Forrester Research suggests telcos will have moderate IPTV success at first. "After a slow ramp-up, we expect one in four European broadband subscribers to have IPTV within 10 years." Which doesn't make IPTV a slam dunk, financially. Forrester assumes IPTV is a "mature" market, so that telcos will have to undercut pricing offered by cable and satellite competitors. So "we expect the average incumbent to get only €11.24 in net annual IPTV revenues per broadband user in year 10," says Lars Godell, Forrester analyst.

Forrester Research suggests telcos will have moderate IPTV success at first. "After a slow ramp-up, we expect one in four European broadband subscribers to have IPTV within 10 years." Which doesn't make IPTV a slam dunk, financially. Forrester assumes IPTV is a "mature" market, so that telcos will have to undercut pricing offered by cable and satellite competitors. So "we expect the average incumbent to get only €11.24 in net annual IPTV revenues per broadband user in year 10," says Lars Godell, Forrester analyst.The good news is that average loop lengths in dense Western Europe are short enough that Digital Subscriber Line probably will work for many of the video services and applications European operators will want to offer. Many North American providers do not have this luxury and will have to think long and hard about a full rebuild using fiber-to-customer platforms. That has some investors shorting Verizon and going long on at&t, since Verizon is biting the bullet and building a fiber-to-home network, while at&t is taking the more cautious tack of building a fiber-to-node network that mimics in many ways the design of a cable TV hybrid fiber coax network.

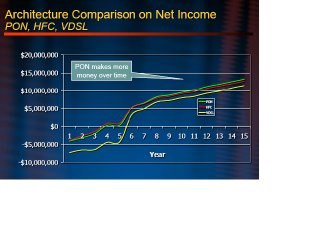

And there's at least some thinking that net income for the expected range of new applications won't vary all that much between a FTTH and FTTN architecture. That, at least, is what Corning argues for a hypothetical community of about 30,000 customers. So why choose the FTTH over the FTTN network? Operating costs, perhaps. Most observers expect greater operating cost savings with an all-fiber plant.

Density, perhaps. Verizon's loops are shorter, on average, than at&t's, so the relative cost of going FTTH arguably are lower than would be the case for at&t.

So far this year, Verizon's FiOS network has knocked 30 cents a share off earnings. But there's at least some thinking the penalty will be zero next year. Christopher Larsen, Credit Suisse analyst is among those who think the FiOS build soon will be earnings neutral.

“We think investors should take a 2nd look at Verizon, as 2007 could be a tipping point for the company to begin reporting year-over-year earnings growth,” he says. “Management has previously commented that it expects 2007 FiOS dilution to be flat compared to 2006," says Larsen. "However, because each quarter in 2006 has seen an increase in FiOS dilution, mathematically there needs to be quarterly, sequential declines in FiOS dilution in 2007. All else equal, this will result in quarterly earnings accretion.”

Of course, there are two opposed conclusions one might draw from the fiber rebuild: It's a mistake because an adequate return can't be earned or that it's a necessary step that must be taken to preserve the value of Verizon's existing business, while creating the platform for tomorrow's business.

We might simply note that Verizon's total access line count fell 7.5% from last year, compared to an industry average of six percent loss. But Verizon also saw a 9.8 percent year-over-year decline in residential lines. So any telecom executive looking at such trends has tough choices to make. Most fundamentally, invest to grow or harvest a declining business while preparing an escape plan. Unfortunately, no telecom executive can make such decisions without considering regulators. And one has to assume regulators will not let Verizon walk away from its core universal service business.

And if Verizon cannot harvest and walk away, it has to reinvest. To be sure, the payoff will not come solely from IPTV and other new service revenues. Operating costs and reduced customer attrition are key parts of the overall payback thesis.

To be sure, Verizon could have chosen the FTTN route. But the incremental capital cost for a full-on fiber rebuild was deemed small enough to justify the full replacement route. Sometimes one is faced with several choices, none of which is really "good." So one chooses from among a set of "least bad" alternatives. It doesn't look as though any telecom executives will be seen as heroes just because they got into the IPTV business. If "all they are able to do" is preserve the existing financial basics of the business, that will ultimately be seen as worthy enough. Because the alternative could easily be a business that generates half the current revenue.

No comments:

Post a Comment