T-Mobile USA says it expects to have 100 metropolitan areas in the United States covered by its upgraded high-speed wireless network, which should operate up to about 21 Mbps or 22 Mbps in the downstream direction, by the end of 2010.

The new HSPA-Plus network is a "3G" technology that operates at speeds very comparable to 4G alternatives, and might very well give T-Mobile the fastest national network, for at least a while, by the end of the year.

HSPA Plus will cover roughly 180 million Americans by the end of the year, T-Mobile USA says. The technology is already live in some regions, including the New York metropolitan area, the Washington DC suburbs, and will be coming soon to Los Angeles.

Oddly, many observers continue to insist there is "no competition" in the U.S. broadband market. Aside from cable operators and telcos, there now are going to be four mobile broadband networks in national operation by the end of the year, offering speeds equivalent to, or faster, than is available in many markets from terrestrial providers.

Showing posts with label TMobile. Show all posts

Showing posts with label TMobile. Show all posts

Tuesday, March 23, 2010

T-Mobile USA's New Broadband Network Will Cover 180 Million, Offer Speeds of 21 Mbps or 22 Mbps

Labels:

att,

mobile broadband,

TMobile,

Verizon

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Tuesday, March 2, 2010

AT&T Will Use Yahoo as Default Search Engine on Motorola's Android-Based Backflip

AT&T apparently will launch the Motorola Backflip, its first Android device, pre-loaded with Yahoo, not Google, as the default search engine. The move is one more example of the growing complexity of value chains in the communications business, where access provider, handset manufacturer and application providers have distinct interests.

In a less-direct sense, the moves also are evidence that the days of the old Internet have changed. These days, there are lots of business deals and arrangements that shape user access to experiences on the Internet and World Wide Web, and which demonstrate that there are numerous "gatekeeper" roles now being played by a variety of participants.

Other Google apps, such as Gmail, Google Maps, Google Talk, Android Market and YouTube, remain.

It’s unclear if T-Mobile will ever have to do the same. It’s been about two years since T-Mobile USA launched its first Google phone, and it has yet to replace Google’s search on Android devces with Yahoo, despite having a similar exclusive partnership with Yahoo.

Last year, Microsoft got exclusive right to manage mobile search and advertising on Verizon’s handsets.

While Bing has been installed on several phones, including BlackBerry devices, Verizon’s Motorola Droid and HTC Droid Eris, come pre-loaded with Google’s search as the default.

Default settings still are seen as valuable because many users do not customize their application profiles on smartphones.

New York Times story

In a less-direct sense, the moves also are evidence that the days of the old Internet have changed. These days, there are lots of business deals and arrangements that shape user access to experiences on the Internet and World Wide Web, and which demonstrate that there are numerous "gatekeeper" roles now being played by a variety of participants.

Other Google apps, such as Gmail, Google Maps, Google Talk, Android Market and YouTube, remain.

It’s unclear if T-Mobile will ever have to do the same. It’s been about two years since T-Mobile USA launched its first Google phone, and it has yet to replace Google’s search on Android devces with Yahoo, despite having a similar exclusive partnership with Yahoo.

Last year, Microsoft got exclusive right to manage mobile search and advertising on Verizon’s handsets.

While Bing has been installed on several phones, including BlackBerry devices, Verizon’s Motorola Droid and HTC Droid Eris, come pre-loaded with Google’s search as the default.

Default settings still are seen as valuable because many users do not customize their application profiles on smartphones.

New York Times story

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Saturday, February 27, 2010

Nexus One for Verizon

The Google-specified Nexus One, released on T-Mobile USA's network in January, will launch on March 23, 2010 on Verizon Wireless, a source says.

Verizon will introduce the Nexus One on the day the International CTIA wireless show begins, Neowin reports.

Pricing and terms of use are not known but likely will be "competitive" with T-Mobile's positioning.

The Nexus One is available for T-Mobile on an unlocked basis for a price of $529. Consumers can also order the phone through T-Mobile for $179 with a two-year contract.

Verizon will introduce the Nexus One on the day the International CTIA wireless show begins, Neowin reports.

Pricing and terms of use are not known but likely will be "competitive" with T-Mobile's positioning.

The Nexus One is available for T-Mobile on an unlocked basis for a price of $529. Consumers can also order the phone through T-Mobile for $179 with a two-year contract.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Monday, January 4, 2010

Google Nexus One Unveiling Jan. 5, 2010?

Google seems to be gearing up for a Jan. 5, 2010 unveiling of its Nexus One smartphone. The somewhat controversial move might be seen as a misguided effort that will undercut Google's effort to support broad adoption of its Android operating system by all the major service providers.

Worse still, in the worst-case scenario, Google is aiming to become a service provider in its own right. That seems highly unlikely. That really would strain relationships with its carrier partners. Nor does Google seem to be angling to become a hardware supplier in the same way that Apple is.

True, it seems to be fostering development of handsets. But even a Google-branded device might be seen as a way of pointing out what it thinks could be done.

One suspects that the unveiling is more of a demonstration project, intended to showcase what might be done with the Android operating system when paired with mobile hardware. One reason for that belief is that unlocked smartphone devices are expensive enough that few actually are sold in the U.S. market.

More seriously, T-Mobile is rumored to be readying a contract-subsidized Nexus One deal, which would put the out-of-pocket cost of the device within typical ranges for some other leading smartphone models. The typical model is a two-year contract in exchange for a device subsidy, and that is what most observers expect to see.

That is a fairly well established business model, giving T-Mobile a period of device exclusivity before it also is made available to other service providers.

The other angle is that if Google were really serious about becoming a player in either the device or service provider business, it likely would have readied deals in multiple countries.

The key thing is whether the user experience winds up being something users clearly can perceive as offering a "delightful" experience. That would seem to be the point. Whether Google can deliver remains to be seen.

