Tuesday, February 16, 2010

Skype on Verizon Wireless Will Use TDM Network

It will also be available on the Motorola Droid, the HTC Droid Eris and the Motorola Devour.

Subscribers will be able to make and receive unlimited and free Skype-to-Skype calls, and use Skype Out to make international calls to any phone at Skype's standard rates. So, the client will be especially useful for users with family abroad, according to Verizon Wireless.

The calls will be carried over Verizon Wireless' voice network, and won't impact overall network quality, according to John Stratton, executive vice president and chief marketing officer at Verizon Wireless. That's probably the most-significant element of the plan.

The Skype client could well help Verizon Wireless set itself apart from other U.S. mobile operators in terms of the dependability of audio quality.

What "you'll see from Verizon, you won't see from anyone else," Stratton says.

So there's your plot twist: Skype, designed to circumvent the old TDM voice network, now will use the TDM network to ensure voice quality on global calls to non-Skype telephone numbers.

It's also a clever way to make better use of an existing asset to provide better user experience and differentiation in the market.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Unlimited Skype Calling on Verizon Smartphones in March 2010

From right to left, John Stratton, executive vice president and chief marketing officer for Verizon Wireless, and Josh Silverman, Skype's CEO, announcing their strategic relationship to bring Skype to Verizon Wireless smartphones during a press conference at the 2010 Mobile World Congress in Barcelona, Spain.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Thursday, December 3, 2009

Big Churn Potential in Wireless Business?

Nearly half of readers surveyed by Consumer Reports are unhappy with their cell phone service. Nearly two thirds had at least one major complaint about their cell phone carrier, with about 20 percent naming price as the chief irritant.

But here's the caveat. Most surveys taken over the last couple of decades suggested there was high dissatisfaction with cable TV service, for example. And, to be sure, consumers began to churn away as first satellite and now telco video alternatives are available. Until satellite became a viable option, though, high dissatisfaction was not accompanied by high churn.

The U.S. mobile industry, though, is among the most competitive in the world, so consumers do have lots of choices. So one wonders why more do not act as theory suggests they will, which is that unhappiness will lead them to try another provider. Maybe they are churning, and maybe their continued unhappiness means the new carriers aren't demonstrably and clear better than the carriers they left.

Apparently, neither better coverage nor new smartphones have been enough to change consumer satisfaction all that much, the report suggests, with the salient exception of the Apple iPhone. So will the latent unhappiness translate into higher churn? It's harder to decipher than one might initially think.

If consumers believe all the carriers have some gaps in coverage, have roughly similar or somewhat distinct retail offers, have adequate bandwidth and availability, and all of them will experience congestion during rush hour, consumers might not be extremely motivated to change providers, even if they are unhappy to some degree. The bad news for service providers might be that network quality and reputation have some effect, but not overwhelming effect on churn behavior.

But handsets are a huge motivator of change, it appears. About 38 percent of consumers who switched phones in the past two years did so to get the phone they wanted.

More than 27 percent went shopping with a specific phone in mind, in fact. About 98 percent of iPhone users said they would purchase the phone again. To point out the obvious, some people might be really happy about their handsets, and simply put up with their service providers.

But there is another way to look at matters. If half of consumers are unahppy to some degree, and that leads them to churn, what would one expect to see? At churn rates about 1.5 percent a month,. one would expect roughly 18 percent annual churn. That would roughly equate to 100 percent churn about every five years or so.

If one assumes only half of consumers are motivated to churn, existing churn rates easily could amount to churn of half the entire customer base about every two and a half years.

So maybe those unhappy consumers are in fact deserting their current providers. The reason they remain unhappy? One explanation could be that none of the providers they are trying are demonstrably better than the carriers they left. One often encounters consumers who say "we've tried them all, and all of them have some problems."

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Tuesday, December 1, 2009

Verizon Ranked First in Consumer Reports’ "Best Wireless" Service Survey

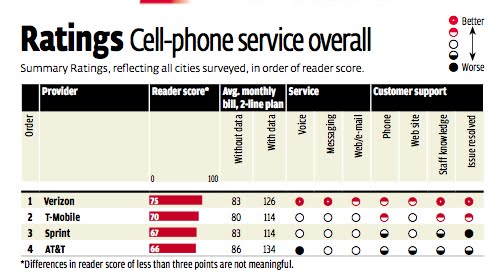

Verizon received an overall score of 75, while T-Mobile USA got 70, Sprint got a score of 67 and AT&T got a score of 66. Consumer Reports itself says that differences of less than three points are not meaningful, so Sprint and AT&T essentially got the same score. And just three points separate T-Mobile from both Sprint and AT&T.

