Wednesday, November 29, 2006

Run on Packed Snow or Ice

So it has been snowing in Denver for 24 hours. Maybe 7 or 8 inches and it is 14 degrees Fahrenheit. Of course, cars have melted some of the snow so now there are sheets of ice mixed in with the packed snow. On such a day I typically postpone my run. But today I slapped a pair of Yaktrax on my running shoes and went out. Yaktrax are the running shoe equivalent of chains for your tires. Worked like a charm. The "Pro" version costs about $30 retail. Great technology.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Mobile Email Using Voice Channel

Berggi will offer a "Pull" email alternative to the Blackberry "push" service, a move that extends email mobility to just about any mobile phone for about $4 a month, without requiring a data plan. Consumers will be able to send and receive email on their phones from Internet services such as Yahoo, Microsoft or Google, along with popular instant-messaging services. Document attachments will not be viewable, though. U.S. consumers can sign up on the company's Web site at http://www.berggi.com.

Berggi will offer a "Pull" email alternative to the Blackberry "push" service, a move that extends email mobility to just about any mobile phone for about $4 a month, without requiring a data plan. Consumers will be able to send and receive email on their phones from Internet services such as Yahoo, Microsoft or Google, along with popular instant-messaging services. Document attachments will not be viewable, though. U.S. consumers can sign up on the company's Web site at http://www.berggi.com.Mail access already is among the most frequently used apps on smartphones, so there is reason to believe email access using the voice channel also will prove popular. Weather sites are hit by about 22 percent of mobile smartphone users. ESPN is popular with nearly 18 percent of users. Mail services provided by Google, Yahoo!, MSN and AOL are used by 65 percent of smartphone users, according to a recent survey by MobileWeb Metrix.

And, of course, email is the leading enterprise mobile application as well.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Tuesday, November 28, 2006

Mobile Data, Multiple Revenue Streams

Multiple revenue streams are better than just one. Cable companies get paid by customers, some program networks and advertisers. Newspapers get paid by subscribers and advertisers. So one obvious way communications companies can get ahead is to expand the range of revenue sources, diversifying away from exclusive reliance on end user recurring fees. Advertising and content sales are the obvious early candidates.

So far, though, this is most logically provided on a mobile smart phone, personal media player or PC, or on a telco IPTV service. Standard telephones just don't seem to be part of the picture. Which is one reason why visually-oriented IP communications sooner or later will be a standard telco offering.

So far, U.S. wireless providers, for example, have quite some way to go before new services revenues contribute anything like the revenue voice services do. All U.S. mobile revenues from sources other than voice will amount to about $5.4 billion this year. Total revenues will probably top $110 billion this year.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Monday, November 27, 2006

You Probably Already Knew This...

...but enterprises now are interested in mobiity solutions for external customer-facing and internal efficiency reasons. Still, the single most important reason for equipping employees and associates with mobility support is to respond to customer inquiries faster, say researchers at Aberdeen Communications.

...but enterprises now are interested in mobiity solutions for external customer-facing and internal efficiency reasons. Still, the single most important reason for equipping employees and associates with mobility support is to respond to customer inquiries faster, say researchers at Aberdeen Communications.

Labels:

marketing

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

U.S. VoIP Passes 8 Million Sub Mark

U.S. VoIP providers added 1.27 million net subscribers in the third quarter, boosting total sub count to 8.2 million, a year-over-year increase of 130 percent from the same quarter last year, according to Telegeography. Revenues increased a bit faster, up 146 percent year-over-year, to $732 million.

U.S. VoIP providers added 1.27 million net subscribers in the third quarter, boosting total sub count to 8.2 million, a year-over-year increase of 130 percent from the same quarter last year, according to Telegeography. Revenues increased a bit faster, up 146 percent year-over-year, to $732 million.Vonage remains the market leader with 1.95 million U.S. subs. Time Warner is second with 1.64 million subs, but its growth rate braked dramatically. Comcast continues to grow fast, adding 483,000 net subs in the quarter, passing Cablevision and claiming the number three spot.

With the notable exception of Vonage, the cable companies are where the high growth is occurring. Independents 8x8 had 169,000 total subs; SunRocket had 156,000 while Primus had an estimated 112,000, says Stephan Beckert, TeleGeography analyst.

Collectively, the cable companies had 5.1 million VoIP subs at the end of the third quarter.

TeleGeography now projects that U.S. VoIP subs will reach 9.7 million by the end of the year, representing about 8.7 percent of U.S. households, with annual revenue of $2.6 billion.