Worse still, in the worst-case scenario, Google is aiming to become a service provider in its own right. That seems highly unlikely. That really would strain relationships with its carrier partners. Nor does Google seem to be angling to become a hardware supplier in the same way that Apple is.

True, it seems to be fostering development of handsets. But even a Google-branded device might be seen as a way of pointing out what it thinks could be done.

One suspects that the unveiling is more of a demonstration project, intended to showcase what might be done with the Android operating system when paired with mobile hardware. One reason for that belief is that unlocked smartphone devices are expensive enough that few actually are sold in the U.S. market.

More seriously, T-Mobile is rumored to be readying a contract-subsidized Nexus One deal, which would put the out-of-pocket cost of the device within typical ranges for some other leading smartphone models. The typical model is a two-year contract in exchange for a device subsidy, and that is what most observers expect to see.

That is a fairly well established business model, giving T-Mobile a period of device exclusivity before it also is made available to other service providers.

The other angle is that if Google were really serious about becoming a player in either the device or service provider business, it likely would have readied deals in multiple countries.

The key thing is whether the user experience winds up being something users clearly can perceive as offering a "delightful" experience. That would seem to be the point. Whether Google can deliver remains to be seen.

Labels:

Android,

Google Phone,

Nexus One,

TMobile

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Thursday, December 3, 2009

Big Churn Potential in Wireless Business?

Despite the fact that AT&T and Verizon have low churn rates, while Sprint and T-Mobile have churn higher than they would like, the potential for huge share shifts remains latent, if consumer satisfaction bears any meaningful relationship to actual churn behavior.

Nearly half of readers surveyed by Consumer Reports are unhappy with their cell phone service. Nearly two thirds had at least one major complaint about their cell phone carrier, with about 20 percent naming price as the chief irritant.

But here's the caveat. Most surveys taken over the last couple of decades suggested there was high dissatisfaction with cable TV service, for example. And, to be sure, consumers began to churn away as first satellite and now telco video alternatives are available. Until satellite became a viable option, though, high dissatisfaction was not accompanied by high churn.

The U.S. mobile industry, though, is among the most competitive in the world, so consumers do have lots of choices. So one wonders why more do not act as theory suggests they will, which is that unhappiness will lead them to try another provider. Maybe they are churning, and maybe their continued unhappiness means the new carriers aren't demonstrably and clear better than the carriers they left.

Apparently, neither better coverage nor new smartphones have been enough to change consumer satisfaction all that much, the report suggests, with the salient exception of the Apple iPhone. So will the latent unhappiness translate into higher churn? It's harder to decipher than one might initially think.

If consumers believe all the carriers have some gaps in coverage, have roughly similar or somewhat distinct retail offers, have adequate bandwidth and availability, and all of them will experience congestion during rush hour, consumers might not be extremely motivated to change providers, even if they are unhappy to some degree. The bad news for service providers might be that network quality and reputation have some effect, but not overwhelming effect on churn behavior.

But handsets are a huge motivator of change, it appears. About 38 percent of consumers who switched phones in the past two years did so to get the phone they wanted.

More than 27 percent went shopping with a specific phone in mind, in fact. About 98 percent of iPhone users said they would purchase the phone again. To point out the obvious, some people might be really happy about their handsets, and simply put up with their service providers.

But there is another way to look at matters. If half of consumers are unahppy to some degree, and that leads them to churn, what would one expect to see? At churn rates about 1.5 percent a month,. one would expect roughly 18 percent annual churn. That would roughly equate to 100 percent churn about every five years or so.

If one assumes only half of consumers are motivated to churn, existing churn rates easily could amount to churn of half the entire customer base about every two and a half years.

So maybe those unhappy consumers are in fact deserting their current providers. The reason they remain unhappy? One explanation could be that none of the providers they are trying are demonstrably better than the carriers they left. One often encounters consumers who say "we've tried them all, and all of them have some problems."

Nearly half of readers surveyed by Consumer Reports are unhappy with their cell phone service. Nearly two thirds had at least one major complaint about their cell phone carrier, with about 20 percent naming price as the chief irritant.

But here's the caveat. Most surveys taken over the last couple of decades suggested there was high dissatisfaction with cable TV service, for example. And, to be sure, consumers began to churn away as first satellite and now telco video alternatives are available. Until satellite became a viable option, though, high dissatisfaction was not accompanied by high churn.

The U.S. mobile industry, though, is among the most competitive in the world, so consumers do have lots of choices. So one wonders why more do not act as theory suggests they will, which is that unhappiness will lead them to try another provider. Maybe they are churning, and maybe their continued unhappiness means the new carriers aren't demonstrably and clear better than the carriers they left.

Apparently, neither better coverage nor new smartphones have been enough to change consumer satisfaction all that much, the report suggests, with the salient exception of the Apple iPhone. So will the latent unhappiness translate into higher churn? It's harder to decipher than one might initially think.

If consumers believe all the carriers have some gaps in coverage, have roughly similar or somewhat distinct retail offers, have adequate bandwidth and availability, and all of them will experience congestion during rush hour, consumers might not be extremely motivated to change providers, even if they are unhappy to some degree. The bad news for service providers might be that network quality and reputation have some effect, but not overwhelming effect on churn behavior.

But handsets are a huge motivator of change, it appears. About 38 percent of consumers who switched phones in the past two years did so to get the phone they wanted.

More than 27 percent went shopping with a specific phone in mind, in fact. About 98 percent of iPhone users said they would purchase the phone again. To point out the obvious, some people might be really happy about their handsets, and simply put up with their service providers.

But there is another way to look at matters. If half of consumers are unahppy to some degree, and that leads them to churn, what would one expect to see? At churn rates about 1.5 percent a month,. one would expect roughly 18 percent annual churn. That would roughly equate to 100 percent churn about every five years or so.

If one assumes only half of consumers are motivated to churn, existing churn rates easily could amount to churn of half the entire customer base about every two and a half years.

