Apple Inc. CEO Steve Jobs says Apple is holding onto $25 billion in cash to take “big, bold” risks. That should be an immediate concern for any company that competes with Apple or thinks it might have to compete with Apple.

Whatever else might be said, Apple already has reinvented itself. Apple used to be thought of as a "computer manufacturer." These days, sales of Macintosh computers probably represent about 18 percent of the company's equity value. The iPod, which not so long ago was the rising company star, now represents about three percent of the company's value.

Even the new iPad, which has just launched, represents four percent of the company's value.

These days, Apple has suddenly, dramatically, become a "mobile handset" company. Sales of the iPhone now represent about 52 percent of the company's equity value.

The iTunes and iPhone App Store represent about 5.6 percent of company equity value.

So what about Apple's purchase of Quattro, a company providing mobile advertising for Apple, Android and other smartphone devices?

Apple probably is less interested in profiting from ads than in making the iPhone the most attractive device for developers to build applications. And money might have a lot to do with that. Right now, eighty to ninely percent of app store downloads are of "free" apps. That isn't such a great business model for a software developer.

Eighty percent of the three billion downloads from Apple’s App Store are free, for example. By offering a way to sell ads, Apple can help entice developers who will have another way to make money, other than selling software.

Apple executives said recently during their quarterly earnings call that the firm had no idea whether mobile advertising would develop as an actual revenue stream for Apple or whether it would simply help reinforce its App Store operations.

"I honestly don’t know," says Peter Oppenheimer Apple CFO. "We will have to see."

Thursday, February 25, 2010

Apple Plans "Big, Bold" Steps, Says Jobs

Labels:

Android,

Apple,

enterprise iPhone,

Quattro

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

App Stores Very Valuable for Handset Suppliers and Users; Maybe Not Developers

App stores have been a huge boost to smartphone perceived value. What they haven't yet proven is that they are an effective way for software developers to sell applications.

About 80 percent to 90 percent of app downloads are of the "free" rather than "paid" variety, according to AdMob.

About 80 percent to 90 percent of app downloads are of the "free" rather than "paid" variety, according to AdMob.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Wednesday, February 24, 2010

Ironically, Low Prices are a Barrier to Mobile VoIP

SK Telecom says it has no plans to allow its smartphone subscribers access to VoIP calling, saying it will deal a blow to its revenue, reports the Korea Herald. That's true, but also likely unsustainable. All it would take is for Korea Telecom to allow it and SK Telecom would have to relent.

Oddly enough, it appears low prices are a problem. An SK Telecom executive says that AT&T and Verizon can afford to allow VoIP because both those carries make enough money with their broadband and voice tariffs to allow cannibalization of legacy voice revenues by VoIP.

Oddly enough, this is a case where higher prices would lead to more innovation. U.S. carriers are moving about as fast as they can to create broadband-driven revenue streams so voice can be cannibalized.

Mobile VoIP is a sensitive issue for SK Telecom precisely because its tariffs are low. "Mobile VoIP will destroy our profit-making structure," Lee Soon-kun, senior vice president of SK Telecom, says. At the same time, Korean mobile providers face mounting pressure to lower tariffs on legacy calling.

Under the "per-second" scheme, which will take effect on March 1, 2010the carrier will charge for every second, instead of every 10 seconds. Under the current system, consumers have to pay for a full 10-seconds of calls, even if they have not been connected for all of that time.

The revamp is expected to lead to a tariff cut of 700 won and 800 won per subscriber on average, SK Telecom said, adding that all of its 25 million subscribers would be able to save a combined 201 billion won ($1.8 million) a year.

SK's move put its rivals KT and LG Telecom under growing pressure to follow suit.

Broadband prices that are too low--basically unable to support the entire cost of running a mobile network--would seem to be a problem for widespread mobile VoIP in the Korean market.

Oddly enough, it appears low prices are a problem. An SK Telecom executive says that AT&T and Verizon can afford to allow VoIP because both those carries make enough money with their broadband and voice tariffs to allow cannibalization of legacy voice revenues by VoIP.

