Forrester Research analyst Pete Nuthall does not think economic stringency will dent

European mobile penetration rate of 84 percent. But he does predict there will be some reduced usage and spending. Purchases of more advanced handsets and services also might dip.

Mobile providers are responding to the anticipated changes by de-emphasizing mobile data services and expanding the variety of SIM-only offers.

Friday, October 31, 2008

European Mobile Behavior Might Shift, Temporarily

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Send and Receive Text Messages from Google Chat

At least some Gmail Chat users now can send text messages to buddies on their mobile phones using Gmail Chat. Recipients also can respond to those text messages just like they would respond to messages sent directly from a mobile phone, as well. As is typical for new feature introductions, the feature is being rolled out in phases, so not every Google Chat user has access to the feature right now.

At least some Gmail Chat users now can send text messages to buddies on their mobile phones using Gmail Chat. Recipients also can respond to those text messages just like they would respond to messages sent directly from a mobile phone, as well. As is typical for new feature introductions, the feature is being rolled out in phases, so not every Google Chat user has access to the feature right now.Google appears to enable that function by providing a virtual phone number. The feature also works for mobiles responding from outside the United States, but the operation isn't quite so automated.

The ability to send a text message from a PC is not new. The ability to receive text message replies to a PC is.

To send text messages, users enter a contact name in the "Search or invite friends" box in "Chat," and select "Send SMS" from the box of options. If a chat window already is open for that contact, users just click "Video & more," and select "Send SMS."

If your contact replies, the text message response will appear as a reply in "Chat." These conversations are stored in your Chat history just like regular chats.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Age a Factor in New App Adoption

Just to confirm what you already know, a new study by ABI Research shows that, when it comes to viewing TV and video, growth in consumer markets is more limited by consumers’ ability to create new habits than by technology availability or ease of use.

“The willingness to adopt new forms of entertainment delivery is in many cases determined by the age of the consumer,” says Steve Wilson, ABI Research principal analyst. “That means that market growth is simply a matter of time.”

Still, there are some new changes. Game console penetration in the 18-to-25 year old segment showed no gain over last year, whereas penetration in the 65-or-over segment grew more than 200 percent.

DVR ownership likewise is up uniformly across all age groups. On the other hand, some 65 percent of the respondents over 65 have never used VOD, compared to 30 percent of those in the 25 to 29 age range. However, 40 to 50 percent of those who have tried it continue use it at least once a month regardless of age.

Internet downloading likewise is only really popular with consumers under 30.

Video cell phone usage: consumers in their 30s are four times more likely to have watched video on their handset than those in their 50s. The wealthy, willing to pay the extra costs, are much more likely to watch video on their handsets than the less affluent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Thursday, October 30, 2008

Cincinnati Bell Revenue: Only 14% Consumer Voice

In some ways, the big story out of Cincinnati Bell in the third quarter was the progress the independent local exchange carrier has had in diversifying its revenue streams. In the third quarter of 2008, just 14 percent of its revenue was generated by consumer voice.

In some ways, the big story out of Cincinnati Bell in the third quarter was the progress the independent local exchange carrier has had in diversifying its revenue streams. In the third quarter of 2008, just 14 percent of its revenue was generated by consumer voice.About 20 percent of the carrier's revenue was earned providing technology solutions including data center and managed services.

Wireless service revenue in the quarter was $74 million, up $6 million or nine percent from a year ago. Cincinnati Bell had 567,000 wireless customers at the end of the quarter, which reflected year-over-year growth of six percent in its post-paid wireless customer base.

Post-paid quarterly average revenue per user was $48.82, an increase of $1.41 year-over-year and $1.46 sequentially. Pre-paid ARPU was $26.33, up 15 percent from the third quarter of 2007 while prepaid subscribers declined eight percent.

Technology Solutions quarterly revenue was $73 million, down $1 million, or one percent from a year ago. Technology Solutions segment operating income of $6 million was up two percent from the prior year quarter.

Data center and managed services revenue was up 39 percent from the third quarter of 2007. But lower-margin equipment revenue declined $10 million or 19 percent from the prior year.

Year-over-year DSL subscriber growth was six percent. At the end of the quarter, Cincinnati Bell had a total of 231,000 DSL subscribers.

Quarterly wireline revenue was $201 million, down $1 million or one percent from the third quarter of 2007. Increased revenue from data services, long distance and expansion markets partially offset lower voice revenue in Cincinnati Bell's traditional service area.

Year-over-year total access line loss in the third quarter was 6.8 percent, reflecting a decline in the company's in-territory consumer access lines. Business lines were even with a year ago while expansion market access lines increased 14 percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

iPhone Penetration Broadening Sharply

The trend can't be identified with any precision yet, but some end users might be adopting a new form of "substitutional" behavior of the sort mobility seems to be causing to wired phone lines.

The trend can't be identified with any precision yet, but some end users might be adopting a new form of "substitutional" behavior of the sort mobility seems to be causing to wired phone lines.Since June 2008 3G iPhone use rose 48 percent among those earning between $25,000 and $50,000 per year and by 46 percent among those earning between $25,000 and $75,000.

These growth rates are three times that of those earning more than $100,000 per year, the original "early adopter" population.

The reason it is not clear whether a new trend is emerging or not is that some of these users, perhaps most, are buying $200 subsidized phones, which puts the devices into a range many might be able and willing to pay for some other sort of smart phone.

And while the cost of a stand-alone, single-device and single-user account might be fairly hefty for users in the fast-growing income ranges, it is conceivable that many are on family or group plans of some sort that do not represent new monthly charges as much as $70 a month.