So maybe those unhappy consumers are in fact deserting their current providers. The reason they remain unhappy? One explanation could be that none of the providers they are trying are demonstrably better than the carriers they left. One often encounters consumers who say "we've tried them all, and all of them have some problems."

Labels:

att Wireless,

churn,

Sprint,

TMobile,

Verizon Wireless

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Tuesday, December 1, 2009

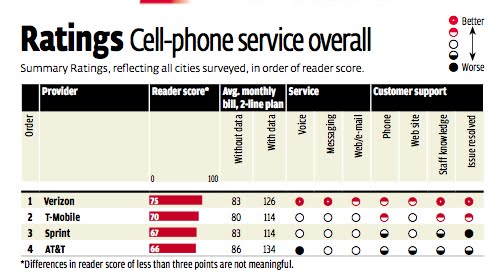

Verizon Ranked First in Consumer Reports’ "Best Wireless" Service Survey

In a survey of more than 50,000 readers spanning 26 U.S. cities, Consumer Reports found Verizon had the highest consumer satisfaction scores, while AT&T had the lowest customer-satisfaction rating in 19 cities surveyed. In fairness, the rankings are fairly close for three of the four service providers ranked.

Verizon received an overall score of 75, while T-Mobile USA got 70, Sprint got a score of 67 and AT&T got a score of 66. Consumer Reports itself says that differences of less than three points are not meaningful, so Sprint and AT&T essentially got the same score. And just three points separate T-Mobile from both Sprint and AT&T.

Another way of looking at matters is that while Verizon got scores noticeably different from the other three providers, and while T-Mobile USA was a clear number two, Sprint and AT&T were fairly close.

Verizon received an overall score of 75, while T-Mobile USA got 70, Sprint got a score of 67 and AT&T got a score of 66. Consumer Reports itself says that differences of less than three points are not meaningful, so Sprint and AT&T essentially got the same score. And just three points separate T-Mobile from both Sprint and AT&T.

Another way of looking at matters is that while Verizon got scores noticeably different from the other three providers, and while T-Mobile USA was a clear number two, Sprint and AT&T were fairly close.

Labels:

att Wireless,

Sprint,

TMobile,

Verizon Wireless

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Wednesday, November 11, 2009

T-Mobile USA Moves to 7.2 Mbps, Plans 21 Mbps

There are times when being late to market is actually a benefit. The latest entrants in any technology-based market have access to the latest technology, and can build their business plans around that fact. There are other times when it's a bit difficult to characterize a particular competitor's position.

That is where T-Mobile USA now sits, for example. T-Mobile USA was the last of the top-four U.S. mobile providers to build a 3G network, and it has uncertain plans for 4G. But the company is on track to have faster versions of 3G up and running before some of its major competitors.

The company had no 3G customers in the second quarter 2008, though it had acquired 3G spectrum. But the 3G network now covers 240 cities and passes 170 million people, with plans to extend coverage to 200 million people by the end of 2009, at which point nearly all major urban areas will be covered.

So here's where the "last shall be first" principle applies.T-Mobile is using the faster 7.2 HSPA air interface, running at 7.2 Mbps downstream, on all its 3G nodes by the end of 2009.

At least one of T-Mobile's primary competitors is upgrading less-capacious 3.6 HSPA networks to 7.2 HSPA, but will not have that conversion completed until the end of 2011.

Likewise, T-Mobile plans to upgrade even the 7.2 HSPA network to HSPA+, a 21 Mbps network. The company says it will start rolling out HSPA+ in 2010. T-Mobile says the upgrade will be a relatively low-cost and relatively easy upgrade.

Of course, the reason T-Mobile's position is complex is that it has not yet announced a specific method for deploying a 4G network, which will require additional spectrum.

Both AT&T and Verizon are building their 4G networks for substantial coverage by 2010, while AT&T will have substantial coverage in 2011. Sprint is banking on the Clearwire network for 4G.

Still, competition in the mobile broadband market might not primarily be about "feeds and speeds." Coverage, pricing, application stores and device exclusivity arguably are more important.

Nor is it yet entirely clear that 4G will offer an entirely new consumer marketing proposition, beyond "faster." European 3G networks languished for years with sluggish uptake because the compelling new services requiring a 3G network were not in place.

In the U.S. market, it has been the mobile Web that has driven an upsurge of 3G uptake. But that adoption was based in part on applications and capabilitiesm, in part on use of particular devices, which require use of the 3G network.

The question for 4G networks is what new value or application will drive uptake.

Perhaps no new discrete driver will be required. Maybe "more" will be sufficient. But as Verizon has so far discovered with its FiOS fiber to the home feature, consumers still need a reason to buy fiber access as compared to hybrid fiber-copper access.

Providers can be last or first. Either way, the applications and device capabilities will remain the drivers of adoption.

That is where T-Mobile USA now sits, for example. T-Mobile USA was the last of the top-four U.S. mobile providers to build a 3G network, and it has uncertain plans for 4G. But the company is on track to have faster versions of 3G up and running before some of its major competitors.

The company had no 3G customers in the second quarter 2008, though it had acquired 3G spectrum. But the 3G network now covers 240 cities and passes 170 million people, with plans to extend coverage to 200 million people by the end of 2009, at which point nearly all major urban areas will be covered.

So here's where the "last shall be first" principle applies.T-Mobile is using the faster 7.2 HSPA air interface, running at 7.2 Mbps downstream, on all its 3G nodes by the end of 2009.

At least one of T-Mobile's primary competitors is upgrading less-capacious 3.6 HSPA networks to 7.2 HSPA, but will not have that conversion completed until the end of 2011.

Likewise, T-Mobile plans to upgrade even the 7.2 HSPA network to HSPA+, a 21 Mbps network. The company says it will start rolling out HSPA+ in 2010. T-Mobile says the upgrade will be a relatively low-cost and relatively easy upgrade.