Oddly enough, this is a case where higher prices would lead to more innovation. U.S. carriers are moving about as fast as they can to create broadband-driven revenue streams so voice can be cannibalized.

Mobile VoIP is a sensitive issue for SK Telecom precisely because its tariffs are low. "Mobile VoIP will destroy our profit-making structure," Lee Soon-kun, senior vice president of SK Telecom, says. At the same time, Korean mobile providers face mounting pressure to lower tariffs on legacy calling.

Under the "per-second" scheme, which will take effect on March 1, 2010the carrier will charge for every second, instead of every 10 seconds. Under the current system, consumers have to pay for a full 10-seconds of calls, even if they have not been connected for all of that time.

The revamp is expected to lead to a tariff cut of 700 won and 800 won per subscriber on average, SK Telecom said, adding that all of its 25 million subscribers would be able to save a combined 201 billion won ($1.8 million) a year.

SK's move put its rivals KT and LG Telecom under growing pressure to follow suit.

Broadband prices that are too low--basically unable to support the entire cost of running a mobile network--would seem to be a problem for widespread mobile VoIP in the Korean market.

Labels:

mobile VoIP,

SK Telecom

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Not Every Telecom Market Did as Well as U.S. in 2009

The U.S. telecommunications and network-based video entertainment markets (cable, satellite, telco) grew revenue in 2009, largely on the strength of performance by the large incumbents that account for most of the industry's revenue.

That was not the case in all markets, though, as the Columbian market, for example, declined about eight percent in 2009, according to researchers at Pyramid Research.

The Columbian market also is in major deregulation shift, so new competitors are expected, especially in the wireless area. Pyramid Research does not think any such new competitors will be able to alter the current market structure, though. Incumbency has its advantages, it seems.

That was not the case in all markets, though, as the Columbian market, for example, declined about eight percent in 2009, according to researchers at Pyramid Research.

The Columbian market also is in major deregulation shift, so new competitors are expected, especially in the wireless area. Pyramid Research does not think any such new competitors will be able to alter the current market structure, though. Incumbency has its advantages, it seems.

Labels:

Columbia,

deregulation,

regulation

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Tuesday, February 23, 2010

23% of U.S. Business Sites Now are Fiber-Served

What percentage of U.S. business locations would you suggest now have optical fiber connections available to them? According to Vertical Systems Group, just 23 percent of U.S. sites and 15 percent of sites in Europe have optical access.

While most large enterprise locations in the United States and Europe are fiber-connected, small and medium business sites generally are underserved with fiber from any service provider.

"The good news is that overall accessibility to business fiber has more than doubled within the past five years," says Rosemary Cochran, Vertical Systems Group principal.

The challenge ahead is to extend fiber connectivity to remote business locations. Of course, not all smaller business locations need the fiber that typically supports gigabit-per-second bandwidth. Given that 1.544 Mbps connections are the mainstay for most smaller and even many mid-sized businesses, many customers might be quite satisfied with speeds in the tens of megabits per second.

While most large enterprise locations in the United States and Europe are fiber-connected, small and medium business sites generally are underserved with fiber from any service provider.

"The good news is that overall accessibility to business fiber has more than doubled within the past five years," says Rosemary Cochran, Vertical Systems Group principal.

The challenge ahead is to extend fiber connectivity to remote business locations. Of course, not all smaller business locations need the fiber that typically supports gigabit-per-second bandwidth. Given that 1.544 Mbps connections are the mainstay for most smaller and even many mid-sized businesses, many customers might be quite satisfied with speeds in the tens of megabits per second.

Labels:

broadband access,

business broadband,

FTTH

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Consumer Price Points for Recurring Subscriptions are Fairly Clear

One might infer from average pricing for a variety of services ranging from fixed telephone service to broadband access, wireless and multi-channel video service that consumers have price sensitivity for any single service above $50 a month.

According to researchers at Pew Research and the Federal Communications Commission, fixed voice costs about $48 a month. Wireless costs about $50 per user, while multi-channel video costs about $60 a month and broadband access costs about $40 a month.