Still, there is a suggestion here that some users might be choosing to use use a single device for a music player, email device, voice and Internet access platform, possibly cannibalizing some amount of broadband access and wireline voice service in the process.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Mobile Usage Up

Over 54 percent of those surveyed said their mobile phone usage had increased by more than 25 percent over the last two years, and one in five respondents said it had increased by more than 50 percent, says Azuki Systems, Inc.

About 62 percent of respondents say they either own or will own a smart phone in the next 12 months.

About 62 percent of respondents say they either own or will own a smart phone in the next 12 months.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

ABI Lowers Mobile Handset Sales Forecast

ABI Research has revised its expectations for fourth quarter 2008 mobile handset sales to 7.5 percent growth from the 10.4 percent it earlier expected.

ABI Research has revised its expectations for fourth quarter 2008 mobile handset sales to 7.5 percent growth from the 10.4 percent it earlier expected.Call that the expected impact of tougher economic conditions.

Year over year annual growth is therefore likely to be between 10.5 percent and 11 percent, to close out the year at around 1.27 billion.

Handset sales grew 8.2 percent during the third quarter, year over year.

Expect to see aggressive marketing and promotional activities from operators and vendors alike as they strive to lure end-users to upgrade their handsets before the year’s end, ABI predicts.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Orange Gets 72% TV Growth

France Telecom has grown subscriber take-up by 72 percent over the last 12 months As of September 30, 2008 the Orange-branded service had 1.746 million subscribers compared with 1.017 million just 12 months earlier. 211,000 customers were signed in the third quarter of 2008.

Stats like that are one reason executives at Comcast see AT&T and Verizon as their primary competitors.

Stats like that are one reason executives at Comcast see AT&T and Verizon as their primary competitors.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Negative Growth in Third Quarter, Commerce Dept. Reports

The Commerce Department has released its preliminary estimate of U.S. third quarter gross domestic product, showing a decline to -0.3 percent. If the fourth quarter follows suit, we will be safe in saying we officially have entered a recession.

Consumer spending fell by -3.1 percent. Business investment fell by -1.0 percent, final sales were down by -0.8 percent. Disposable income came in at -8.7 percent.

The odd thing is that despite the generally-tough tone since perhaps the summer of 2007, growth has been positive through the second quarter of 2008.

Consumer spending fell by -3.1 percent. Business investment fell by -1.0 percent, final sales were down by -0.8 percent. Disposable income came in at -8.7 percent.

The odd thing is that despite the generally-tough tone since perhaps the summer of 2007, growth has been positive through the second quarter of 2008.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Wednesday, October 29, 2008

Hulu Finds Less is More

Hulu, the online video site, finds that when it comes to advertising, less is more. In contrast to the multiple-ad format used by broadcast TV, only one ad is shown during each segment break on Hulu.

Hulu, the online video site, finds that when it comes to advertising, less is more. In contrast to the multiple-ad format used by broadcast TV, only one ad is shown during each segment break on Hulu.In a customer survey commissioned by Hulu and conducted in July and August, 76 percent of nearly 18,000 respondents said that the site had the right amount of ads given the "no incremental cost to view" format, according to the New York Times.

Just over 17 percent said there was less advertising than they expected. The survey also found a 22 percent increase in advertiser message association and a 28 percent increase in intent to purchase among users.

There might be some "novelty" element driving the findings, so everyone will have to wait and see whether ad effectiveness of this sort continues, on Hulu and other sites that may choose the same format.

Only one finding remains consistently true: consumers tend to say they "hate ads." They also prefer getting free content and will tolerate ads if that is the price of getting the content at no additional charge.

Hulu has another advantage, however. The ads are short, and there is no way to zip past them, as would be the case if viewing on a digital video recorder.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

$3 Trillion Global Service Provider Revenue is Forecast

Between now and 2013, a time when global communications service provider revenue will climb from $2 trillion to about $3 trillion, wireless is going to be a key factor.

Between now and 2013, a time when global communications service provider revenue will climb from $2 trillion to about $3 trillion, wireless is going to be a key factor.Whatever else happens, mobility services in developing regions are going to play a big part in that growth.

In developed regions, pressure on landline voice revenues will be the challenge. In developed regions, service providers will have to create new services based on wireless and broadband, especially services that combine formerly-separate experiences such as voice, image, video, audio, text, presence, location independence and devices.

Nothing is certain, in that regard. History suggests that service providers, even those deemed to the most slow-moving, can replace their revenue mainstays. Wired telephone services providers, generally considered the slowest-moving contestants, already have twice done so.

They made a transition from "dial tone" to "long distance" as the revenue mainstay. Then they made a transition from "long distance to wireless." The next transition will be to replace wireless, as inconceivable that might seem. IP services are part of the answer. Video and content are parts of the answer. Software and information technology services are part of the answer. Personal broadband is part of the answer.

It remains unclear whether, in the next iteration of industry business models, there will be a single revenue source that clearly underpins all the others, even though this has been the classic model. The only thing that is clear is that, as important as wireless is, it also will someday fade as the key industry revenue driver.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Global Telecom Capex to Fall in 2009, Accelerate in 2011

Global telecom capital spending will decline in 2009,compared to 2008 levels, say researchers at Insight Research.

Global telecom capital spending will decline in 2009,compared to 2008 levels, say researchers at Insight Research.Spending will accelerate in 2011, driven in part by wireless and broadband spending in developing regions such as India and China, Insight Research predicts.

Between 2008 and 2013, those investments will drive global revenue from the current $2 trillion level to more than $3 trillion, the company projects.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

MDU Developers Turn to Broadband

New research from Parks Associates indicates high-tech amenities like broadband, security, and energy controls positively influence the sale and rental of multifamily properties.