Of course, the reason T-Mobile's position is complex is that it has not yet announced a specific method for deploying a 4G network, which will require additional spectrum.

Both AT&T and Verizon are building their 4G networks for substantial coverage by 2010, while AT&T will have substantial coverage in 2011. Sprint is banking on the Clearwire network for 4G.

Still, competition in the mobile broadband market might not primarily be about "feeds and speeds." Coverage, pricing, application stores and device exclusivity arguably are more important.

Nor is it yet entirely clear that 4G will offer an entirely new consumer marketing proposition, beyond "faster." European 3G networks languished for years with sluggish uptake because the compelling new services requiring a 3G network were not in place.

In the U.S. market, it has been the mobile Web that has driven an upsurge of 3G uptake. But that adoption was based in part on applications and capabilitiesm, in part on use of particular devices, which require use of the 3G network.

The question for 4G networks is what new value or application will drive uptake.

Perhaps no new discrete driver will be required. Maybe "more" will be sufficient. But as Verizon has so far discovered with its FiOS fiber to the home feature, consumers still need a reason to buy fiber access as compared to hybrid fiber-copper access.

Providers can be last or first. Either way, the applications and device capabilities will remain the drivers of adoption.

Labels:

att,

mobile broadband,

Sprint Nextel,

TMobile,

Verizon

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Monday, November 9, 2009

Mobile is Not "Too Big to Fail"

Some people set up straw men that are easy to knock down, such as the big, rich telcos and mobile providers. Reality is more complex. They still are big, but they also are businesses facing cannibalization of their core revenue stream, voice, and will have to replace most of that revenue with something else.

We as a nation have made this sort of mistake before, trying to bring more competition to the landline voice business precisely as that business was entering a serious period of decline. Mobile providers now are in the same predicament. No matter how big they are, their base business is going to go away, for the the most part, meaning every single cent of revenue they now earn will have to be replaced.

If you think the telecom business is in great shape you don't work in the business. Granted U.S. wireless data revenues grew five percent quarter over quarter in the third quarter of 2009 and 27 percent year over year, to reach $11.3 billion by the end of the third quarter of 2009, according to analyst Chetan Sharma.

But overall service provider average revenue per user decreased by 14 cents during the third quarter. Average voice ARPU declined by 57 cents per user while the average data ARPU grew by 43 cents.

The point is simply that the communications business already is in the midst of a necessary transition from its traditional revenue models to new models, none of which are assured. It is going to take a great deal of very-hard work to pull this off and while consumer displeasure with such providers is understandable at times, they are not "too big to fail."

Most of that gain in data revenue was realized by Verizon and AT&T, which between them accounted for 80 percent of the increase in data revenues in the third quarter. AT&T and Verizon also now account for 68 percent of the market data services revenues and 61.5 percent of the subscriber base, Sharma says.

AT&T experienced the most growth with a six-percent increase quarter over quarter, followed by Verizon and Sprint with five percent revenue growth each.

Overall mobile service provider revenue grew about two percent year over year. On an annualized basis, data represents about 28 percent of total mobile service provider revenues.

Analyst Chetan Sharma estimates that by end of 2009, U.S. mobile data traffic is likely to exceed 400 petabytes, up 193 percent from 2008.

Smartphones also now represent 25 percent of U.S. devices in service, says Sharma, while mobile penetration stands at about 91 percent.

The average number of text messages used in the U.S. market now averages almost 568 messages per subscriber per month.

We as a nation have made this sort of mistake before, trying to bring more competition to the landline voice business precisely as that business was entering a serious period of decline. Mobile providers now are in the same predicament. No matter how big they are, their base business is going to go away, for the the most part, meaning every single cent of revenue they now earn will have to be replaced.

If you think the telecom business is in great shape you don't work in the business. Granted U.S. wireless data revenues grew five percent quarter over quarter in the third quarter of 2009 and 27 percent year over year, to reach $11.3 billion by the end of the third quarter of 2009, according to analyst Chetan Sharma.

But overall service provider average revenue per user decreased by 14 cents during the third quarter. Average voice ARPU declined by 57 cents per user while the average data ARPU grew by 43 cents.

The point is simply that the communications business already is in the midst of a necessary transition from its traditional revenue models to new models, none of which are assured. It is going to take a great deal of very-hard work to pull this off and while consumer displeasure with such providers is understandable at times, they are not "too big to fail."

Most of that gain in data revenue was realized by Verizon and AT&T, which between them accounted for 80 percent of the increase in data revenues in the third quarter. AT&T and Verizon also now account for 68 percent of the market data services revenues and 61.5 percent of the subscriber base, Sharma says.

AT&T experienced the most growth with a six-percent increase quarter over quarter, followed by Verizon and Sprint with five percent revenue growth each.

Overall mobile service provider revenue grew about two percent year over year. On an annualized basis, data represents about 28 percent of total mobile service provider revenues.

Analyst Chetan Sharma estimates that by end of 2009, U.S. mobile data traffic is likely to exceed 400 petabytes, up 193 percent from 2008.

Smartphones also now represent 25 percent of U.S. devices in service, says Sharma, while mobile penetration stands at about 91 percent.

The average number of text messages used in the U.S. market now averages almost 568 messages per subscriber per month.

Labels:

att,

business model,

Sprint Nextel,

TMobile,

Verizon Wireless

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Wednesday, October 28, 2009

Wirefly’s Top 10 Most-Anticipated Cell Phones

In a major change, the top-two "most anticipated" new mobile devices are made by Motorola. That hasn't happened for quite some time, and will be a huge test of Motorola's decision to rely on Android as its ticket back into the top ranks of manufacturers of "hot" devices.

The launches are equally important for mobile service providers, who have found devices to be primary ways of differentiating their services. We'll have to see, but it is possible, perhaps likely, that a key new feature of the top-two Android devices will be their methods of integrating contact information and status updates across applications. That's an angle on "unified communications" we have not seen so much in the mobile arena.