Another way of looking at matters is that while Verizon got scores noticeably different from the other three providers, and while T-Mobile USA was a clear number two, Sprint and AT&T were fairly close.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Monday, November 9, 2009

Mobile is Not "Too Big to Fail"

We as a nation have made this sort of mistake before, trying to bring more competition to the landline voice business precisely as that business was entering a serious period of decline. Mobile providers now are in the same predicament. No matter how big they are, their base business is going to go away, for the the most part, meaning every single cent of revenue they now earn will have to be replaced.

If you think the telecom business is in great shape you don't work in the business. Granted U.S. wireless data revenues grew five percent quarter over quarter in the third quarter of 2009 and 27 percent year over year, to reach $11.3 billion by the end of the third quarter of 2009, according to analyst Chetan Sharma.

But overall service provider average revenue per user decreased by 14 cents during the third quarter. Average voice ARPU declined by 57 cents per user while the average data ARPU grew by 43 cents.

The point is simply that the communications business already is in the midst of a necessary transition from its traditional revenue models to new models, none of which are assured. It is going to take a great deal of very-hard work to pull this off and while consumer displeasure with such providers is understandable at times, they are not "too big to fail."

Most of that gain in data revenue was realized by Verizon and AT&T, which between them accounted for 80 percent of the increase in data revenues in the third quarter. AT&T and Verizon also now account for 68 percent of the market data services revenues and 61.5 percent of the subscriber base, Sharma says.

AT&T experienced the most growth with a six-percent increase quarter over quarter, followed by Verizon and Sprint with five percent revenue growth each.

Overall mobile service provider revenue grew about two percent year over year. On an annualized basis, data represents about 28 percent of total mobile service provider revenues.

Analyst Chetan Sharma estimates that by end of 2009, U.S. mobile data traffic is likely to exceed 400 petabytes, up 193 percent from 2008.

Smartphones also now represent 25 percent of U.S. devices in service, says Sharma, while mobile penetration stands at about 91 percent.

The average number of text messages used in the U.S. market now averages almost 568 messages per subscriber per month.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Friday, November 6, 2009

Verizon Droid Launches Today

Verizon Wireless has launched two Android-powered smartphones Nov. 6, 2009. At the top, the much-anticipated Droid retails at $199.99 and is the first Android smartphone to feature the version 2.0 platform.

But Verizon also launched a second Droid-branded device, called Eris and manufactured by HTC. Eris will retail at $99.99.

A successful launch is regarded by many as critical to Motorola's future success, as the company attempts to regain market share.

Verizon also launched a number of other handsets, including the new BlackBerry Curve 8530 (already offered by Sprint), a new LG Chocolate device, and Samsung's Push-To-Talk Convoy.

Droid will the most-important launch, for several reasons. The success of its Android phones is crucial for Motorola if it is to climb back into the top ranks of handset manufacturers. It would be fair at this point to say Android is a "do or die" move for Motorola.

For HTC, the device is less important than the fact that HTC now is trying to build its own brand name, growing beyond its contract manufacturing roots.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Thursday, March 6, 2008

T-Mobile Handles Churn

Though it doesn't appear T-Mobile USA will be changing its market share position in the near term, it appears to be doing a good job on the churn front.

It added 951,000 net new customers added in the fourth quarter of 2007, up from 901,000 in the fourth quarter of 2006. That's important because "net" adds are what one has left after deducting the customers who churned away in any given time period. The other data point is that, in its most-recent quarter, T-Mobile's churn dropped to 1.8 percent, down from 2.1 percent in the fourth quarter of 2006.'

That is notable because T-Mobile has a large percentage of contracts that are of the one-year variey, not the the two-year contracts that increasingly are the norm in the postpaid segment of the market. It also is notable because there is some evidence T-Mobile customers are more active than customers of some of the other leading mobile carriers in investigating alternatives.

"T-Mobile customers are the most active in checking out competitive products and services," says Compete.com analyst Jeff Hull.

"This is partly because they are a younger, more active subscriber base, and partly because of the legacy of one-year contracts at T-Mobile," says Hull.

"If you look at an upstart like Helio, four percent of their site traffic is from existing T-Mobile customers, with two percent from both AT&T and Verizon Wireless, and Sprint/Nextel customers seemingly uninterested in checking out the MVNO."