New research from Parks Associates indicates high-tech amenities like broadband, security, and energy controls positively influence the sale and rental of multifamily properties.Researchers found nearly 50 percent of multiple-dwelling unit developers are seeking new electronic products and services that will differentiate their properties in an increasingly competitive market.

In particular, in-unit broadband service is becoming a “must-have” feature, with 60 percent of multi-family units offering some form of high-speed Internet. Security systems and monitoring services, electronic locks, and energy/utility management systems are also becoming more common in order to increase the speed of sale or rental of an MDU property.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Tuesday, October 28, 2008

No Wireless Data Dip

Wireless analyst Chetan Sharma sees no sign yet of any weakening of mobile data revenues from the AT&T and Verizon wireless reporting of the third quarter.

Since the fourth quarter is seasonally strong, we might not see any slowdown in the fourth quarter, either, he suggests. In all likelihood, we'll have to wait for first-quarter 2009 results to see whether economic stringency has negatively affected mobile data.

Personally, I would bet against a dip.

Since the fourth quarter is seasonally strong, we might not see any slowdown in the fourth quarter, either, he suggests. In all likelihood, we'll have to wait for first-quarter 2009 results to see whether economic stringency has negatively affected mobile data.

Personally, I would bet against a dip.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Where is Telco Capex Going?

As global carriers are in the midst of capital planning exercises for 2009, one key question their suppliers must grapple with is what changes might be forthcoming. Analysts at ABI Research perhaps optimistically think global carrier capex will dip just about 1.3 percent from 2008 levels, when capex grew a bit more about eight percent.

Ovum believes the most likely scenario is a generally mild impact on the telecoms industry, with growth and spending slowing but not declining. The scenarios are described in the October edition of Ovum’s Straight Talk Monthly communication to clients.

Researchers at Ovum say they aren't yet sure, but offer three possible scenarios. In the optimistic forecast, 2009 capex will be at the level of 2007, reflecting a slower 2008 spending pattern.

The most-likely outcome is slower spending through 2009, though. In a worst-case scenario,

capex could fall as much as 28 percent, a level somewhat consistent with the "nuclear winter" years after the Internet and telecom bubble just after the turn of the century.

Ovum believes the most likely scenario is a generally mild impact on the telecoms industry, with growth and spending slowing but not declining. The scenarios are described in the October edition of Ovum’s Straight Talk Monthly communication to clients.

Researchers at Ovum say they aren't yet sure, but offer three possible scenarios. In the optimistic forecast, 2009 capex will be at the level of 2007, reflecting a slower 2008 spending pattern.

The most-likely outcome is slower spending through 2009, though. In a worst-case scenario,

capex could fall as much as 28 percent, a level somewhat consistent with the "nuclear winter" years after the Internet and telecom bubble just after the turn of the century.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Monday, October 27, 2008

Cox to Launch Mobility Services

Cox Communications plans to launch mobile phone service in the second half of 2009, using Sprint network facilities. But Cox also owns its own spectrum and plans to build its own third-generation wireless network, although it also says it will test Long Term Evolution as an eventual 4G platform.

Cox executives say the management and delivery of converged content is at the core of the company's wireless strategy. "Cox customers will be able to use their mobile phone to access television favorites, program their DVR, access content saved on their home computer and simplify their lives with enhanced voice features," the company says.

A reasonable way forward would be for Cox to rely on Sprint for typical wireless voice, text messaging and mobile broadband services, while using its own network for applications more focused on content services related to what it currently delivers using its wired networks.

All Cox phones will include a network address book that automatically synchronizes with home PCs, the company says.

Cox also says that subscribers will be able to watch TV shows, and possibly full-time channels, on their handsets.

The move into mobility is hardly unprecedented. Cox joined with Comcast and Tele-Communications Inc. as equity owners in Sprint PCS in 1994.

Cox executives say the management and delivery of converged content is at the core of the company's wireless strategy. "Cox customers will be able to use their mobile phone to access television favorites, program their DVR, access content saved on their home computer and simplify their lives with enhanced voice features," the company says.

A reasonable way forward would be for Cox to rely on Sprint for typical wireless voice, text messaging and mobile broadband services, while using its own network for applications more focused on content services related to what it currently delivers using its wired networks.

All Cox phones will include a network address book that automatically synchronizes with home PCs, the company says.

Cox also says that subscribers will be able to watch TV shows, and possibly full-time channels, on their handsets.

The move into mobility is hardly unprecedented. Cox joined with Comcast and Tele-Communications Inc. as equity owners in Sprint PCS in 1994.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Online Video Goes Mainstream

Online video services have gotten positively mainstream over just the last six months, according to Ipsos MediaCT.

Online video services have gotten positively mainstream over just the last six months, according to Ipsos MediaCT.The percentage of female Internet users ages 12 and older that have streamed a video online in the past 30 days has grown from 45 percent to 54 percent, an all-time high for this demographic and nearly equal to the percentage of men (58 percent) whom have recently streamed video content online.

Moreover, the percentage of adults aged 35 to 54 that have recently streamed video online has also shot up since December 2007, rising from 49 percent to 60 percent in that time span.

In the past, such behavior disproportionately was a younger male activity.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Sunday, October 26, 2008

Skype Puts Up Numbers Most Would Envy

In the third quarter this year, and for the year, eBay's Skype has posted numbers most companies would love to have. Use of Skype-out minutes increased 54 percent, which drove revenue growth of 46 percent for the quarter.

Revenue over the past year came in at $ 521 million compared to $332 million for the comparable prior year, an annual revenue growth rate of 56.9 percent.

Registered users increased 51 percent over the prior year and Skype-to-Skype minutes increased 63 percent to 16 billion minutes.