Here's Wirefly's ranking and commentary.

1. Motorola Droid (Verizon Wireless) - The most anticipated cell phone launch of the season is just days away, but the hype for this the Motorola Droid smartphone has been building for quite some time. Verizon Wireless has invested heavily in a national “teaser” marketing campaign, while keeping the details about this Android-based device close to the vest. The Droid is the first commercial phone released with the new Android 2.0 platform, and has been dubbed the “iPhone killer” by many a technology-writer. Verizon Wireless is stoking the fire with a campaign that touts all the things the Droid does that the iPhone doesn’t – from running multiple apps, to a full slide-out keyboard, to changeable batteries and memory to a 5.0 megapixel camera that takes photos in the dark.

2. Motorola CLIQ MB200 (T-Mobile) - The highly-anticipated Motorola CLIQ is the new king of the T-Mobile Android smartphone lineup, and the first since the original G-1 to have a full slide-out keyboard. What really makes it buzz-worthy, though, is that it utilizes the new MotoBlur user interface that syncs your social media, contacts, and e-mail in real time, providing instant access to the latest happenings and messages from friends. (The Cliq is currently available to existing T-Mobile customers, however, new customers will not be able to purchase the device until November 2nd, and therefore, it still garners a spot on our top picks.)

3. Samsung Moment (Sprint) - Sprint’s second Android device, the Samsung Moment, mark’s Samsung’s entry into the Android smartphone market with a full slide-out keyboard and a first-of-its-kind AMOLED touch screen, providing unprecedented brightness that’s also kind to your battery life.

4. LG Chocolate Touch (Verizon Wireless) – The LG Chocolate is an iconic Verizon Wireless phone, and this new touch version should be even sweeter than its predecessors.

5. Samsung Behold II (T-Mobile) – The Behold II is the sequel to the very successful Samsung Behold but with one MAJOR difference - the latest version runs on the Android smartphone operating system. The Behold II also features a "cube menu" that provides quick access to six multimedia features at the flick of a finger: music, photos, videos, the Web, YouTube, and Amazon MP3.

6. HTC Desire 6200 (Verizon Wireless) – Verizon Wireless is making headlines with the Droid, but is expected to follow quickly with a second Android-powered smartphone dubbed the Desire. The Desire will not have a keyboard, and will boast HTC’s touch screen “Sense” interface that has won rave reviews on the HTC Hero.

7. Sprint Palm Pixi (Sprint) – The Sprint Palm Pixi is being touted as a tiny, sleek webOS-based handset that offers many of the same features and functionality as the Pre without the hefty price tag.

8 . BlackBerry Storm 2 (Verizon Wireless) – This next generation of the touch screen BlackBerry Storm looks similar to the original model on the outside, but boasts notable improvements on the inside such as a Wi-Fi radio, sleeker design, and an improved SurePress typing system.

9. BlackBerry Bold 9700 (AT&T & T-Mobile) –This smartphone is an updated version of the high-end Blackberry Bold that hit the market last year. It is thinner and lighter with a faster Web browser than its predecessor and replaces the original Bold's track ball with an optical track pad.

10. LG Shine 2 (AT&T) – The successor to the immensely popular Shine; but as its name indicates, it promises to be twice as sleek and sexy.

The launches are equally important for mobile service providers, who have found devices to be primary ways of differentiating their services. We'll have to see, but it is possible, perhaps likely, that a key new feature of the top-two Android devices will be their methods of integrating contact information and status updates across applications. That's an angle on "unified communications" we have not seen so much in the mobile arena.

Here's Wirefly's ranking and commentary.

1. Motorola Droid (Verizon Wireless) - The most anticipated cell phone launch of the season is just days away, but the hype for this the Motorola Droid smartphone has been building for quite some time. Verizon Wireless has invested heavily in a national “teaser” marketing campaign, while keeping the details about this Android-based device close to the vest. The Droid is the first commercial phone released with the new Android 2.0 platform, and has been dubbed the “iPhone killer” by many a technology-writer. Verizon Wireless is stoking the fire with a campaign that touts all the things the Droid does that the iPhone doesn’t – from running multiple apps, to a full slide-out keyboard, to changeable batteries and memory to a 5.0 megapixel camera that takes photos in the dark.

2. Motorola CLIQ MB200 (T-Mobile) - The highly-anticipated Motorola CLIQ is the new king of the T-Mobile Android smartphone lineup, and the first since the original G-1 to have a full slide-out keyboard. What really makes it buzz-worthy, though, is that it utilizes the new MotoBlur user interface that syncs your social media, contacts, and e-mail in real time, providing instant access to the latest happenings and messages from friends. (The Cliq is currently available to existing T-Mobile customers, however, new customers will not be able to purchase the device until November 2nd, and therefore, it still garners a spot on our top picks.)

3. Samsung Moment (Sprint) - Sprint’s second Android device, the Samsung Moment, mark’s Samsung’s entry into the Android smartphone market with a full slide-out keyboard and a first-of-its-kind AMOLED touch screen, providing unprecedented brightness that’s also kind to your battery life.

4. LG Chocolate Touch (Verizon Wireless) – The LG Chocolate is an iconic Verizon Wireless phone, and this new touch version should be even sweeter than its predecessors.

5. Samsung Behold II (T-Mobile) – The Behold II is the sequel to the very successful Samsung Behold but with one MAJOR difference - the latest version runs on the Android smartphone operating system. The Behold II also features a "cube menu" that provides quick access to six multimedia features at the flick of a finger: music, photos, videos, the Web, YouTube, and Amazon MP3.

6. HTC Desire 6200 (Verizon Wireless) – Verizon Wireless is making headlines with the Droid, but is expected to follow quickly with a second Android-powered smartphone dubbed the Desire. The Desire will not have a keyboard, and will boast HTC’s touch screen “Sense” interface that has won rave reviews on the HTC Hero.