T-Mobile customers also are over-represented at the Boost Mobile site, another youth oriented brand that is successfully attracting T-Mobile user interest. At the margin, and it might only be at the margin, there does seem to be a difference between customer bases at T-Mobile and Sprint or Nextel, for example.

Given the apparent high "shopping" and "comparison" behavior, the lower churn is an accomplishment.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Thursday, February 28, 2008

Sprint Unlimited Plan: Unlimited Everything

Sprint Nextel now has responded with a new “Simply Everything” plan offering not just talk, not just unlimited texting, but unlimited Web surfing, email access, GPS navigation services, DirectConnect, GroupConnect, Sprint TV and Sprint music.

The $99.99 Simply Everything plan is available to customers on both Sprint's CDMA and iDEN networks, and goes way beyond T-Mobile's comparable plan that includes unlimited voice and texting.

Sprint has thrown in the kitchen sink.

Existing Sprint customers can switch to the Simply Everything plan without extending their current contract either by contacting Sprint customer service or by stopping by any participating Sprint retail location.

New line activations require a two-year agreement.

For families, Simply Everything includes an incremental $5 discount for each incremental line, up to five lines on the same bill. For example, two lines would amount to $194.98 ($99.99 + $94.99); a third line would cost an additional $89.99. This is in sharp contrast to the multi-line unlimited rates offered by some competitors. The Sprint plan offers significant savings the more lines a customer adds.

Observers were wondering whether Sprint would go nuclear. This move is more "nuclear" that offering an unlimited voice plan for lower prices than the now-industry-standard $100 a month. Sure, Sprint Nextel would have frightened a lot of people if it had gone with an $60, or even an $80 unlimited voice plan.

What it has done, at least for users who really like several of the enhanced features, is create a package so compelling lots of people are going to upgrade lower-priced plans to get them. Don't worry about some high-end voice plans being downgraded.

The big issue here is a potentially significant upgrade of lots of other plans, to get the huge palatte of upgraded features. It is the sort of move one would expect from Dan Hesse.

For users who don't mind the lack of subscriber information modules (SIMs), the plan offers more value than competing plans offered by T-Mobile, which bundles unlimited voice and text messaging. Both at&t Wireless and Verizon Wireless plans provide unlimited voice for $100 a month.

For users who simply want unlimited voice, Sprint will offer a $90 voice-only plan. So far, the feared price war has not broken out.

As for why unlimited plans might not damage wireless carrier revenue, take a look at what Sprint has been finding with its Boost mobile prepaid business. After launching unlimited plans, traditional prepaid growth slowed, but unlimited plans more than made up for the slower growth for the traditional plans.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Monday, February 25, 2008

Verizon to Hold "Open Network" Conference for Developers

The conference will discuss the certification of devices that users can use on the Verizon network, without having to buy a device directly from Verizon.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Thursday, February 21, 2008

TA 96, Digital One Rate: Which was More Important?

Though the subscriber stats don't paint the picture quite so clearly, wireless minutes of use exploded after 1998, when AT&T Wireless Services introduced "Digital One Rate," a new plan that eliminated the difference between local and long distance services, and used a "bucket" of minutes packaging approach.

Though the subscriber stats don't paint the picture quite so clearly, wireless minutes of use exploded after 1998, when AT&T Wireless Services introduced "Digital One Rate," a new plan that eliminated the difference between local and long distance services, and used a "bucket" of minutes packaging approach.U.S. competitive local exchange carrier lines in service, on the other other hand, ramped up through about 2004, and then began to decline, even as more telephone and cable companies themselves became "CLECs" for purposes of providing services outside their historic service territories.

In 1998, when Digital One Rate was introduced, mobile subscribers numbered about 69 million. By the middle of 2007, mobile subscribers numbered more than 243 million. At this point, the time is long past when wired lines exceeded wireless lines. These days, wireless accounts far outnumber wired accounts.

In many respects, and without belittling the Telecommunications Act of 1996, Digital One Rate has had far more impact than anything that has happened on the wired side of the business.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Verizon Has 0.5 Percent Exposure to Unlimited Calling Plan Downgrades

Verizon Communications has 305,000 single-line Nationwide Unlimited Anytime customers with monthly voice price plans in excess of $99.99 per month. That's important as the investment community now is nervous the introduction of new plans costs about $100 a month will cause those sorts of customers, paying $125 to $135 a month, will downgrade to the $100 a month plan.