Also, growth seems to be accelerating. Skype recently achieved its fastest growth rate of user activity in its history, by one measure, with an additional one million more concurrent users in just 35 days. Skype tends to measure usage by the numbe of concurrent sessions occurring.

Skype saw 63 percent annual growth rate of minutes. Not so important, you might think, since lots of Skype usage is of the free sort. But use of paid minutes (2.2 billion SkypeOut minutes) increased 54 percent.

Skype had third quarter 2008 revenue of $143 million and is on track to reach 2008 revenue of $570 million. In a sort of worst case scenario--if a global economic sluggishness decreases Skype use, about the opposite of what some of us think will happen--and Skype revenue growth slows, it should neverthless continue to grow annual revenue above the expected 2008 level (negative growth is hard to imagine).

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Saturday, October 25, 2008

The Difference Between Voice and Video Bandwidth

In a recent conversation with a financial analyst, the matter of Internet video bandwidth came up. The simple observation was that video consumes an order of magnitude (10 times) to two orders of magnitude (100 times) more bandwidth than voice does.

In a recent conversation with a financial analyst, the matter of Internet video bandwidth came up. The simple observation was that video consumes an order of magnitude (10 times) to two orders of magnitude (100 times) more bandwidth than voice does.The implication, of course, is that if online video consumption becomes popular, it represents a network engineering and challenge potentially 10 to 100 times more complicated than was the case for access networks built for voice.

That isn't to say costs scale precisely that way, but it suggests the dimensions of the cost problem for any network services provider charged with adding that much bandwidth.

The cost of deploying a fiber-to-the-cabinet (fiber to the neighborhood) network in the United Kingdom, for example, has been estimated at £5.1 billion. The cost of a fiber-to-the-home network is estimated at £28.8 billion, according to the Broadband Stakeholder Group.

The immediate difference in potential bandwidth might not be an order of magnitude. But the potential bandwidth difference ranges from an order of magnitude and up.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Broadband: When a "Problem" Actually Isn't a Problem

Since broadband first became widely available to consumers in the late 1990s, adoption has hit the

halfway point faster than most other information and communication technologies, one easily can conclude.

It took 18 years for the vpersonal computer to reach 50 percent of Americans, 18 years for color TV, 15 years for the cell phone, 14 years for the video cassette recorder, and 10.5 years for the compact disc player.

It has taken about 10 years for broadband to reach 50 percent of adults in their homes.

The point is that, looking historically at the matter, there is not now, nor has there actually been, a "broadband adoption problem." One can quibble about costs, the rate at which speeds are increasing, traffic shaping or business models.

But as a simple historical model, broadband was adopted faster than any other popular mass market service, ever.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

No SaaS Slowdown

Worldwide software-as-a-service revenue in the enterprise application markets is on pace to surpass $6.4 billion in 2008, a 27 per cent increase from 2007 revenue of $5.1 billion, according to Gartner, Inc. The market is expected to more than double with SaaS revenue reaching $14.8 billion in 2012.

Gartner analysts say the adoption of SaaS is growing and evolving within the enterprise application markets as new entrants challenge incumbents, popularity increases, and interest for platform as a service grows, despite the challenging economic climate.

The fastest-growing markets for SaaS are office suites and digital content creation, albeit from small bases, says Sharon Mertz, Gartner research director.

Gartner estimates that the revenue attributed to SaaS within the office suites market will reach 99.2 per cent compound annual growth rate from 2007 through 2012, with a total SaaS revenue reaching $1.9 billion in 2012.

By 2012, Gartner estimates that web-based freeware such as Google Apps, Adobe Buzzword, ThinkFree, Zoho and SaaS offerings will account for nine percent market share of total software revenue.

Gartner forecasts 96.1 percent CAGR for SaaS revenue in the digital content creation segment from 2007 through 2012.

“DCC software is becoming increasingly important as organisations evolve toward a more Web-centric business model," she says.

The content, communications and collaboration markets remains the largest contributor to the overall SaaS enterprise application markets with revenue exceeding $2.1 billion in 2008, and it is expected to amount to $4.7 billion in 2012.

SaaS will represent two percent to three percent of enterprise content management and more than 70 per cent of Web conferencing in 2007.

The second largest contributor to the overall SaaS enterprise application markets is customer relationship management. In 2008, SaaS within the CRM industry is expected to exceed $1.7 billion in total software revenue. Gartner expects CRM SaaS revenue to exceed $3.2 billion in total software revenue in 2012.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Using Cable TV Analogy for Broadband

Net broadband subscriber adds, at least for U.S. cable and telephone providers, were much slower in the second and apparently third quarters of 2008. Part of that slowdown likely can be attributed to growing saturation of the broadband access market.

But it also is likely there is some contributing pressure from general economic conditions as well. Dial-up users might just decide to hold off on a move to broadband for a little while.

Cable TV marketers long have argued that multichannel video is a bigger and better value in tough times, representing a relatively-affordable source of entertainment for a family. An argument along those lines might help marketers of broadband access as well.

"Product strategists responsible for the success of residential broadband services can continue to grow broadband penetration in a tough economic climate by positioning their service as a gateway to cheap content and communications," argues Sally M. Cohen, Forrester analyst.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Downturn Behavior: True to Form So Far

What typically happens in an economic downturn, in the area of communications or network-based entertainment services, is that people reduce consumption of some "enhanced" features while retaining the base service.

In the cable TV segment, consumers tend to hand on their ad-supported services but skimp a bit on "premium" service. So you might see less use of fee-based video on demand, for example.

Taking a look at mobile service, Forrester Research analyst Pete Nuthall says "the economic downturn won't put a dent in the European mobile penetration rate of 84 percent, but mobile services providers are feeling the impact of reduced usage and spending as consumers review their regular outgoings."