Beckert sees no cause for alarm when evaluating Time Warner's unusual results. "I think in significant part, the slowdown is due to market swaps with Comcast, all related to their dividing the spoils of the Adelphia bankruptcy," says Beckert. "Time Warner and Comcast swapped a few markets to rationalize their geographic footprints, and also dissolved partnerships in Houston and Kansas City."

As a result, Time Warner effectively "transferred" 143,000 IP voice subs to Comcast.

On the other hand, "it does appear that Time Warner's 'organic' growth is slowing, but one quarter--especially one that involved such significant asset transfers--doesn't make a trend," says Beckert. "I expect we'll need to wait another quarter or two to see if their underlying growth rate really has slowed."

Labels:

VoIP

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Friday, November 24, 2006

The Most Notable Shift...

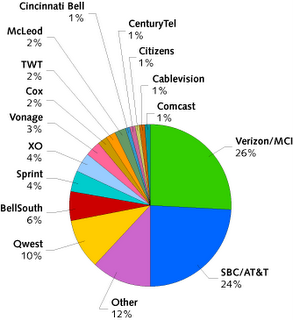

In the competitive local exchange carrier (CLEC) market of late has been the emergence of the cable companies and independent telcos and VoIP companies as providers with noticeable revenue share. In the early 1990s, it was believed that the primary competitors to the incumbent telcos would be other newly-formed telcos. Instead, it turns out to be cable companies and VoIP providers, not "CLECs with Class 5 switches."

In the competitive local exchange carrier (CLEC) market of late has been the emergence of the cable companies and independent telcos and VoIP companies as providers with noticeable revenue share. In the early 1990s, it was believed that the primary competitors to the incumbent telcos would be other newly-formed telcos. Instead, it turns out to be cable companies and VoIP providers, not "CLECs with Class 5 switches."Wireless also is an unanticipated force, to the extent that untethered and mobile communications are in some cases a direct substitute for landline services.

To be sure the term always has been a bit imprecise. Many Internet Service Providers get CLEC status just to buy access circuits at lower cost, for example, and aren't retail providers of telecom services in the classic sense. But the framework used to create the Telecom Act of 1996 clearly turns out to have come at a time when the whole communications business was about to morph in any case. It isn't simply the World Wide Web, the Internet or IP communications. Once also has the fusing of broadcasting, print, cable TV and common carrier regulatory models. At one end "network neutrality" is an impermissible interference with the right of free speech. At the other end it is a guarantee against discrimination. Neither model works well for the sort of world we are entering.

So the larger issue isn't simply "what is a CLEC?". The more important issue is "what is a broadcaster, publisher or common carrier?".

Labels:

broadband,

business model,

VoIP

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

10 Percent Ad, Video Revenues?

Vodafone CEO Arun Sarin says social networking, mobile advertising, mobile video, and other advanced applications will generate "10 percent of our revenue within three or four years." Some might consider that target an aggressive posture for a company that today generates $60 billion in annual revenues. $6 billion annually from advertising and video? But Vodafone already gets in excess of 20 percent of total revenues from data services of one sort or another. By some measures, U.S. wireless operators now get just a bit over 10 percent of total revenues from data services.

Vodafone CEO Arun Sarin says social networking, mobile advertising, mobile video, and other advanced applications will generate "10 percent of our revenue within three or four years." Some might consider that target an aggressive posture for a company that today generates $60 billion in annual revenues. $6 billion annually from advertising and video? But Vodafone already gets in excess of 20 percent of total revenues from data services of one sort or another. By some measures, U.S. wireless operators now get just a bit over 10 percent of total revenues from data services.During the first half of 2006, wireless data revenues have been on the rise in North America, Asian and Europe. Japan led the way with approximately $10 billion in wireless data service revenues for the first half of 2006. The U.S. market and China followed with approximately $7 billon and $5.5 billion in data revenues.

The most successful carrier worldwide in terms of total wireless data revenue for the first six months of 2006 was NTT DoCoMo with over $5.1B in data revenues.

Labels:

business model,

mobile

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Subscribe to:

Posts (Atom)

More Computation, Not Data Center Energy Consumption is the Real Issue

Many observers raise key concerns about power consumption of data centers in the era of artificial intelligence. According to a study by t...

-

We have all repeatedly seen comparisons of equity value of hyperscale app providers compared to the value of connectivity providers, which s...

-

It really is surprising how often a Pareto distribution--the “80/20 rule--appears in business life, or in life, generally. Basically, the...

-

Who gets to use spectrum, and concerns about interference from other users, now appears to be an issue for Google’s Project Loon in India. ...