Keep in mind that customers paying more than $100 a month for a single line represent just 0.5 percent of Verizon's customer base.

Verizon believes that the reduced revenue from the $100+ customers will be more than offset by other customers on lower-priced plans moving up to the $100 a month plans. The exposure to the downside isn't that high--possibly $109 million or so.

On the other hand, assume just 300,000 customers upgrade their plans to the unlimited plan, out of the base of total 65.7 million users, and that the incremental revenue is $30 a month.

Despite some momentary imbalance, it seems more logical that the upgraders outnumber the downgraders by as much as two orders of magnitude.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Monday, February 18, 2008

Verizon Wireless to Launch Unlimited Calling?

Other plans include a $120 plan with unlimited texting and voice; $140 for plans that add email and VCast content services. For $150 users can get unlimited data, voice and texting.

A $170 plan adds international data capabilities. A $200 family plan reportedly will be limited to additional two lines, priced at $100 per additional line.

It appears there will be no caps on data sent or received.

In one sense the new pricing plans represent an attempt to change the nature of mobile service pricing, making pricing a lot more like VoIP, or wired calling with unlimited, flat rate long distance within the continental United States.

And that might be the thing to watch: not so much a redefinition of mobile pricing as a new rationale for going "wireless only." Assuming a landline costs in the neighborhood of $50 a month, a user might rationally conclude that he or she is no worse off, and marginally better off, ditching a landline and using the mobile for all calling.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Monday, February 11, 2008

Will Sprint Unleash Nukes?

So the issue is whether Sprint will "go nuclear," unleashing some sort of market-disrupting attack it expects its competitors will not want to match. Its a risky gambit, to be sure. AT&T completely changed the basic way mobile voice minutes of use are packaged when it launched "Digital One Rate."

But the tactic has not had long-term differentiating value because all the other major carriers simply shifted their packaging to match. So Sprint has to find a proposition that is startling and compelling to end users, but not appetizing for the more dominant providers to mimic quickly.

If the attempt is to "drive sales through the roof," nothing short of a disruptive move will work. Some suggest "unlimited calling" is one such tactic. Some smaller wireless providers such as Leap Wireless have prospered by offering unlimited local mobile calling. In so doing Leap and others have carved out a definable niche in the "wireline replacement," value calling and ethnic market segments.

There is some thinking that unlimited calling on at least a continental basis might be the same sort of market-shaking move, eliminating the "what is the right bucket size?" decision every consumer has to make, and transforming what is still a service sold on the basis of "scarcity" into a service whose premise is "abundance."

In some sense, Sprint CEO Dan Hesse actually has to hope that such an assault really would drive call volumes through the roof. Because if Sprint can do so, and its relatively generous spectrum will support the additional traffic, some other key competitors--especially Verizon and at&t--might not be able to quickly turn up additional bandwidth to match the offer.

And that's the other part of the equation. The offer must shake up user perceptions of value compared to price, as did Digital One Rate. But the offer must challenge Sprint's competitors enough that they will not immediately respond.

And at some level this is a nuclear strategy in an operational sense: if Sprint moves to provoke a non-linear increase in voice usage, can it handle the load? More important, can Sprint's competitors handle increases of the same magnitude if they decide to respond to the offer.

Likewise, there is the financial angle. If competitors match Sprint's offer, what is the level of damage they sustain in average revenue per minute of use, or average revenue per user? How does Sprint price and package so a direct competitive response is too painful to contemplate?

If Verizon and at&t can't match the offer without losing more than they gain, they won't match the offer. And if they won't, Sprint gains the distinctive positioning it seeks.

"Going nuclear" is going to be dangerous. But the only thing more dangerous at this point is thinking Sprint somehow can "creep" its way to success. The issue is where "unlimited calling" is, in itself, destabilizing enough to achieve what Sprint wants.

My sense is that it would not. Leap Wireless already offers a plan that is for most users a "national unlimited calling" plan, for about $50 a month. But there are other angles.

Unlimited texting or Web access might be more attractive. If Sprint really wants to disrupt the market, it can do something about texting plans.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Wednesday, February 6, 2008

So Maybe Verizon is Bidding Against Itself

In this scenario Verizon would simply have to ensure that its regional bids were high enough to top the amount any other player submitted for the entire national spectrum. Clever.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Monday, January 28, 2008

SureWest Sells Wireless Assets

SureWest, which operates triple play services in Roseville, Calif. and Kansas City, seems to have decided that mass market wireless is a scale business inefficiently operated by a purely local operator. Also, now that SureWest operates in more than one geography, it is unable to offer the same set of services in Kansas City that it now offers in Roseville, complicating the firm's marketing efforts.