That's confirmation that what has tended to happen in the past just might happen again. "The price of core services, voice and SMS, is of growing importance to more mobile users, while advanced handsets and services are becoming less important to fewer mobile users than a year ago," he notes.

"Product strategy professionals are responding by de-emphasizing mobile data services and expanding the variety of SIM-only offers," he points out.

Using the same sort of logic, it is conceivable that some broadband users will downgrade their service plans. And it isn't hard to imagine some users ditching landline service, at least for the moment, so long as they can afford a mobile calling plan that covers their typical usage.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Thursday, October 23, 2008

Blyk Outsources to Nokia Siemens Networks

Blyk, a provider of ad-supported mobile services for 16 to 24 year olds is outsourcing its Netherlands and Belgium operations to Nokia Siemens Networks. Nokia Siements will provide prepaid charging, messaging systems and device management services for Blyk in those two countries, as a hosted service.

The move is but one example of something we are seeing lots more of: service providers and carriers are outsourcing important network operations and facilities to third parties.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

63% of U.S. Population Uses Internet

eMarketer estimates that 63.4 percent of the U.S. population uses the Web at least once per month, and that nearly seven out of 10 Americans will do so by 2013.

eMarketer estimates that 63.4 percent of the U.S. population uses the Web at least once per month, and that nearly seven out of 10 Americans will do so by 2013.Some of us are shocked the numbers are that low. Once a month?

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Wednesday, October 22, 2008

AT&T's iPhone: Serious Business Impact

It would be hard to overestimate the impact the Apple iPhone has had, as a business innovation, for AT&T, in ways that have nothing to do with device features, user interface or changes in user behavior. The iPhone seems to have a significant role in boosting AT&T's wireless market share, wireless data subscriptions, service upgrades, floor traffic, sales close rate and even sales of other smart phone devices and data plans.

It would be hard to overestimate the impact the Apple iPhone has had, as a business innovation, for AT&T, in ways that have nothing to do with device features, user interface or changes in user behavior. The iPhone seems to have a significant role in boosting AT&T's wireless market share, wireless data subscriptions, service upgrades, floor traffic, sales close rate and even sales of other smart phone devices and data plans.When AT&T launched the iPhone 3G on July 11th, it activated 2.4 million iPhone 3G units, 40 percent of them to customers who were new to AT&T. Perhaps somebody else knows the answer to this question, but I am not aware this ever has happened before: that a single device has lead to such a gain in market share in such a short time.

It is possible, though unlikely, that some of these buyers were "first-time" mobile phone buyers. In all likelihood, however, virtually all these new buyers were defecting from another mobile provider.

The iPhone 3G helped drive two million total net adds in the quarter, 1.7 million of them post-paid, making this the best retail post-paid net add quarter in our company’s history," according to AT&T Mobility and Consumer Markets CEO Ralph De La Vega.

But AT&T executives long have expected a "halo effect." The thinking has been that some, perhaps many, prospects would be drawn in to look at the iPhone, but ultimately would choose another device. That indeed seems to have happened.

Same-store traffic was up 15 percent versus the third quarter last year and two thirds of third quarter post-paid net adds chose integrated devices (smart phones with either a qwerty or touch-screen keyboard).

More than 40 percent of customers upgrading their current plans purchased an Internet data plan for the first time, de la Vega says.

The net present value of a iPhone subscriber, is more than two times the NPV of AT&T's average post-paid subscriber. NPV is a way of accounting for total cash flows over time, discounted for the cost of borrowing or investment to create the cash flow.

The percentage of post-paid subscribers who have an integrated device doubled over the past year to reach 22 percent of all devices in use. The number of 3G devices in the base also has grown dramatically from around seven million a year ago to more than 17 million at the end of the third quarter.

The third quarter also was AT&T's best laptop connect quarter ever, and the company has more than doubled its 3G laptop connect base over the last year. AT&T now has nearly 5.9 million broadband speed laptop cards, dongles and integrated devices in service, though it does not break out the percentage of dongles and cards.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

40 Gbps Gear Sales Grow 59% Annually

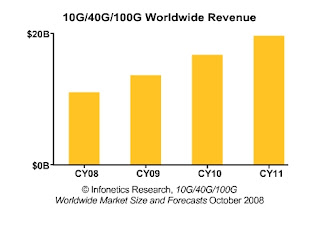

The 10 gigabit-per-second equipment market is big and growing fast, on target to hit nearly $9.5 billion worldwide in 2008, say researchers at Infonetics Research. At the same time, 40 G system sales are ramping rapidly, and 100 G should begin soon and take off by 2013, the company says.

The 10 gigabit-per-second equipment market is big and growing fast, on target to hit nearly $9.5 billion worldwide in 2008, say researchers at Infonetics Research. At the same time, 40 G system sales are ramping rapidly, and 100 G should begin soon and take off by 2013, the company says.“A majority of service providers we've spoken to are expecting to invest in 40 G until the 100 G market is up and running; some providers are hoping to skip the 40 G phase altogether, but we don't see that being a viable option, as growing traffic demands are outstripping current capacities and 100 G won't reach reasonable price points until about 2012 or 2013," says Michael Howard, Infonetics co-founder and principal analyst.

"When 100 G Ethernet arrives, it’ll be the next big thing and the most important, because it will last to at least 2025, solving traffic problems for a very long time," Howard says.

40G equipment revenue is forecast to increase at a fast clip, with a compound annual growth

rate of 59 percent from 2007 to 2011, Infonetics projects.