7. Sprint Palm Pixi (Sprint) – The Sprint Palm Pixi is being touted as a tiny, sleek webOS-based handset that offers many of the same features and functionality as the Pre without the hefty price tag.

8 . BlackBerry Storm 2 (Verizon Wireless) – This next generation of the touch screen BlackBerry Storm looks similar to the original model on the outside, but boasts notable improvements on the inside such as a Wi-Fi radio, sleeker design, and an improved SurePress typing system.

9. BlackBerry Bold 9700 (AT&T & T-Mobile) –This smartphone is an updated version of the high-end Blackberry Bold that hit the market last year. It is thinner and lighter with a faster Web browser than its predecessor and replaces the original Bold's track ball with an optical track pad.

10. LG Shine 2 (AT&T) – The successor to the immensely popular Shine; but as its name indicates, it promises to be twice as sleek and sexy.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Tuesday, October 27, 2009

T-Mobile USA Launches Unlimited Prepaid Offer

Given the relative strength of prepaid wireless, and a renewed spate of competition in the segment, it might not be too surprising that T-Mobile USA has launched a new unlimited mobile plan available to customers who do not like contracts.

What might have been disruptive is an extension of such plans to all postpaid customers as well, a move that might have sparked yet another round of price cuts in the postpaid business. But it was a move T-Mobile USA chose not to take.

The new plan offers unlimited talk, text and Web surfing for $79.99 a month to customers who do not want to sign up for a long-term contract, which typically lasts two years.

It will also offer a $50 per month unlimited service for non-contract customers that only want access to voice calls, not text messaging or Web access.

By some measures, the new deal represents a 20 percent discount on T-Mobile's standard unlimited monthly fee for contract customers.

Nobody knows what might have happened had T-Mobile USA launched a $50 per month unlimited voice and data service plan for all customers, but an immediate price war is one likely outcome.

As matters stand, that is unlikely to happen. On its third quarter earnings call, Verizon said Verizon Wireless was unlikely to respond to T-Mobile USA's new offer with a similar one of its own.

That is unsurprising given Verizon's general stance on prepaid, which is that it remains a niche tough to square with Verizon's historic focus on higher-end postpaid customers.

Prepaid accounted for 80 percent of U.S. subscriber growth in the first quarter of 2009, though growth has moderated since then.

Sprint subsidiary Boost Mobile launched a $50 monthly plan in January 2009 and has been matched by the other leading prepaid providers.

What might have been disruptive is an extension of such plans to all postpaid customers as well, a move that might have sparked yet another round of price cuts in the postpaid business. But it was a move T-Mobile USA chose not to take.

The new plan offers unlimited talk, text and Web surfing for $79.99 a month to customers who do not want to sign up for a long-term contract, which typically lasts two years.

It will also offer a $50 per month unlimited service for non-contract customers that only want access to voice calls, not text messaging or Web access.

By some measures, the new deal represents a 20 percent discount on T-Mobile's standard unlimited monthly fee for contract customers.

Nobody knows what might have happened had T-Mobile USA launched a $50 per month unlimited voice and data service plan for all customers, but an immediate price war is one likely outcome.

As matters stand, that is unlikely to happen. On its third quarter earnings call, Verizon said Verizon Wireless was unlikely to respond to T-Mobile USA's new offer with a similar one of its own.

That is unsurprising given Verizon's general stance on prepaid, which is that it remains a niche tough to square with Verizon's historic focus on higher-end postpaid customers.

Prepaid accounted for 80 percent of U.S. subscriber growth in the first quarter of 2009, though growth has moderated since then.

Sprint subsidiary Boost Mobile launched a $50 monthly plan in January 2009 and has been matched by the other leading prepaid providers.

Labels:

prepaid wireless,

Sprint,

TMobile,

Verizon

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Wednesday, April 22, 2009

T-Mobile Ultimately will Allow Skype over 3G

Despite understanable teeth gnashing over T-Mobile's blocking of Skype when using the 3G network, T-Mobile ultimately will allow it, either because customer pressure forces them to do so, or because European Union regulators do so.

Labels:

consumer VoIP,

mobile VoIP,

Skype,

TMobile

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Thursday, March 6, 2008

T-Mobile Handles Churn

Though it doesn't appear T-Mobile USA will be changing its market share position in the near term, it appears to be doing a good job on the churn front.

It added 951,000 net new customers added in the fourth quarter of 2007, up from 901,000 in the fourth quarter of 2006. That's important because "net" adds are what one has left after deducting the customers who churned away in any given time period. The other data point is that, in its most-recent quarter, T-Mobile's churn dropped to 1.8 percent, down from 2.1 percent in the fourth quarter of 2006.'

That is notable because T-Mobile has a large percentage of contracts that are of the one-year variey, not the the two-year contracts that increasingly are the norm in the postpaid segment of the market. It also is notable because there is some evidence T-Mobile customers are more active than customers of some of the other leading mobile carriers in investigating alternatives.

"T-Mobile customers are the most active in checking out competitive products and services," says Compete.com analyst Jeff Hull.

"This is partly because they are a younger, more active subscriber base, and partly because of the legacy of one-year contracts at T-Mobile," says Hull.

"If you look at an upstart like Helio, four percent of their site traffic is from existing T-Mobile customers, with two percent from both AT&T and Verizon Wireless, and Sprint/Nextel customers seemingly uninterested in checking out the MVNO."

T-Mobile customers also are over-represented at the Boost Mobile site, another youth oriented brand that is successfully attracting T-Mobile user interest. At the margin, and it might only be at the margin, there does seem to be a difference between customer bases at T-Mobile and Sprint or Nextel, for example.

Given the apparent high "shopping" and "comparison" behavior, the lower churn is an accomplishment.