Necessity often is the mother of invention, and SureWest seems now to be betting its future on broadband services, not wireless and broadband. In similar fashion, Qwest has decided to take a similar posture, having outsourced its wireless offerings to Sprint and its video entertainment to DirecTV.

It's worth keeping in mind: business strategies appropriate for scale players do not often make as much sense--if sense at all--for niche players. It is less a matter of what one would like to do and more a matter of what one practically can do.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Verizon: 2.7% Consumer Wireline Revenue Gain

In football, they'd call his "tough yards on the ground." Verizon's four percent increase in fourth-quarter profit came primarily from the mobile business, as traditional land-line metrics continue to drift lower, despite gains in FiOS broadband access, Digital Subscriber Line sales and FiOS TV services.

Still, quarterly revenue in the consumer segment was up 2.7 percent, a significant achievement against a backdrop of share losses in the legacy consumer wireline voice business.

Verizon added about two million net wireless customers in the quarter, offsetting wireless declines of about 616,000 lines. For the full year 2007, Verizon lost about three million residential lines, or 10.6 percent of total, while business lines dropped 3.7 percent.

In essence, Verizon is getting higher average revenue per unit in its wireline business, even as the total number of customers is dropping. If you wanted any proof about the revenue impact product bundling has, Verizon is providing the evidence.Though there are important churn reduction effects, the primary reason dual play, triple play and quadruple play offers work is that they raise ARPU dramatically, allowing service providers to build businesses based on scope (selling more things to customers) rather than scale (selling the same thing to more customers).

The company added 245,000 net FiOS broadband access customers as well as another 226,000 net FiOS TV customers in the most recent quarter.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Wednesday, January 23, 2008

Wireless Open Access Watch

With a change of presidential administration, and the high possibility that the White House will be occupied by a Democrat, all bets are off where it comes to the composition, leadership and therefore direction of Federal Communications Commission policy. But it is fair to say that a more heavily regulated approach is likely if Democrats win the White House. Incumbent tier one U.S. telcos won't like that. For other reasons, cable industry leaders will be happy as well. Competitive providers might well think their chances improve as well.

So it might be all that significant that Commissioner Michael Copps, a Democratic member of the FCC, seems to want to give incumbent wireless providers a bit of time to make good on their recent pledges to move towards more open networks, allowing any devices or applications compliant with their networks to be used.

That's an obvious counterweight to any thinking by an eventual owner of a new national broadband network that construction and activation of that similarly open network should be built as slowly as legally possible, essentially "warehousing" spectrum as long as possible. The motivation obviously is to extend the life of current revenue models as long as possible.

Pressure to keep those promises about openness on the Verizon and at&t Wireless networks will remain high if Democrats win the White House. In fact, pressure to open up wireless networks more than before is likely unstoppable if Republicans retain the White House as well. The 700-MHz auction rules about openness were pushed through by a Republican FCC chairman and the market seems to be shifting inevitably in the direction of open devices because of the market force exerted by the Apple iPhone and Google, in any case.

Dominant wireless carriers really would prefer not to deal with more openness. But it appears they no longer have a choice. That's going to be good for some new handset providers, application developers and end users, both consumer and business.Bidden or unbidden, openness is coming.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Friday, January 18, 2008

Sprint Loses Customers

It's not wonder Sprint is axing 4,000 employees, closing stores and halting distribution agreements with some partners. In the fourth quarter Sprint Nextel reported yet another quarter in which it lost more customers than it gained.

True, Sprint reported a "net gain" of 500,000 subscribers through wholesale channels, growth of 256,000 Boost Unlimited users and net additions of 20,000 subscribers within affiliate channels.

Bu those gains were offset by "net losses" of 683,000 post-paid subscribers and 202,000 traditional pre-paid users. In other words, Sprint lost 885,000 customers in the quarter and gained 776,000.

In other words, Sprint had a net loss of 109,000 customers.

In the churn area, where Sprint has arguably its single greatest challenge, post-paid churn (customers billed monthly) was 2.3 percent, slightly better performance than the previous quarter, and within striking distance of the slightly less than two percent range Verizon and at&t now have.