The number of 10 G, 40 G, and 100 G ports shipping on enterprise and service provider equipment will jump from over one million in 2007 to 7.4 million in 2011, with 100 G making its small debut in 2009.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

AT&T Reverses DSL Slowdown

AT&T added 148,000 net wired netwwork broadband access customers, up from the 46,000 AT&T added in the second quarter of 2008. That's a far cry from the 300,000+ quarterly net adds AT&T was putting up in 2007, but the broadband access market clearly is reaching saturation.

Some of us had suggested that a shocking fall-off in broadband access net adds in the second quarter this year would be repeated in the third quarter. We'll have to wait to see reporting from Verizon and Qwest to confirm the thesis, but AT&T's results suggest marketing attention that had lapsed in the second quarter now has been sharpened.

Wireline broadband subscribers, including both consumer and business customers, totaled 14.8 million, up 1.1 million over the past year.

Perhaps the other notable story coming out of AT&T's third quarter report was the huge increase in wireless broad band net adds. Total broadband-capable connections in service increased 2.9 million in the third quarter to reach 20.7 million.

About 2.75 million of those net adds came on the wireless network, not the wired network. Wireless broadband connections include data users with 3G LaptopConnect cards and broadband-speed integrated devices with

a QWERTY or touchscreen keyboard. AT&T does not provide detail on the percentage of cards or dongles and broadband handsets.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Telco and Satellite TV Subs "More Satisfied"

Cable television customers say they are less satisfied than customers of satellite and telco TV providers, according to Parks Associates. A new study by Parks Associates suggests, as other surveys have found, that subscribers to satellite television and telco IPTV are significantly more likely to be satisfied with their services than both basic cable and digital cable subscribers.

Cable television customers say they are less satisfied than customers of satellite and telco TV providers, according to Parks Associates. A new study by Parks Associates suggests, as other surveys have found, that subscribers to satellite television and telco IPTV are significantly more likely to be satisfied with their services than both basic cable and digital cable subscribers.“Cable subscribers are generally less satisfied, which creates opportunities for satellite and telco/IPTV providers to grab customers,” says Kurt Scherf, Parks Associates VP. “Although cable operators have improved service efforts, cable operators will still hemorrhage subscribers unless they are perceived as offering leading-edge features at equal or better value. In today’s economic climate, carriers cannot afford to ignore these findings.”

Cable operators have struggled in selling the value of their services, Scherf said, and framing their services as an enhanced and convenient form of entertainment will be critical in reestablishing higher satisfaction. Video on demand initiatives, particularly those aimed at delivering a “Primetime, Anytime” experience, should be key elements in this effort.

“Subscribers who actively use primetime VoD services show significantly higher satisfaction levels,” Scherf says.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Mobile Broadband Overtakes Wi-Fi

Proponents of mobile broadband have argued that 3G and other mobile broadband networks ultimately would make Wi-Fi networks largely unnecessary. While that is not yet completely true, it increasingly true. Mobile broadband now has pushed the mobile phone networks ahead of Wi-Fi hotspots as the most popular way of accessing the Internet on the move, in the United Kingdom, according to Point Topic.

U.K. mobile phone companies have managed to grow their market share to 47 percent of users accessing the Internet away from home or work, compared to 42 percent who use Wi-Fi hotspots. A year earlier the ratio was 40:30 in favor of Wi-Fi, Point Topic says.

Point Topic says 26 percent of those who use a mobile network to access the Internet are O2 customers. Orange and Vodafone each take about 20 percent of the market, while T-Mobile and 3 have 14 percent and 12 percent respectively.

Vodafone is the leading provider of the dongle-user segment, with 24 percent share. of respondents. O2 comes in at 23 percent, followed by Orange, T-Mobile and 3, Point Topic says.

U.K. mobile phone companies have managed to grow their market share to 47 percent of users accessing the Internet away from home or work, compared to 42 percent who use Wi-Fi hotspots. A year earlier the ratio was 40:30 in favor of Wi-Fi, Point Topic says.

Point Topic says 26 percent of those who use a mobile network to access the Internet are O2 customers. Orange and Vodafone each take about 20 percent of the market, while T-Mobile and 3 have 14 percent and 12 percent respectively.

Vodafone is the leading provider of the dongle-user segment, with 24 percent share. of respondents. O2 comes in at 23 percent, followed by Orange, T-Mobile and 3, Point Topic says.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Tuesday, October 21, 2008

RSS Stalled?

Now this prediction I will find quite shocking, if it materializes: Forrester Research now estimates that use of Real Simple Syndication (RSS) might be nearing a peak of usage, among online marketers. About half of marketers already have put RSS feeds on their Web sites.

Now this prediction I will find quite shocking, if it materializes: Forrester Research now estimates that use of Real Simple Syndication (RSS) might be nearing a peak of usage, among online marketers. About half of marketers already have put RSS feeds on their Web sites.Keep in mind that RSS is used by about 11 percent of Web users, up from two percent in 2005, reports Steve Rubel at Micropersuasion.

It might be one thing to forecast that RSS is a technology that is not going mainstream anytime soon. It is quite something else to predict it is nearing saturation.

Forrester says a recent survey of marketers found that of the 89 percent of those who don't use feeds, only 17 percent say they're interested in using them.

"Unless marketers make a move to hook them, and try to convert their apathetic counterparts, RSS will never be more than a niche technology," Forrester analyst Jeremiah Owyang suggests.

Rubel himself does think RSS use by marketers has peaked. But then, I'm biased. I can't think of any development more important for many content businesses than RSS.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

P2P Really Stresses the Upstream

Overall, peer-to-peer file sharing represents 43.5 percent of total North American consumer broadband consumption, while Web browsing represetns 27.3 percent and streaming contributes 14.8 percent of overall demand.