Labels:

att Wireless,

Sprint Nextel,

TMobile,

Verizon Wireless

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Thursday, February 28, 2008

Sprint Unlimited Plan: Unlimited Everything

Sprint Nextel now has responded with a new “Simply Everything” plan offering not just talk, not just unlimited texting, but unlimited Web surfing, email access, GPS navigation services, DirectConnect, GroupConnect, Sprint TV and Sprint music.

The $99.99 Simply Everything plan is available to customers on both Sprint's CDMA and iDEN networks, and goes way beyond T-Mobile's comparable plan that includes unlimited voice and texting.

Sprint has thrown in the kitchen sink.

Existing Sprint customers can switch to the Simply Everything plan without extending their current contract either by contacting Sprint customer service or by stopping by any participating Sprint retail location.

New line activations require a two-year agreement.

For families, Simply Everything includes an incremental $5 discount for each incremental line, up to five lines on the same bill. For example, two lines would amount to $194.98 ($99.99 + $94.99); a third line would cost an additional $89.99. This is in sharp contrast to the multi-line unlimited rates offered by some competitors. The Sprint plan offers significant savings the more lines a customer adds.

Observers were wondering whether Sprint would go nuclear. This move is more "nuclear" that offering an unlimited voice plan for lower prices than the now-industry-standard $100 a month. Sure, Sprint Nextel would have frightened a lot of people if it had gone with an $60, or even an $80 unlimited voice plan.

What it has done, at least for users who really like several of the enhanced features, is create a package so compelling lots of people are going to upgrade lower-priced plans to get them. Don't worry about some high-end voice plans being downgraded.

The big issue here is a potentially significant upgrade of lots of other plans, to get the huge palatte of upgraded features. It is the sort of move one would expect from Dan Hesse.

For users who don't mind the lack of subscriber information modules (SIMs), the plan offers more value than competing plans offered by T-Mobile, which bundles unlimited voice and text messaging. Both at&t Wireless and Verizon Wireless plans provide unlimited voice for $100 a month.

For users who simply want unlimited voice, Sprint will offer a $90 voice-only plan. So far, the feared price war has not broken out.

As for why unlimited plans might not damage wireless carrier revenue, take a look at what Sprint has been finding with its Boost mobile prepaid business. After launching unlimited plans, traditional prepaid growth slowed, but unlimited plans more than made up for the slower growth for the traditional plans.

Labels:

att Wireless,

Sprint Nextel,

TMobile,

Verizon Wireless

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Thursday, February 21, 2008

T-Mobile USA Continues Fixed-Mobile Trial

T-Mobile USA continues to test a Wi-Fi-based, dual-mode phone approach to fixed-mobile integration, allowing users to send and receive calls and messages using their in-home broadband network and a Wi-Fi router instead of sending and receiving messages and calls over the mobile network. The user advantage is that the airtime plan isn't decreased when using the Wi-Fi connection.

The tests began last June in Seattle and now is providing service in Seattle and Dallas.

The additional monthly cost is $10 for the "Hotspot at Home" feature, which isn't much of an issue. The issue is that the service only works with two phone models, the BlackBerry Curve and the Samsung T409.

Someday handset limitations won't be so big a deal, as more devices come natively equipped with Wi-Fi, and when operators stop disabling the function. But right now, the limitation to just two devices is an issue that will limit adoption.

The tests began last June in Seattle and now is providing service in Seattle and Dallas.

The additional monthly cost is $10 for the "Hotspot at Home" feature, which isn't much of an issue. The issue is that the service only works with two phone models, the BlackBerry Curve and the Samsung T409.

Someday handset limitations won't be so big a deal, as more devices come natively equipped with Wi-Fi, and when operators stop disabling the function. But right now, the limitation to just two devices is an issue that will limit adoption.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

TA 96, Digital One Rate: Which was More Important?

Though the subscriber stats don't paint the picture quite so clearly, wireless minutes of use exploded after 1998, when AT&T Wireless Services introduced "Digital One Rate," a new plan that eliminated the difference between local and long distance services, and used a "bucket" of minutes packaging approach.

Though the subscriber stats don't paint the picture quite so clearly, wireless minutes of use exploded after 1998, when AT&T Wireless Services introduced "Digital One Rate," a new plan that eliminated the difference between local and long distance services, and used a "bucket" of minutes packaging approach.U.S. competitive local exchange carrier lines in service, on the other other hand, ramped up through about 2004, and then began to decline, even as more telephone and cable companies themselves became "CLECs" for purposes of providing services outside their historic service territories.

In 1998, when Digital One Rate was introduced, mobile subscribers numbered about 69 million. By the middle of 2007, mobile subscribers numbered more than 243 million. At this point, the time is long past when wired lines exceeded wireless lines. These days, wireless accounts far outnumber wired accounts.

In many respects, and without belittling the Telecommunications Act of 1996, Digital One Rate has had far more impact than anything that has happened on the wired side of the business.

Labels:

att,

Sprint,

TMobile,

Verizon Wireless

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Dan Hesse, Digital One Rate

Dan Hesse, Sprint Nextel CEO, was CEO of AT&T Wireless Services back in 1998, not many will recall. That was the month Hesse was able to act on a vision he had strenuously to sell to his superiors: that wireline minutes of use could be shifted to wireless, saving at&t money on access fees by doing so.

The Digital One Rate Plan was not primarily aimed against other wireless carriers at all, but rather at reducing a significant cost of doing business on the AT&T long distance side of the house.

At the time, Hesse pointed out that "we're taking a chunk out of revenue usually going to our competitors," meaning by that the Regional Bell Operating Companies that at&t had to pay access fees to.

The point is that major packaging initiatives can have unanticipated consequences. Digital One Rate was just a way to save AT&T long distance operations money on terminating traffic charges paid out to local carriers.

So make no mistake: Hesse is used to launching unusual packaging programs for non-intuitive reasons. But not even Hesse was able to fathom that Digital One Rate would change the way the entire industry packaged its basic product.