Unfortunately, Sprint Nextel's rate of involuntary churn, where it has to cut off service to a customer, rose over the prior quarter.

At the end of 2007, Sprint Nextel served a total subscriber base of 53.8 million subscribers including 40.8 million post-paid, 4.1 million traditional pre-paid, 500,000 Boost Unlimited, 7.7 million wholesale and 850,000 subscribers through affiliates.

As this chart from Bear Stearns shows, churn creates a couple problems. First, it directly reduces the number of revenue-generating units a company has. Secondly, it almost always raises the cost of acquiring new customers as well. The former hits revenue, the latter costs.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Thursday, January 10, 2008

What's Good for Suppliers Also Good for You?

If you casually stroll past displays of PCs on the shelves of any electronics retailer, you'll see at least a few notebooks preconfigured for one brand of wireless data card access. Now, in one sense this is the same strategy used when software comes preloaded on your brand-new machine. Dial-up Internet access services, anti-virus, firewall and security, media players, browsers, games and so forth provide examples.

In the same vein, there has been an argument that the notebook screen represents real estate that a provider's icon must occupy to get more usage or attention. Up to a point there's a clear logic to such thinking.

But there's some point at which the strategy breaks down. Lots of machines sport RJ-11 connections for dial-up Internet access. I don't know how many of you think that's a "feature" instead of a "bug" anymore, but it's clearly not an important feature for many.

The point is that USB and Ethernet ports, like RJ-11 ports, are general purpose computing capabilities. They don't lock anybody into a continuing commercial relationship with any single provider. The user has choice.

Providing that a new notebook has sufficient hard disk capacity, most users probably just ignore all that preloaded software and most of the offers. Norton might disagree, of course, and that might be one of the salient exceptions. Others of us have to spend some time removing all the unwanted software from the machine or at least disabling their ability to start up automatically.

Suppliers might think otherwise, but the incremental cost of preconfiguring a PC for one flavor of 3G data card access probably outweighs everything but the revenue the manufacturer gets from the service provider for preloading the software.

Most people don't seem to have any problem buying a card when they want to use wireless broadband services. To be sure, there might be some instances where a particular buyer of a particular model actually wants to buy wireless broadband from the precise supplier whose access software is preloaded on that machine. But not very often.

Perhaps an argument can be made that the revenue gotten by the PC manufacturer from such deals helps in some small way to control the overall cost of the device. In that sense, there is a consumer benefit. So maybe this is the PC equivalent of advertising. Users might not "like" it, or "want it," but it might help lower the cost of acquiring and using something else (their PC).

Still, it's hard to imagine that preloading broadband wireless for a single provider can be done on a wide-enough scale to produce incrementally-significant customer additions.

The way this could work, though, is to do the reverse: sell a cheap device that actually is configured to use one broadband access provider. Consumers can do the math. If the value of getting a general-purpose computing device is low enough, and the price is lock in to one broadband access supplier, some buyers will do so.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Friday, December 14, 2007

Windows Vs. BlackBerry in Enterprise?

A recent poll of enterprise wireless subscribers found 84 percent of respondents who do use smart phones, use a BlackBerry, according to InfoTech. Palm Treo and HTC devices trail and Microsoft OS devices, though growing fast, appear to fare no better than fourth.

But Windows Mobile finally is making inroads. "As such, the world essentially will come down to RIM vs. Microsoft in the enterprise market," says InfoTech.

More than 70 percent of respondents say email is the most important function of a smartphone, followed by Internet Wi-Fi access at 12 percent, the survey found.

More than 80 percent of respondents indicated they also use text messaging.

About 49 percent of survey respondents across all enterprise sizes said they were using wireless data card, with nearly 38 percent reporting a preference for the Verizon Wireless network.

Sprint the second-largest base at 24 percent. And speed apparently matters. Some 81 percent of respondents would switch operators to get faster speeds.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

When Robotaxis Will Displace Auto Rentals

Inevitably, people are going to wonder when, and under what circumstances, robotaxis are going to displace auto rentals, just as there was s...

-

We have all repeatedly seen comparisons of equity value of hyperscale app providers compared to the value of connectivity providers, which s...

-

It really is surprising how often a Pareto distribution--the “80/20 rule--appears in business life, or in life, generally. Basically, the...

-

One recurring issue with forecasts of multi-access edge computing is that it is easier to make predictions about cost than revenue and infra...