Some argue U.S. customers are worse off since the end of network neutrality regulations, referring to transparency of charges and fees. Others would offer argue that net neutrality rules are sort of “noise,” not signal.

Broadband prices also are not high in U.S. markets, as a percentage of household or national income. Prices over time arguably have dropped, as between 1990 and 2000, for example. Adjusting for purchasing power parity, U.S. prices are in line with global prices.

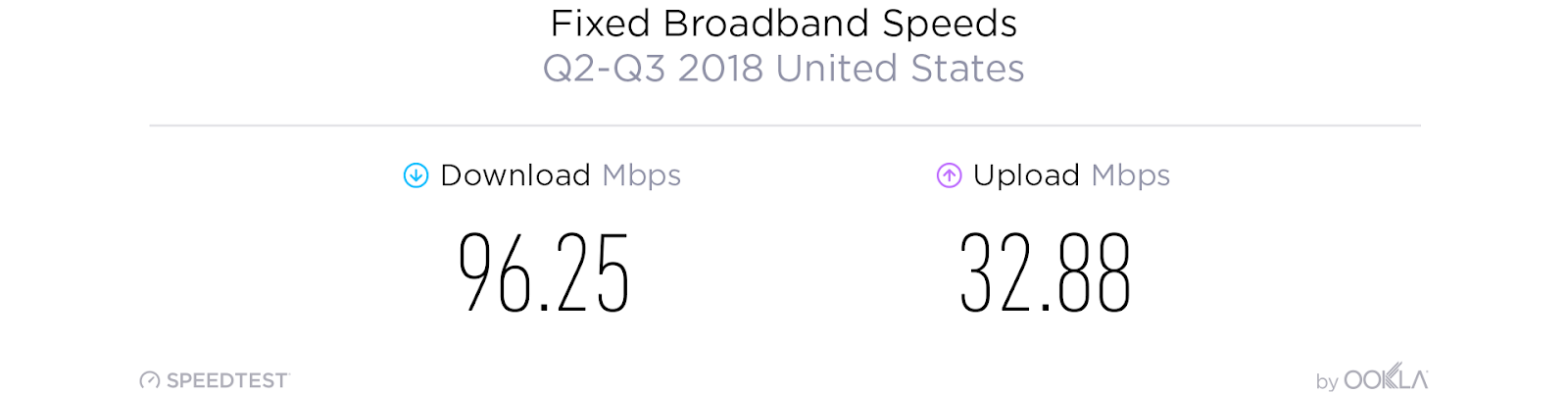

With or without the rules, speeds are climbing--and fast--while prices are in line with global norms or have decreased.

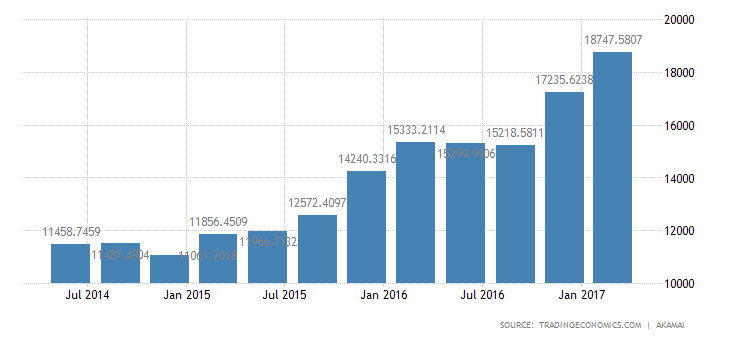

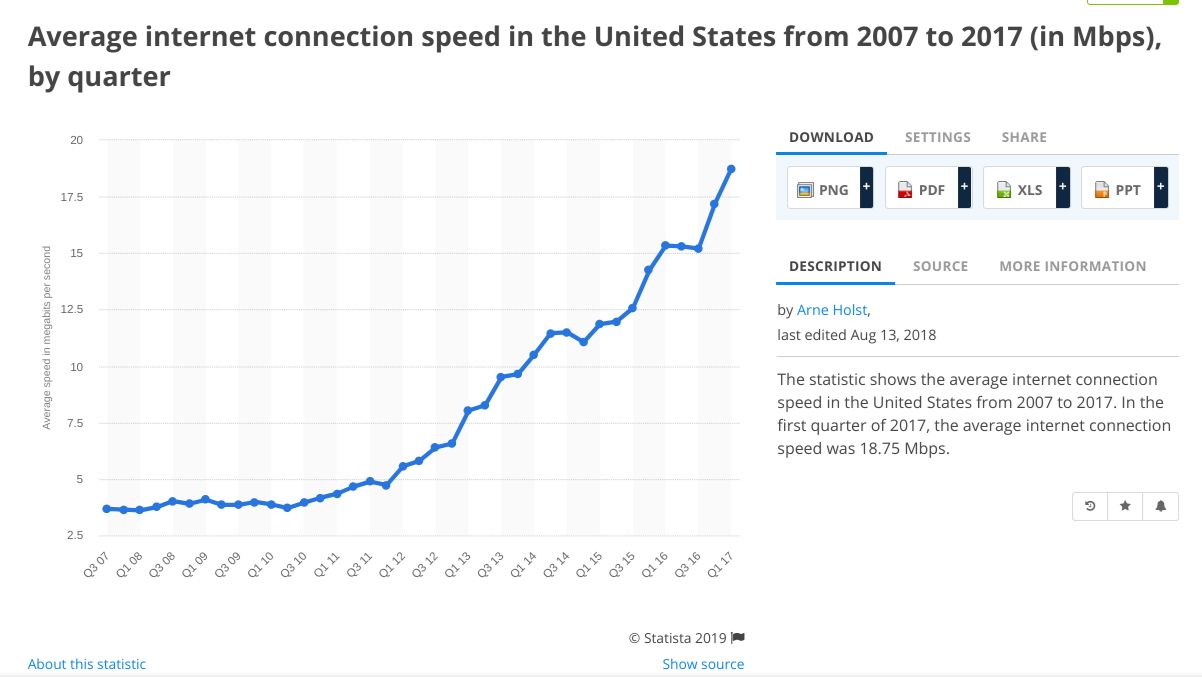

Though there are many other reasons for investments in networks that lead to speed improvements, network neutrality rules were in place from 2015 to 2017.

The larger point is that average U.S. fixed network speeds have risen dramatically since 2010.

Some focus on price as the problem, but absolute prices do not appear to have changed much, even as speeds and usage allowances have grown rapidly. Stand-alone pricing for residential internet access costs between $50 and $60 a month, less if purchased as part of a bundle, which most consumers do.

Broadband prices also are not high in U.S. markets, as a percentage of household or national income. Prices over time arguably have dropped, as between 1990 and 2000, for example. Adjusting for purchasing power parity, U.S. prices are in line with global prices.