If Sprint does launch some sort of "nuclear" strategy to try and shake things up, you can bet Hesse isn't going to choose some sort of simple copycat unlimited calling plan.

Dan Hesse is the guy who got the whole "buckets of minutes" train rolling, and wiped out the difference between local and long distance calling in the U.S. domestic market.

He's the guy who triggered an explosion of mobile adoption and a sharp increase in usage of mobile minutes.

Financial analysts seem to be riveted on what a $60 unlimited calling plan might mean for the fortunes of all leading wireless providers. I don't think that is what they ought to be focusing on. Digital One Rate was about moving "long distance" minutes from the landline network to the wireless network.

That's what "unlimited" mobile calling plans do. That's why Sprint is testing femtocell technology in Denver: figuring out the operational and marketing issues around small in-home transmitters that improve wireless signal quality and also create a marketing opportunity for "home zone" services where a wireless handset can replace a landline handset and service.

Nobody should be surprised if Sprint Nextel comes out with a program of its own in the "unlimited" calling area. But nobody should expect Hesse to confine his initiatives there. At this point, rolling out its own unlimited-calling plan is nothing more than a tactical response to prevailing market conditions on the packaging front.

It isn't the sort of industry-transforming plan Digital One Rate was. But we also need to keep in mind that industry transformation was not what AT&T had in mind in launching Digital One Rate.

Watch out for the unintended consequences.

Labels:

att,

Sprint Nextel,

TMobile,

Verizon

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Wednesday, February 20, 2008

What if Sprint "Goes Nuclear"?

There now is speculation Sprint Nextel is considering an unlimited calling plan costing as little as $60 a month. Aside from disrupting nearly all pricing plans in the U.S. mobile business, one has to wonder what that does for wireless substitution and consumer VoIP as well.

If one can get unlimited calling for that sort of price point, most people who use mobiles and also live in single person, or households of unrelated people, are going to have huge incentives just to go "wireless only."

To the extent that consumer VoIP is mostly about cheap calling, mobile is going to be hugely competitive in a new way, in the event of "nuclear" conflict.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Mobile Price War Impact?

Though the impact might be quite overblown, at least some investment analysts think the recent adoption of unlimited calling plans by three of the four largest U.S. mobile providers is going to hammer their revenues.

Credit Suisse telecom analyst Christopher Larsen, for example, has reduced his rating on at&t, Verizon, Qwest and Sprint Nextel.

He worries that unlimited calling plans will trigger “a wireless price war.”

UBS telecom analyst John Hodulik thinks the potential impact will affect Verizon and at&t, at least at this point.

Hodulik says Sprint is likely to launch an unlimited voice plan in the next few weeks is considering pricing at $60-$80 a month. If Sprint gets traction, that logically would compel Verizon and at&t to reduce their prices to match.

I am not so sure about that. Each of the carriers might see some lost "overage" revenue from heavy users. But each should gain some customers who upgrade from lower-priced plans, as well as some customers upgrading because they are substituting wireless for wireline service.

It is possible higher subscription revenue will compensate for the loss of "overage" revenue.

Credit Suisse telecom analyst Christopher Larsen, for example, has reduced his rating on at&t, Verizon, Qwest and Sprint Nextel.

He worries that unlimited calling plans will trigger “a wireless price war.”

UBS telecom analyst John Hodulik thinks the potential impact will affect Verizon and at&t, at least at this point.

Hodulik says Sprint is likely to launch an unlimited voice plan in the next few weeks is considering pricing at $60-$80 a month. If Sprint gets traction, that logically would compel Verizon and at&t to reduce their prices to match.

I am not so sure about that. Each of the carriers might see some lost "overage" revenue from heavy users. But each should gain some customers who upgrade from lower-priced plans, as well as some customers upgrading because they are substituting wireless for wireline service.

It is possible higher subscription revenue will compensate for the loss of "overage" revenue.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Tuesday, February 19, 2008

T-Mobile Adds $100 Unlimited Plan

T-Mobile USA will offer consumers an unlimited calling plan including unlimited ationwide text messaging for $99.99 per month. This offer will be available beginning Feb. 21.

Note that the T-Mobile offer includes unlimited text messaging (SMS), picture messages (MMS) and instant messages (IM). Full details of the at&t Wireless offer are not yet available, but it wasn't immediately clear whether at&t Wireless would include unlimited text messaging as part of the $100 a month unlimited voice plan.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Thursday, February 14, 2008

T-Mobile 3G This Summer

T-Mobile USA will launch commercial 3G services this summer, finally. The company blames spectrum issues for the delay (3G was supposed to launch mid-2007). T-Mobile invested $4.2 billion in 2006 to more than double its spectrum holding in the top 100 U.S. cities it serves.

Those of you who have had to live with EDGE access speeds (just like most iPhone users) will be happy. Up to this point, EDGE access has felt remarkably like "dial up" access. And how many of you can imagine doing important work, or trying to get any of the normal sorts of information you look for in a day, over a dial-up connection?

People don't use the mobile Web much because it's too painful, even if there were interesting applications.

Those of you who have had to live with EDGE access speeds (just like most iPhone users) will be happy. Up to this point, EDGE access has felt remarkably like "dial up" access. And how many of you can imagine doing important work, or trying to get any of the normal sorts of information you look for in a day, over a dial-up connection?

People don't use the mobile Web much because it's too painful, even if there were interesting applications.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Subscribe to:

Posts (Atom)

More Computation, Not Data Center Energy Consumption is the Real Issue

Many observers raise key concerns about power consumption of data centers in the era of artificial intelligence. According to a study by t...

-

We have all repeatedly seen comparisons of equity value of hyperscale app providers compared to the value of connectivity providers, which s...

-

It really is surprising how often a Pareto distribution--the “80/20 rule--appears in business life, or in life, generally. Basically, the...

-

Who gets to use spectrum, and concerns about interference from other users, now appears to be an issue for Google’s Project Loon in India. ...