Overall, peer-to-peer file sharing represents 43.5 percent of total North American consumer broadband consumption, while Web browsing represetns 27.3 percent and streaming contributes 14.8 percent of overall demand.But those statistics conceal something far more fundamental about P2P impact on access networks.

In the upstream direction, P2P absolutely dominates. The three biggest traffic generators in the upstream direction are P2P at 75 percent of total load, tunneling at 9.9 percent and Web browsing at 9.1 percent. Entertainment, not productivity, is driving bandwidth consumption during the peak evening hours.

Web traffic and streaming videos account for 59 per cent of downstream bandwidth consumption as well, says Sandvine. The three biggest traffic generators in the downstream direction are P2P at 35.6 percent, Web browsing at 31.6 percent and streaming content at 17.9 percent.

Over time, the proportion of P2P traffic might decline as a percentage of total, as more streaming services aimed at PCs and TVs take hold. Those services will add more demand primarily in the downstream direction.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Monday, October 20, 2008

80% of Mobile Users Send Text Messages; or Do They?

The amount of time users spend doing things on their mobile phones is increasing. About the only issue is by how much.

About 54 percent of mobile users surveyed in September 2008 reported their usage had increased by more than 25 percent over the past two years. One-fifth of respondents estimated their usage had increased by 50 percent or more.

One third of respondents talked on their mobile phone more than 10 hours per week, and 34 percent of respondents ages 17 and under talked for more than 15 hours weekly.

Nearly four out of 10 mobile Internet users said they surfed the mobile Web for two or more hours every week. The key adjective there is "mobile Web" users. Other researchers have found that just about 16 percent of mobile users have the ability to access the Web from their mobiles.

Some 62 percent of mobile users surveyed said they either already owned a smart phone or would own one within the next 12 months.

Text messaging is nearly universal, with 80 percent of mobile users saying they use that feature and 29 percent of those who did spent more than two hours every week on the activity, says Azuki Systems.

Researchers at Nielsen Mobile don't think so. They report just 53 percent text messaging usage during the second quarter of 2008.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Vonage Dodges a Bullet

Vonage has Vonage has signed definitive agreements to refinance its convertible debt, a move that virtually everybody assumed was essential for Vonage to stay in business, and about which there has been doubt in some quarters.

The financing package consists of a $130.3 million senior secured first lien credit facility, a $72.0 million senior secured second lien credit facility, and the sale of $18.0 million of senior secured third lien convertible notes.

Vonage says it will use the net proceeds of the financing along with its own cash on hand to repurchase up to $253.5 million of the company's existing convertible notes in a tender offer commenced on July 30, 2008.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Saturday, October 18, 2008

Verizon Has Fewest Dropped Calls

Verizon Wireless has the lowest percentage of dropped calls among all major U.S. service providers, according to ChangeWave.

Verizon Wireless has the lowest percentage of dropped calls among all major U.S. service providers, according to ChangeWave.Verizon subscribers report that, on average, just 2.7 percent of their calls were dropped over the past 90 days, nearly a percentage point better than AT&T (3.6 percent), their closest competitor.

Sprint/Nextel (4.4 percent) and T-Mobile (4.5 percent) were third and fourth respectively.

Importantly, one-in-five Verizon users (20 percent) say they didn't experience ANY dropped calls over the past three months, compared to 18 percent for T-Mobile, 17 percent for AT&T, and 10 percent for Sprint/Nextel.

In addition, 43 percent of Verizon's customers in the survey say they're "very satisfied" with Verizon's service.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

New Versions of Chrome and Firefox are Faster

New beta versions of Firefox and Google Chrome now are available, and in recent tests, CNet found Firefox the fastest, with Chrome right behind, in executing JavaScript, which powers applications such as Gmail and Google Docs.

The answer: both browsers made big strides, but Firefox still beats Chrome on one widely-used performance test, says Stephen Shankland. CNet writer.

When Chrome was released, Shankland ran Google's JavaScript speed test on Firefox 3.0.1, the initial Chrome beta, Internet Explorer 7 and 8 beta 2, and Safari 3.1.2.

He found Chrome led the speed test with an overall score of 1,851 and Firefox in second place at 205.

Running the same test on the latest developer version of Chrome, 0.3.154.3, boosted the browser's score to 2,265, a 22 percent increase. And Firefox jumped 15 percent to 235. Firefox 3.1 beta one, he says.

That test measures Firefox without its new TraceMonkey JavaScript engine enabled, though.

Faster execution matters for a couple of reasons. At some point, the browser will become the client for executing any number of consumer and enterprise applications that are not stored on a local hard drive. Speed will matter.

Also, users simply like faster-executing Web pages. Faster execution provides a higher end user experience.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Friday, October 17, 2008

Telco Business Model Transformation? Been There; Done That

Some people think the global telecom industry is not lead by people capable of fundamental business model transformation. Nobody can say for sure whether that opinion is correct.

Some people think the global telecom industry is not lead by people capable of fundamental business model transformation. Nobody can say for sure whether that opinion is correct.What might be useful to reflect on, though, is the fact that the global already has managed several fundamental shifts in its revenue.

In 1995, for example, U.S. telcos earned about $19.49 a month selling consumers basic dial tone. But telcos earned $42 a month selling enhanced services and long distance.

In other words, 68 percent of consumer revenue was generated not from the basic dial-tone product but from other services and applications. For an industry generally considered at that time to be an "access lines" business, the appellation already was inaccurate.

In 1997, nearly half of all local telco revenue came from long distance alone. By 2007, long distance represented just 18 percent of total revenue. So a business once based on "lines" then became a business based on long distance and enhanced services, only to be replaced by a business where half of all revenue was generated from wireless services.