Some of you immediately will note that your own spending is higher than these average figures suggest, with the greatest variability occurring in the mobile arena, as that is a service bought a person at a time, where the other services are bought household by household.

That's worth keeping in mind when surverys suggest there is robust consumer demand for just about any new application or service. Very few products ever have gotten mass adoption at prices above $300. Very few subscription products ever have gotten mass adoption at prices above $50 a month.

That doesn't mean it cannot be done; obviously it can. It simply is to point out that getting lots of consumers to buy a new recurring service at prices ranging from $5 to $10 a month is a big deal.

That's the reason so much consumer-focused content is advertising supported.

According to researchers at Pew Research and the Federal Communications Commission, fixed voice costs about $48 a month. Wireless costs about $50 per user, while multi-channel video costs about $60 a month and broadband access costs about $40 a month.

Some of you immediately will note that your own spending is higher than these average figures suggest, with the greatest variability occurring in the mobile arena, as that is a service bought a person at a time, where the other services are bought household by household.

That's worth keeping in mind when surverys suggest there is robust consumer demand for just about any new application or service. Very few products ever have gotten mass adoption at prices above $300. Very few subscription products ever have gotten mass adoption at prices above $50 a month.

That doesn't mean it cannot be done; obviously it can. It simply is to point out that getting lots of consumers to buy a new recurring service at prices ranging from $5 to $10 a month is a big deal.

That's the reason so much consumer-focused content is advertising supported.

Labels:

broadband,

cable,

consumer behavior,

marketing,

voice

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

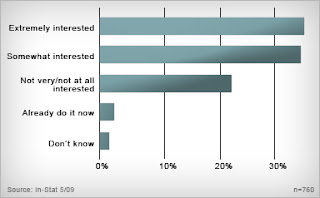

37% of Broadband Users Want Streaming Video to TVs

Nearly 37 percent of broadband households in North America are "extremely" or "very" interested in viewing over-the-top video content on the home TV, according to In-Stat.

Streaming should be easier in the future as more TVs, Blu-ray Players, digital media players and set top boxes support Internet connections.

By 2013, In-Stat predicts that nearly 40 percent of all digital TV shipments will be Web-enabled devices. Across all categories, there will be over half a billion Web-enabled consumer electronics devices in operation worldwide by 2013.

Shipments of such Web-enabled devices will see a compound annual grow rate of nearly 64 percent between 2008 and 2013, In-Stat predicts.

It always is hard to tell how well consumer input of this sort will translate into actual behavior, especially when spending on one category of purchases has to be shifted from some other existing category of expenses.

Doubtless the stated intentions are closer to reality when there is no incremental cost to view such content, and drops fairly predictably as the price of doing so raises above "zero."

Streaming should be easier in the future as more TVs, Blu-ray Players, digital media players and set top boxes support Internet connections.

By 2013, In-Stat predicts that nearly 40 percent of all digital TV shipments will be Web-enabled devices. Across all categories, there will be over half a billion Web-enabled consumer electronics devices in operation worldwide by 2013.

Shipments of such Web-enabled devices will see a compound annual grow rate of nearly 64 percent between 2008 and 2013, In-Stat predicts.

It always is hard to tell how well consumer input of this sort will translate into actual behavior, especially when spending on one category of purchases has to be shifted from some other existing category of expenses.

Doubtless the stated intentions are closer to reality when there is no incremental cost to view such content, and drops fairly predictably as the price of doing so raises above "zero."

Labels:

online content,

streaming

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Subscribe to:

Comments (Atom)

At Alphabet, AI Correlates with Higher Revenue

Though many of the revenue-lifting impacts of artificial intelligence arguably are indirect, as AI fuels the performance of products using ...

-

We have all repeatedly seen comparisons of equity value of hyperscale app providers compared to the value of connectivity providers, which s...

-

It really is surprising how often a Pareto distribution--the “80/20 rule--appears in business life, or in life, generally. Basically, the...

-

One recurring issue with forecasts of multi-access edge computing is that it is easier to make predictions about cost than revenue and infra...