MTN Uganda’s mobile money services generated about 15 percent of total revenue in mid-2014.

Tanzania’s M-Pesa service represented 21.3 percent of the operator’s total service revenue in 2014.

By 2014, 255 mobile money services operated in 89 countries and is now available in 61 percent of developing markets.

Retail mobile payments in developed markets have, to this point, been another story. Though In 2015 mobile payments might have represented $8.71 billion in mobile retail transaction volume, very little of that activity flowed through mobile operator services.

The SoftCard initiative lead by AT&T, Verizon and T-Mobile US was quietly folded into Google Wallet, not that Google Wallet has fared better.

The space has been tough for many others, as well. The Merchant Customer Exchange, branded as CurrentC, and representing major mass market retailers, faces a splintering.

Walmart was a lead backer of MCX, but now plans to introduce its own mobile payments service, Walmart Pay. Target, another early MCX supporter, appears to be mulling its own payments system as well.

It remains to be seen whether retail mobile payments will, in the future, be a significant revenue driver for mobile service providers.