Also, consider that over the last decade we have seen the broadband access business grow from single digits to "near saturation" levels.

The point is that business model transformations have happened several times in industry history, sucessfully. The next transformation likely will involve wholesale and business partner services of various types, augmented by content services.

One can argue telco executives can't make this next change, even if they have transformed themselves before. I would not bet on that.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Life throws curve balls.

Life throws curve balls. Patriots don't get the perfect season. Red Sox come from behind to keep their title hopes alive. It happens.

Life throws curve balls. Patriots don't get the perfect season. Red Sox come from behind to keep their title hopes alive. It happens.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Enterprise Mobility Demand Still Growing

Roughly half of all business and consumer communications spending goes to wireless services. But there appear to be relatively-distinct niches within the enterprise mobile user base. The "information worker" segment, including sales, information technology and managers use real-time data, email, calendar and portal accessed applications, say reserachers at Forrester Research. There are lots of devices used and IT staff tends to have limited control over them.

"Task workers" such as supply chain personnel, medical personnel, manufacturers and others using line-of-business applications on a single device such as inventory scanners, data entry tablets. IT tends to have significant control over the limited range of supported devices.

But there is an emerging demand from "wannabes," including just about any worker not represented in one of the two other segments. Wannabees likely will use a wide range of devices for email, calendar, product information management and basic portal access, for work and personal uses. IT will have to support a wide range of devices and will have limited control over them, Forrester argues.

So far, though 57 percent of smart phone users engage in work--related phone calls,

48 percent check email and 42 percent acess the Internet or a company Intranet for work related information. Some 35 percent of users say they use their smart phones "only for personal purposes." Keep in mind that nearly seven out of 10 enterprise mobility users pay for their own service.

At the moment, 69 percent of employees pay for their voice service, while 23 percent have mobile paid for by the employer, Forrester says. About eight percent of workers cost share with their employers.

About 59 percent of employees pay for their own mobile data services. About 34 percent have their mobile data service paid for by their employers. About seven percent of workers have a cost share agreement with their employer.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Thursday, October 16, 2008

What Does AT&T Do For An Encore?

Executives at AT&T have to be spending time thinking about what to do when the Apple iPhone ceases to be an AT&T-only product.

Executives at AT&T have to be spending time thinking about what to do when the Apple iPhone ceases to be an AT&T-only product. In October 2006, before potential customers were aware that AT&T would have exclusive rights to market the iPhone, Verizon Wireless was getting twice as much upside from "churners" as AT&T was.

About 28 percent of poll respondents surveyed by ChangeWave indicated they would be switching to Verizon for mobile service. About 14 percent indicated they would be switching to AT&T.

After the deal was announced, the churn gap closed. And AT&T has had a net advantage in customer switching behavior since very-early 2008. Many would say this is an "iPhone effect." Some might argue it also is the result of other activities, including AT&T promotional activity.

We won't really know until the iPhone exclusivity deal ends. In the meantime, AT&T marketing staffs have to be working on the next game-changer.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Wednesday, October 15, 2008

Sylantro in the Amazon Cloud

Sylantro Systems has announced compatibility of its Synergy platform with the Amazon Web Services’ Elastic Compute Cloud (EC2). By doing so, Sylantro makes its voice and Web applications available in a cloud computing environment.

Amazon EC2 from Amazon Web Services is a Web service providing hosted, resizable compute capacity on a pay-as-you-go basis. It is designed to make Web-scale computing easier and cheaper.

So look at it this way: applications developed for Web delivery, using the Amazon infrastructure, now can be configured to work with Sylantro calling and communication features. In principle, this allows more applications or services to provide a range of communication features one normally would expect from a business phone system.

Service providers can use the capability to test demand for services provided on a hosted basis, especially on a "sample this" basis, or as a way to provide hosted business or consumer communications services with a disaster recovery angle.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Sometimes Demand, Not Supply, is the Issue

SureWest Communications has expanded television, Internet and telephone service to some 3,500 Kansas City area homes and remains on track to reach 10,000 by the end of the year.

In the broadband services area, SureWest customers and prospects have something like an embarassment of riches, though some will argue the prices are too high.

Customers can buy 20-megabits-per-second connections for about $92 when purchased as part of a bundle, and can get 50 Mbps service for about $192 when when bundled with one other service.

Business customers can buy 100 Mbps service. So the issue, at least where SureWest operates, is demand, not supply.

The argument can, and probably will be made, that prices for the higher bandwidths are too high. Observers should keep in mind that commercial prices for T1 lines offering 1.544 Mbps service cost as much as the 50 Mbps service, if not more. Perhaps that will not be enough to sway some opinion on the pricing front.

But in this case, at least, broadband supply is not a problem. Demand is the issue. One can argue that prices should be lower. It is harder to argue that SureWest's ability to remain in business requires that level of prices at its forecast penetration levels. If SureWest does a lot better than it now forecasts, lower prices are possible. But this now is a demand generation exercise.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

"Hyperconnection" Driving Wireless Broadband?

Some 16 percent of Internet users live a “hyperconnected” life, meaning they regularly use more than seven devices and more than nine applications, says Scott Wickware, Nortel general manager.

Some 36 percent are “increasingly connected,” meaning they use four devices and nine applications, he adds. About 20 percent are passive online users and 28 percent are "not very connected," he says.

So although about half of Internet users might not agree they are living in "a hyperconnected world” that requires or benefits from mobile broadband access, Wickware suggests 52 percent are candidates for mobile broadband.

The logic is simple enough: as users got comfortable with email and then wanted to have email available in their pockets and purses, so they increasingly will want access to their social networks, video and audio entertainment in the same way.